Continental Finance Company (“CFC”) is a significant marketer and servicer of credit cards for those with bad credit in the United States.

CFC, which was founded in 2005, takes pride in its corporate commitment to clients, which includes three key features: a solid customer care programme, fair treatment, and responsible lending.CFC prides itself on great customer service and access to products with unique features, having managed over 2.6 million credit cards since its inception. They specialise in giving individuals who are underserved by traditional credit card issuers access to credit goods and services. They can deliver several services to consumers when other financial institutions cannot do so, thanks to a cutting-edge consumer underwriting, marketing, and servicing platform. They can help you get a product that is suited for you, whether you have good credit, bad credit, or no credit.

CFC has a specialised customer service team that recognises the importance of assisting consumers in carefully managing their credit. Their mission is to give each customer the finest level of customer service possible, including all of the educational resources they’ll need to manage their credit successfully.

The products supplied to you are constantly reevaluated, keeping you, the consumer, in mind. Both in print and online, the application and credit approval processes, as well as fees and payment obligations, are spelt out clearly and concisely. The idea is to provide this information to both current and potential clients in a completely open manner.

As a result, it’s critical to ensure that clients can afford to pay back the credit that has been provided to them regularly. As a result, using a “low and grow” credit limit strategy encourages consumers to responsibly manage their accounts before increasing the credit limit to levels they may not be able to manage today. Credit limits, for example, are only increased after a consumer has demonstrated good financial management.

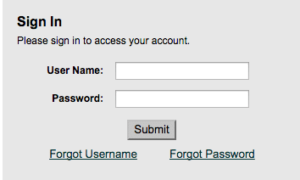

How to login

To log in to the Surge Mastercard Website, simply follow the simple steps below.

- You must go to surgecardinfo.com, which Continental Finance operates.

- You must click on the “Login1” catch on the newly opened page.

- Now type in your Username and Password and click SUBMIT.

- Finally, you’ve logged in to the website.

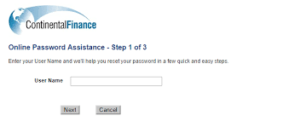

How to reset forgot password?

You can just follow us if you have forgotten your Surge Credit Card Login password.

- To begin, click on the ‘forgot password link.

- After that, you’ll be taken to the password reset page.

- You can change your password there. Depending on what they ask for, enter your account number or user ID there.

- You will soon be able to reset your password as a result of this.

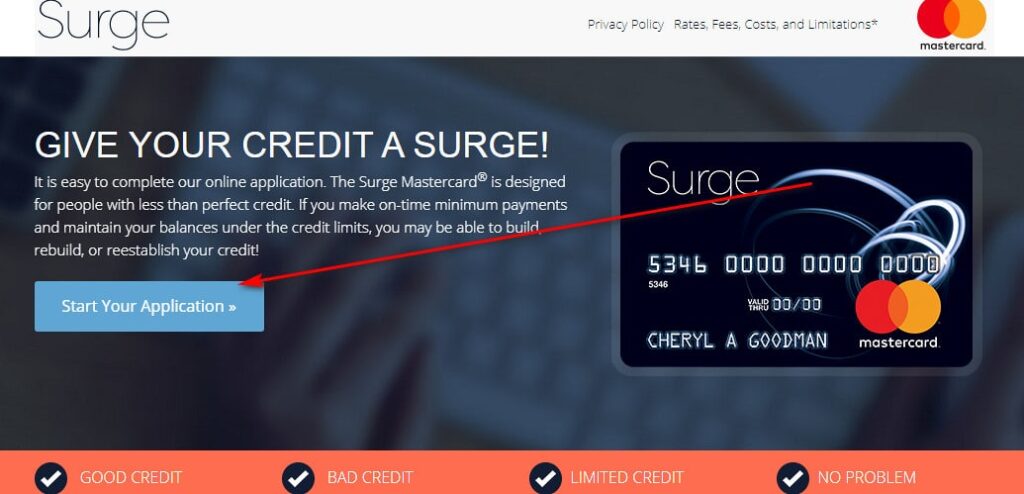

How to enroll?

