Before we dive into the actual content, let us get to know about Wells Fargo.

Many of us might have heard it for the first time. Anyways, Wells Fargo & Company is an American multinational financial services company headquartered in San Francisco, California. Its central offices are located all over the United States. It has around 7400 plus branches, a family of 70 million customers and 263000 employees, 13000 ATMs and a market value of $118 B!! The figures are enormous and are enough to showcase the company’s greatness and excellence.

Founded in 1852, the company has experienced a lot of ups and downs and has continued its journey through prosperity, depression and war. And after 160 years, we see the company’s six-horse stagecoach majestically reigning the market through its sheer efforts, dedication and sincerity. It earned an unbreakable trust and a no-match reputation by its attention and loyalty to the customers; and has set the bar high for its fellow competitors.

Now we have known about the company and its greatness, let us get into the matter.

Before we begin, let us get to know what a routing number is. It’s a technical term, and many of us might not be aware of it. So it is better to throw some light on it. And it will even work as a kick start for the matter.

What Is A Routing Number?

The routing number, sometimes also referred to as an ABA (American Bankers Association) routing number, is a set of nine unique digits used by the banks as an identity number. It also gives information if the bank is federal or state associated. Small banks generally have a single routing number whereas large multinational banks may have several of them, depending on the state in which you hold the bank account.

These routing numbers are beneficial in your financial transactions like deposition of money, tax payments, payment of consumer bills etc. They also help you to track your money transfers. They play a significant role in domestic and international wire transfers.

In India, we have a MICR (Magnetic Ink Character Recognition) number, which plays the same role played by the routing numbers.

Wells Fargo Routing Numbers By State

As mentioned earlier, Wells Fargo has expanded its reach over 7400+ locations. They may be in different states. As the state changes, the routing numbers ought to change. So branches have got different and unique routing numbers.

Here are some of the routing numbers that will be put on so that you can figure out whether they are unique or not.

| STATE | WELLS FARGO ROUTING NUMBER |

| Wells Fargo Alabama | 062000080 |

| Wells Fargo Arkansas | 111900659 |

| Wells Fargo Connecticut | 021101108 |

| Wells Fargo Florida | 063107513 |

| Wells Fargo Idaho | 124103799 |

| Wells Fargo Louisiana | 121042882 |

| Wells Fargo Massachusetts | 121042882 |

It might come to your observation that the branches at Massachusetts and Louisiana, both have the same routing number. This is because both the branches belong to the same state. Whereas, all other branches have got their unique and different routing numbers.

Ways To Find Your Routing Number

You can find the number with or without check. Without the check, you can get it via the customer care contact number of the bank. You can also get it on the ABA official website. If you are a registered customer for online banking, you can get it at the account numbers and more sections.

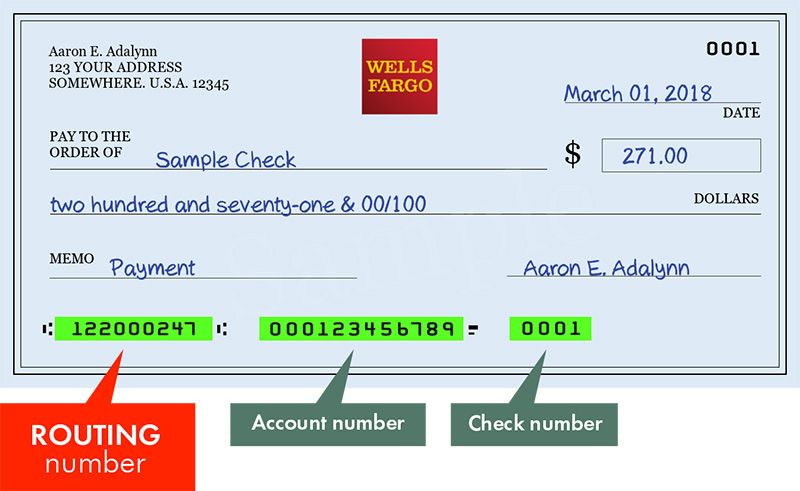

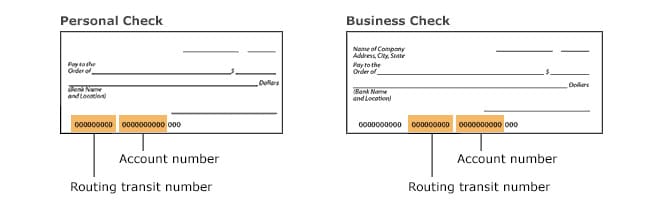

Finding Your Routing Number On A Check

The routing number can be easily found on your check. Just open your chequebook, and on the bottom left portion of your check, you will see a nine-digit unique routing number. At the right, you have your ten-digit account number. Please do not get confused between routing and an account number.

Why The Bank Has Multiple Routing Numbers?

A routing number identifies a bank, so different banks have their own routing numbers so that they can be recognized uniquely. Whereas a multinational bank, with many branches, has a unique routing number for each branch that is in different states. This is because, via the routing number, it can be figured out whether the bank is state or federal oriented. These are the reasons why a bank has multiple routing numbers.

How To Find A Correct Routing Number That Should Be Used?

The routing number is printed in unique fonts at the left-most portion of your check. It is a nine-digit number. Please do not get confused with the account number. Once you get it, how do you know if the routing number is correct and is the same number you are supposed to use.

It is too simple. You can check it in the list of the routing numbers that are put up on the official website of the bank. If it matches, then it is the correct one. Just make sure that you are looking at the correct branch name and the state because different branches in different states have unique routing numbers.

You can also get it through the official ABA routing number site. You can also dial in the customer care number.

Wells Fargo Routing Number For International Wire Transfers

The USA is the only country that uses a routing number system. If you wish to make an international bank transfer to a U.S. account from a bank account outside the U.S., you need to provide their routing number to complete the transactions.

To ensure a successful international wire transfer in your Wells Fargo bank account, please use the following bank instructions.

Bank Details

Bank Name: Wells Fargo Bank N.A.

Bank Address: 420, Montgomery Bank City, State- San Francisco, Zip- CA 94104

SWIFT/BIC Code: WFBIUS6S

Bank Location: Varies according to the region

Routing Transfer Number: See Details

Finding The Routing Number Online

You can find the number with or without a check. Now we’ll look at how to find it online.

- Log in to online banking.

- Select an account from the options.

- Click on account numbers and more.

You can also search for your bank on the ABA routing number website. You just have to type your bank’s name and location in the search bar. Within moments, you will get the requested routing number.

Similar Bank Routing Number

The Difference Between Routing Numbers, SWIFT codes, BIC, and IBANs

We have got to know now what a routing number is.

Let us look at the SWIFT and BICs.

SWIFT code is used during an international transfer between the two banks. It is an electronic message transfer system used to convey the message in a specific format.

The BIC (Business Identifier Codes) are primarily used to identify financial and non-financial institutions that are involved in day-to-day business transactions. It refers to the set of digits that is used to send international payments.

IBAN is a standardized system to identify an overseas bank account. It does not entirely replace the account number but acts as an assistant to the account number.

These were some of the insights of the various tracking details of domestic and international payments. Happy Banking.