Union Bank provides corporate and commercial banking services and wealth management solutions in the united states. Union bank offers online banking to access their bank accounts anywhere, anytime. It is easy to enroll in internet banking & access your account anywhere in the globe.

If you don’t know how to use internet banking, this guide will help you register, log in, and reset your password for internet banking.

Union Bank Online Banking Login

Login in your union bank of account is effortless. You can access all your bank details by your login details. Anyone can access their account anytime from anywhere. Let’s start with the steps you need to follow for your online union banking service.

Step1: Open the Official Website of the Union Bank.

Step2: In the top right corner of the homepage, you can see “Sign On” button.

Step3: Now, enter your User Id and then click on the “Sign On” button.

Step4: Here you have to enter your password and then click on the “Submit” button.

You will be granted access to your online account. Make sure you use the correct id & password for login.

How to Reset Your Password?

If you cannot log into your union bank of India account or forgot your password, you can easily change your password with the help of union bank. These are the steps to reset your union bank India password :

Step1: Open the Official Website of the Union Bank.

Step2: In the top right corner of the homepage, you can see “Sign On” button.

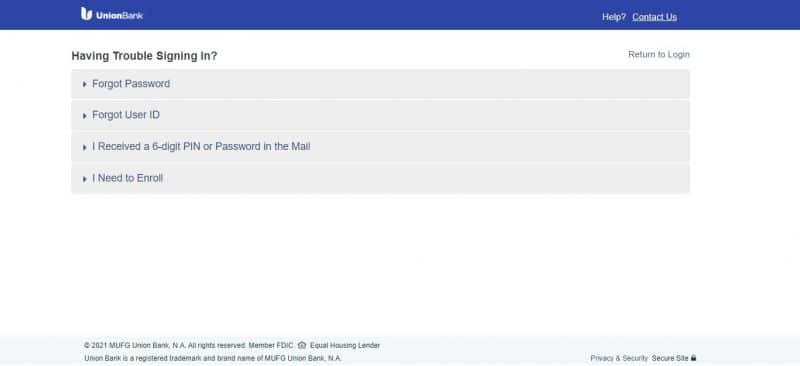

Step3: Click on the “Forgot User ID or Password?” link.

Step4: Here you have to click on the “Forgot Password” button.

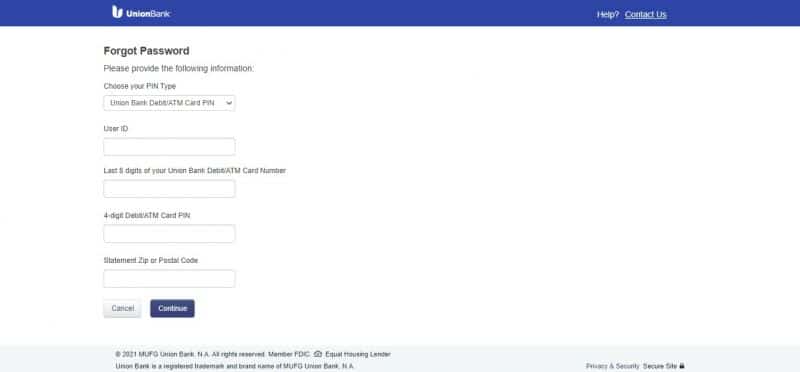

Step5: After clicking on the “Forgot Password” button, you have to select the type of account you have, for reference here we are selecting “Personal Accounts” button.

Step6: In this step you have to Choose your PIN Type, enter your User ID, Last 8 digits of your Union Bank Debit/ATM Card Number, 4-digit Debit/ATM Card PIN, Statement Zip or Postal Code and once you entered all these details click on the “Continue” button.

How to Enroll into Union Bank Online Banking

Union Bank provides a free service of internet banking. You can easily enroll or register for the services. Internet banking is only available for customers who have a bank account in the union bank. These are the steps to register:

Step1: Visit the Official Website of the Union Bank.

Step2: In the top right corner of the homepage, you can see “Sign On” button.

Step3: Click on the “Enroll Now” link.

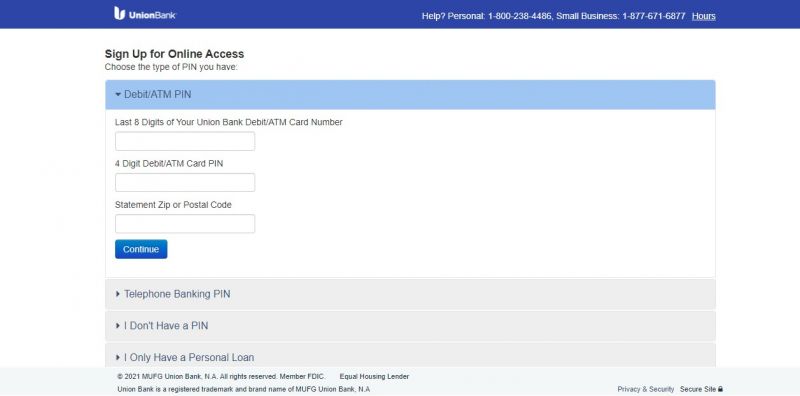

Step4: In this step you have to choose the type of PIN you have. For reference here we are selecting “Debit/ATM PIN” button.