You don’t need to do much now to apply for the Surge Credit Card. You can accomplish that by simply following the directions provided here. There aren’t many instructions, and they’re all straightforward. As a result, you don’t have to be concerned about not keeping up with them.

- The first step in applying for the Surge Credit Card is to visit the website, which we have provided a link to below. www.yourcreditsurge.com/Apply is the website’s address. Once you’ve arrived, fill out your personal information, and you’ll be able to apply for a Surge credit card shortly.

- You’ll be asked to enter information such as your complete name, street address, state, ZIP code, email address, phone number, and length of stay.

- Finally, once you’ve entered everything, you’ll need to verify that you’re above the age of 18.

- Also, you must complete the Recaptcha to prove that you are a human. Then select the option to “continue your application.”

- Once you’ve done that, there aren’t many steps left. As a result, don’t be concerned. You will soon be able to apply for a Surge credit card as a result of this.

- A Surge Credit Card will soon be in your possession.

How to pay using Surge Credit Card?

You only need to follow the steps outlined below to make your Surge Credit Card Payment.

Surge Credit Card Payment Online

- The first step in making a Surge Credit Card Payment is to visit CNA Financial’s online website. It has already been provided with a link. You’ll need to log into your online account after you’ve arrived. Then you can select the ‘payments’ option. There will be two boxes there when you arrive.

- Fill in the boxes with your Surge username and password. After that, click on the ‘login’ button. You will be able to log into your online account using this method. Once you’ve completed this step, you’ll have completed half of the Surge Credit Card Payment process.

- Go to the ‘payments’ section of your account once you’ve logged in. There, you can choose the payment method you want to use. As a result, you can make your Surge Credit Card Payment online through your account using this method. This is how you can make a payment with your Surge Credit Card.

Surge Credit Card payment by phone

The Surge Credit Card Customer service phone number for payments and other assistance is 1-800-518-6142

Surge Credit Card Payment by mail

The address for payment through the mail is;

Surge Card

P.O. Box 6812

Carol Stream, IL 60197-6812

Benefits Of Surge Credit Card

The following are some of the advantages of the Surge Credit Card:

- You can use it to handle your online payments.

- These cards are incredibly simple to use.

- Surge’s official mobile app allows you to manage it.

- Your online account can be accessed at any time, on any day.

- You’ll get a monthly report on your credit card spending, as well as tips on how to save money. As a result, you can use that report to keep track of your credit card balance.

FAQs

- Does surge credit card give increases?

You may be eligible for a credit line increase after you’ve been authorised for the Surge Credit Card and have used it properly for six months.

- What is the processing time for the Surge Mastercard credit card?

Your Surge Mastercard credit card will arrive in the mail in 2 weeks at the most.

- Can I use my surge credit card to receive a cash advance?

The annual cost for the Surge credit card ranges from $75 to $99, which is pretty high for a credit-building credit card. There’s also the possibility of a $10 monthly maintenance fee. A cash advance fee of 5% of the cash advance amount or $5, whichever is greater, applies to the card.

Similar Credit Card Login:

- Old Navy Credit Card

- Dicks Sporting Goods Credit Card

- Comdata Cardholder Credit Card

- biPetRebates.com Prepaid Credit Card

- TJX Rewards® Credit Card

- Justice Credit Card

- Carson Pirie Scott Credit Card

- NTB Credit Card

- P.C Richard Credit Card

- Pep Boys Credit Card

- Raymour & Flanigan Credit Card

- Reflex Credit Card

- Art Van Credit Card

- Victoria’s Secret Credit Card

- Saks Credit Card

- Kay Jewelers Credit Card

- Frys Credit Card

- Tractor Supply Credit Card

- Meijer Credit Card

- Home Depot Credit Card

- Pier 1 Credit Card