The Northern Bank of Alabama, which would become the First National Bank of Huntsville and was the forerunner of Regions Financial, was established in 1852 as the Northern Bank of Alabama.

The Second National Bank of Montgomery, which would later become the nucleus of Regions, opened in a two-story facility on Market Street in 1871 and had more than $521,000 by 1875.

Exchange Bank in Birmingham, the third bank that would become part of Regions, opened its doors in 1928 with $35,000 in capital contributed by members of the Birmingham Exchange Clu members.

Their early years were marked by economic challenges, including the 1929 stock market crash and the Great Depression. Astonishingly, all three banks survived the Great Depression when four out of every ten banks in Alabama collapsed.

Regions Financial Corporation is one of the nation’s biggest full-service consumer and commercial banking, wealth management, and mortgage products and services and is a member of the S&P 500 Index. Regions serve customers throughout the South, Midwest, and Texas.

Following the Great Depression, all three banks saw significant expansion via innovation and acquisitions for the next three decades. They were pioneers in the business, opening a hospital-based branch and banking on a military post. These institutions expanded, always with a concept of taking care of clients, associates, and communities, from offering the state’s first drive-through teller in the 1940s to early adoption of the credit card industry in the 1960s.

Regions Bank Online Banking Login

Step1: Go to the Official Website of the Regions Bank.

Step2: On the left of the website, you will find the login section. In that login section you have to enter your Online ID and then click on the “Log In” button.

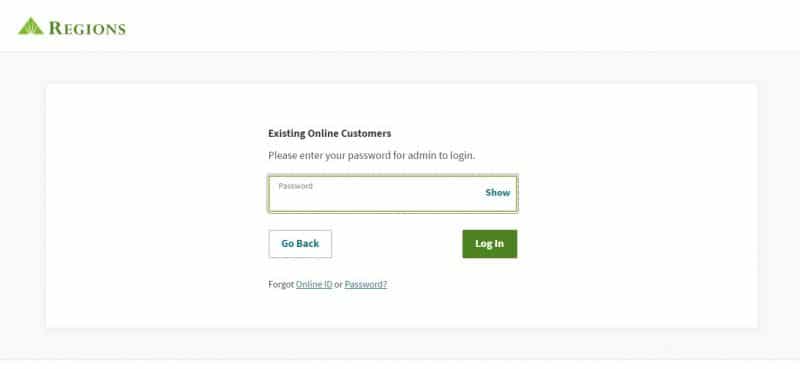

Step3: In this step you just have to enter your Password and then click on the “Log In” button.

How to Reset Your Password

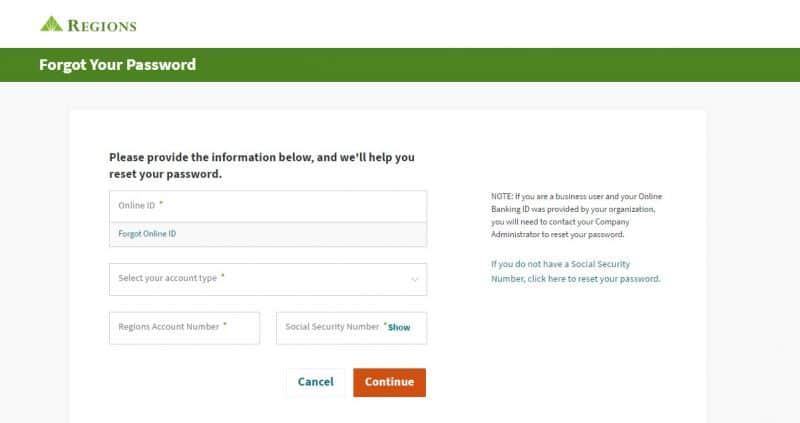

If you enter the wrong username or password, you will be denied access to your online account. As a result, you’ll need to change your password. The following are the steps you must take:

Step1: Go to the Official Website of the Regions Bank.

Step2: On the left of the website, you will find the login section. In that login section you have to click on the “Forgot Password?” link.

Step3: Now, enter some of your personal details, such as your online ID, select your account type, your Regions Account Number, Social Security Number and after entering all the details click on the “Continue” button.

After that, you’ll need to create a new password for your online account.

How to Enroll into Regions Bank Online Banking

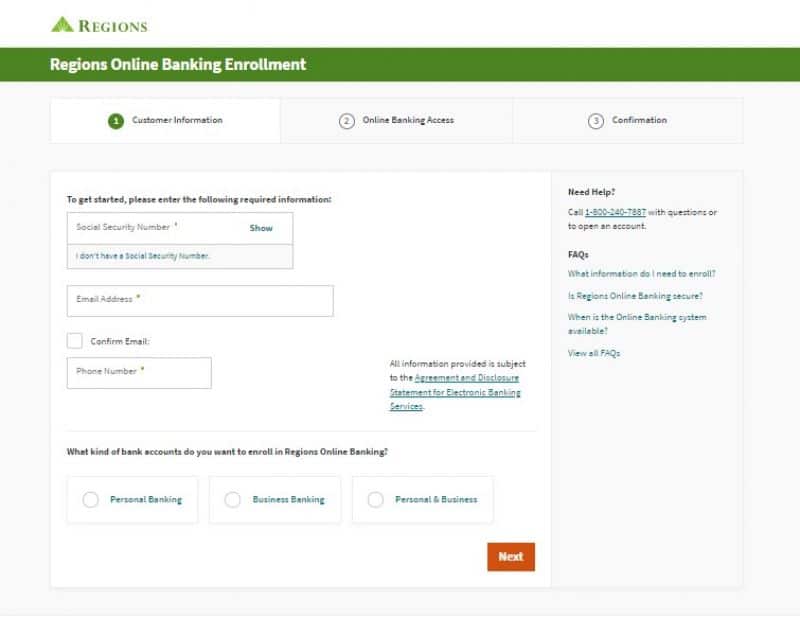

If you have a bank account, you may sign up for online banking so that you can manage and access your account at any time. Enrollment takes only a few minutes and is completely free! To enroll, follow these steps:

Step1: Go to the Official Website of the Regions Bank.

