Rio bank is hugely advantageous for every one of its clients. The bank is notable for its services. Many individuals of the country trust the bank for its validity. Going from individual to business banking, Rio bank offers numerous benefits to help all the money related requirements. The bank additionally provides advances, credit cards, and home loans to assist its clients with their requirements and needs.

Rio Bank account holders get the advantages of internet banking. To utilize and get benefited, you have to know a few things, and we shall discuss all of them in detail.

If you already have an account in Rio Bank, you go through the login process and log in to your online banking dashboard. There, you can easily manage all your banking activities.

Rio Bank Online Banking Login

Rio Bank Online Banking offers a lot of advantages. However, to use such benefits, one must sign in to Rio online banking. The login process of online banking with Rio Bank is simple and straightforward and easy to understand.

To login to Rio bank, follow the steps:

Step1: Visit the official site of Rio bank.

Step2: Go to the login space.

Step3: Once you arrive, enter your username, your password, and then click on the “Go” button.

After confirming your details, the bank will take to your account from where you can take all the facilities of online banking.

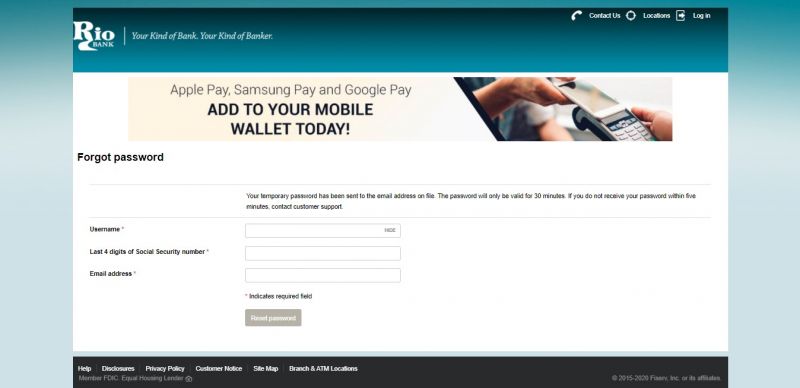

How to Retrieve Forgotten Password

Throughout some time, it is always a good thing to change the password. If you need to change your password for security reasons or have lost it, the process to get it back is very simple.

Rio bank permits its clients to change their password or login after failing to remember the password in an introductory manner. You should follow some simple and straightforward steps. Here are the steps that you can follow to retrieve your forgotten password.

Step1: Open the official site of Rio bank.

Step2: Navigate to the login section of the website.

Step3: Now, click on the “Forgot Password” link.

Step4: Here, you have to enter some of your details like your Username, last four digits of Social Security Number, email address, and then click on the “Reset Password” button.

Step5: After this, the bank will send you a temporary password on your email and that password will valid only for 30 minutes.

To look for additional assistance in resetting your password, you can contact the bank client support. Email Bank at info@Riobank.com or call Customer Service.

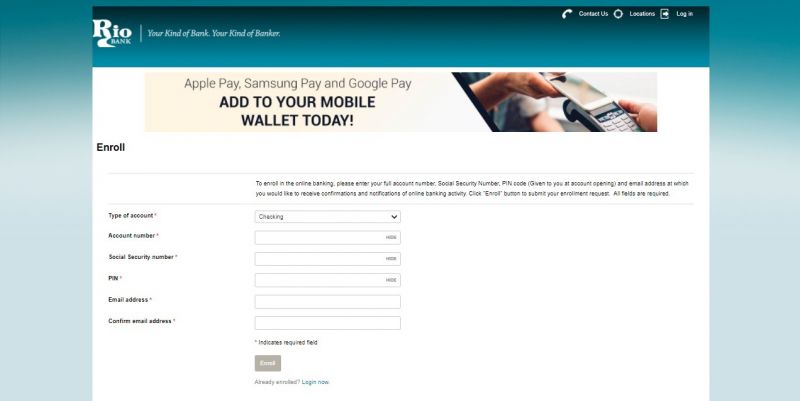

How to Enrol in Rio Bank Online Banking

To enroll in the online banking of Rio bank, it is essential to have a Rio account in the bank. If you don’t have an account you can visit the nearest branch of the Rio Bank to open an account. And If you do have an account, it will take a couple of moments to finish the enrolment. Follow the below steps to enroll yourself in the online banking of Rio bank.

Step1: Open the official site of Rio bank.

Step2: Navigate to the login space.

Step3: There you have to click on the “First Time User” link.

Step4: Here, you have to select the type of account, then enter some of your details such as your full account number, Social Security Number, PIN code, and email address. After entering all the details, click on the “Enroll” button.

Step5: After this, you will receive a confirmation mail on the mail that you have entered.

To look for additional assistance with enlistment, you can contact the bank client support Email Bank at info@Riobk.com.

MANAGE YOUR ONLINE ACCOUNT

After enrolling in Rio bank online banking, you are available to numerous advantages and services. Internet banking offers you comfort. You can deal with a lot of banking words from your home.