Step5: Now you have to enter some of your details such as last eight digits of your bank card number & 4 digits debit/ATM card pin, statement, postal code and then click on the “Continue” button.

Manage Your Union Bank Online Account

Feature of Online Union Bank Accounts :

1) Easy transactions

2) Easy viewing of account statement

3) Direct, indirect tax payments

4) You can quickly pay utility bills like electricity bills, telephone bills, insurance premium payments, credit cards, mutual funds, etc.

5) Online booking

More Credit Card Options

The Bank mainly has three credit card options with several features and advantages for its customers. The Bank’s Reward Visa credit serves 2,500 points on the cardholder’s first purchase without any annual fees, and available for every dollar spent on groceries, the Bank offers two points and one point for other things.

Customers can earn additional bonuses between 25% and 50% for reward points deposited in personal banking accounts or towards mortgage principal reduction payments. The Bank’s Visa card without any annual fees is mean for people seeking lower interest rates. The Bank’s secure Visa is intended to assist customers that want to build a good credit history.

Money Market and Savings Account

If customer wants to open a savings account with Union Bank, customers need to deposit $50. The funds have variable interest rates, which Union Bank pays out to its customers once in three months.

It provides overdraft protection. Union Bank’s saving account has a $4 service charge per month, and Customers can avoid this monthly service charge by maintaining a minimum daily balance of $300 or by depositing $25.

You can also choose from one of Union Bank’s money market accounts. These accounts usually pay out higher interest rates; however, they require a considerable deposit to open. Anyone who wants to open this account is required to deposit $2,500.

Customers who maintain a minimum daily balance of $2,500 can avoid a monthly service fee of $9 if they opt for online statements. Union Bank also offers a personal savings account that gives customers access to money market account features. For this service, customers only need $50 to open an account. If any customers have a high balance, they will earn more interest—Rates for savings account range from between 0.01% APY and 0.15.

Benefits of Union Bank Online Banking

Union Bank is one of the most popular banks in the United States and benefits its users. Despite being a brick and motor bank, it has also embraced technology, and customers can now bank online:

- Flexible services and features 24*7

- Only pay for the services you need

- A low minimum deposit

- Wide range of checking accounts

- Free access for non-Union Bank ATM

Downsides of Union Bank Online Banking

Union Bank among one of the best banks in the United States, but it also has its downsides. For example, it has many locations, making it challenging to give their customers the same level of customer service.

- Low-interest rates

- Fees required for regular banking procedures

- High minimum balance for high-interest rates

Union Bank Review

Union Bank offers the service of internet banking. Union Bank has 120+ million customers and a total business of US $106 billion. Union Bank provides an international debit cum ATM card facility, free internet banking ( fund transfers+ bill payment) free passbook. Account statements, etc. Union Bank offers many credit card options for customers with different rewards and rates.

Union Bank Contact Details

Union Bank Customer Support Number

1-800-238-4486

Union Bank Address

Not Available

Union Bank Information

Bank’s Website: www.unionbank.com

Routing Number: 122000496

Swift Code: See Details

Phone Number: 1-800-238-4486

Similar Bank Login

- Minnwest Bank

- UMB Bank

- Tinker Federal Credit Union

- Red River Bank

- Lee Bank

- Dollar Bank

- WSFS Bank

- New York Community Bank

- ENT Credit Union

- South Georgia Banking

- Farmers State Bank

- Alaska USA Federal Credit Union

- Metro Bank

- Call Federal Credit Union

Frequently Asked Questions

Is Union Bank is Safe?

Union Bank has gone to extraordinary lengths to ensure that online transactions are safe by placing its devices in the most secure environment, as evidenced by the digital certificate issued by “VERISIGN.”

What are the Benefits of the Union Bank?

Union Bank of provides:

Unlimited free multicity checkbooks.

Free demand drafts/pay orders drawn at union bank locations.

Complete free electronic fund transfer facility

Issue free ATM cum debit card

What is the Minimum Balance in Union Bank?

Anyone can open no minimum balance requirement as an account with a Zero balance. If you want to deposit cash, Cash Deposit Charges will be applicable in the statement.

How Can I open a Zero Balance account in Union Bank?

It would better if you visited the bank branch to open the account. Fill the account opening form, nomination form, along with attested photocopies and passport photocopies. Customers can open 0 balance of Union Bank of India online by filling up the online account opening form of Union Bank.

How much can I Withdraw from Union Bank?

At Union Bank ATMs, you can make the withdrawal of up to $500 or an amount equal to your available account balance daily, whichever is less.

Conclusion

Union Bank offers a range of credit card options, and their savings and checking accounts are outstanding. However, you should know that interest rates are usually low for these accounts.

{{CODEfaq}}