Step2: On the left of the website, you will find the login section. In that login section you have to click on the “Enroll in Online Banking” link.

Step3: Here you have to enter some of your details such as Social Security Number, Email Address, Phone Number, and then select the type of account you have, and then click on the “Next” button.

Step4: After this you have to through some more prompt and then verify your account.

Regions Bank Online Account Management

These clients who have signed up for online banking can conduct their banking at any time, and these services are free. Online banking offers several advantages:

- Making payments is simple.

- Money may be transferred between accounts quickly and easily.

- You can see how much money you have in your account.

- You can find the nearest ATM here.

- You may sign up for an account.

Regions Bank services

Here are several choices for opening a deposit account with Regions Bank so that you can manage your payments or save money:

- If you need to save money in a bank account, you should undoubtedly consider saving in this savings account. Regions Bank’s savings account makes it simple for you to optimize your savings. You may pick from three types of savings accounts: low-fee savings accounts, no-fee savings accounts, or start an account for your children to help them learn appropriate financial habits from a young age.

- The bank provides five different checking accounts. There will always be an account for you, whether it’s an online checking account, an interest checking account, a low-fee checking account, or a direct deposit with unlimited check-writing capabilities.

- Money market account-Are you dissatisfied with your Regions savings account’s rate of return? You aren’t the only one, after all. Regions Bank’s money market account will assist you in achieving your financial objectives. Money market accounts are divided into two categories: primary and premium. A money market account will set you on the right road, whether you’re saving for retirement, a nest egg, or a down payment.

- A money market account isn’t the only way to make money. You may also make money using a certificate of deposit. The rates on Regions certificates of deposit are relatively cheap, and the returns are guaranteed. In addition, there is no daily compounding of interest or maintenance cost. You may also choose to have your CD automatically renewed when it expires.

Expanding Regions Bank

The three banks—Exchange Security Bank of Birmingham, First National Bank of Huntsville, and First National Bank of Montgomery—filed a bank holding company application with the Federal Reserve Bank on July 2, 1970. They have $446 million in assets between them. While each bank’s motives for the new structure were varied, the ability to lend more money, enhanced acquisition possibilities, and job development in the state were all critical factors. Despite initial resistance, the Federal Reserve approved the formation of First Alabama Bancshares in 1971 by a vote of 5-to-2.

The bank expanded fast from the 1970s through the 1990s via acquisitions and new products, services, and business areas. In 1986, changes to the Interstate Banking Bill allowed bank holding corporations to buy branches in states where they were not chartered. This shift in the law resulted in tremendous growth.

Regions Bank Loan

- Regions Bank’s mortgage loan-mortgage rates are always at an all-time low. You will always locate mortgage alternatives that match your needs, whether you wish to purchase or build a house. If you want to refinance your mortgage or apply for a home equity loan, a house loan may be the best option.

- When you choose Regions Bank for a loan, you’ll benefit from rates as low as 2.04 percent, whether you’re refinancing or purchasing a car.

Regions Bank Credit Card

Regions Bank credit card offers four different types of credit cards. A Regions credit card might be the perfect match for folks seeking an account to assist them in establishing their credit history or just a card with perks like travel cancellation insurance or lost luggage replacement.

Regions Bank Online Banking Benefits

With mobile banking you can, saving you time and money. To set up automated bill payments, go into your bank’s online banking and select Bill Pay.

- You can feel safe with secure mobile banking and fraud prevention features.

- When you use your Regions Visa Check Card to make purchases, you’ll be rewarded.

- Choose from a variety of online declarations to help the environment.

- Online transactions that are simple and convenient

- Overdraft protection safeguards you against unanticipated balance pulls.

- You’ll get email and mobile alerts to keep you up to date.

Regions Bank Contact Details

Regions Bank Customer Support Number

1-800-472-2265

Regions Bank Postal Address

Regions Bank

Office of Customer Satisfaction

250 Riverchase Parkway East

Birmingham, Alabama 35244

Regions Bank Information

Bank’s Website: www.regions.com

Routing Number: 062005690

Swift Code: See Details

Phone Number: 1-800-472-2265

Similar Bank Login

- Dollar Bank

- WSFS Bank

- New York Community Bank

- ENT Credit Union

- South Georgia Banking

- Farmers State Bank

- Alaska USA Federal Credit Union

- Metro Bank

- Call Federal Credit Union

- Union Bank

- M&T Bank

- KeyBank

- Security Service Federal Credit Union

- BB&T Bank

- Randolph Brooks Federal Credit Union

Conclusion

I hope you find this helpful material helpful and get all the information related to Region Bank. Please let us know, in case you have any questions in the comments section, and we will gladly answer them.