You can check your record balance whenever and at anyplace. The bank permits you to screen your financial movement with your record.

If you are looking for any of your exchange histories, you can access it without much of a stretch. The internet banking of Rio bank additionally lets you oversee outer individual store account assets with Bank-to-Bank Transfer.

You can take care of every one of your tabs from anyplace. The bank offers an individual to individual installment, utilizing which you can move cash to loved ones.

Aside from every one of these services, you can check the status of your credits. The bank permits you to pay your credit from your online financial balance without going to the bank.

Advantage of the Bank

The bank offers decent financial support to every one of its clients. It has some broad highlights which help its clients with their cash.

A portion of its benefits to its clients are:

- Their banking services of Rio bank are exceptionally gainful to clients.

- It offers three types of banking: Personal banking, Business Banking, and Wealth Management.

- In personal banking, you can open the two investment funds and financial records at low costs.

- In personal banking, you can open reserve funds and financial records to screen your banking.

- It requires no base equilibrium and no month to a monthly administration charge.

- The bank offers home advances and other home loans to support its clients.

- It offers accommodation in mobile banking, advanced banking, and computerized wallet to advance internet banking.

- The bank client care is consistently there to help you. You can get in touch with them in any hazardous circumstance.

Downsides

Regularly, clients gripe about the services of the bank, which needs a touch of progress.

Rio Bank Contact Details

If there should be an occurrence of any objection or issue with Rio bank, you can reach them in the accompanying ways:

Rio Bank Customer Support Number

956-631-7890

Rio Bank Postal Address

Rio Bank

701 E. Expressway 83 Box 1

McAllen, Texas 78501

Rio Bank Information

Bank’s Website: www.riobk.com

Routing Number: 114915447

Swift Code: See Details

Phone Number: 956-631-7890

Review

Rio Bank is a notable bank. It is the fourteenth biggest bank in Mcallen, Texas. The bank has clients across the country. The bank has branches in 35 areas. It has gotten an A+ wellbeing rating.

It offers three types of banking: Personal banking, Business Banking, and Wealth Management. The services of every one of the three financial territories are decent. Many individuals trust the services of Rio bank to protect their cash. The bank additionally offers advances, home loans, and MasterCard to its clients.

The web-based banking of Rio bank offers you a ton of advantages. You don’t have to go anyplace to make your exchange. You can deal with your ledger with your cell phone.

Similar Bank Login

- America First Credit Union

- Center State Bank

- Fulton Savings Bank

- First Republic Bank

- Hebron Savings Bank

- Simmons Bank

- Lone Star National Bank

- TCF Bank

- Whitaker Bank

- Zions Bank

- Bryant Bank

- 1880 Bank

- ACNB Bank

- Cornerstone Bank

- Patelco Credit Union Bank

- Smart Bank

FAQs

What are the highlights of the Rio Money Market Investment Account?

There are different highlights of currency market venture account in Rio bank, for example:

- It permits you to compose checks.

- It offers the clients layered financing costs so you can acquire more as your equilibrium develops.

- It requests a $2,500 least to open a Money Market Investment manage an account with Rio.

- You need not stress over any month to month upkeep charges.

- The bank permits you to make up to six exchanges or withdrawals for each month.

What are the terms advances and credit alternatives of Rio bank?

The bank offers advances and credit choices for clients needing to

Put resources into land or for working capital. You can likewise apply for advances and Mastercards to buy gear, stock, vehicles, and proprietor involved land. The bank offers credits to renegotiate existing obligations too.

What is the Difference between Free financial records, compass checking, and start checking?

Free checking:

It offers you all the fundamentals of banking. A free checking ledger doesn’t need any base equilibrium or month to a monthly administration charge. It requires a $50.00 at least opening store to keep up your record.

Compass Checking

It incorporates all the fundamentals added with additional worth-added advantages to improve banking significantly more. The compass financial records offer you to keep up a free box of chosen minds a yearly premise. You additionally get an open store box for one year. With the utilization of the BaZing portable application, you get a great deal of shopping, feasting, and travel limits.

Star Checking

It is a prime enrollment of Rio bank that offers numerous highlights in revenue of clients. You will procure payment on your checking offset with layered rates. It brings to both of you free boxes of chosen keeps an eye on a yearly premise. You can utilize the free coin counter and appreciate shopping, eating all with limits.

What to do if that I look for help from the bank?

There are different approaches to contact the manage an account with various issues.

- You can contact the bank whenever for your question by visiting there.

- You can call them on 844.842.0268 for questions identified with web-based banking.

Conclusion

Rio bank is a decent decision to make as it offers an assortment of services. The bank causes you your troublesome circumstances, just as with new dreams. You can get simple advances and Visa alternatives for different individual and business needs.

The bank client care is consistently there to help you. Many individuals audit the manage an account with an insistence. The bank would be a great decision for all your money related necessities.