At Prosperity Bank, they are committed to offering services that make our clients’ financial lives more manageable.

Prosperity Bancshares, Inc. is a bank holding company with Texas and central Oklahoma operations. Its headquarters are in Houston, Texas. At present, the corporation had 285 locations as of December 31, 2019: out of which 65 is in Houston, including The Woodlands, Texas; 30 in South Texas, including Corpus Christi, Texas, and Victoria, Texas; 75 in the Dallas–Fort Worth metroplex; 22 in East Texas; 29 in Central Texas, including Austin, Texas and San Antonio; 34 in West Texas, including Lubbock, Texas, Midland–Odessa, and Abilene, Texas; 16 in Bryan–College Station.

The upgraded identity verification procedure provides increased security connections, offering good experiences at every touchpoint, from in-person to digital, and ensuring the protection of our customers’ personal information and financial data.

You’ll find experienced employees eager to assist you with precision and a smile at Prosperity Bank, and we’re happy to care about the communities they serve.

Prosperity Bancshares, Inc is a $36.512 billion regional financial holding corporation located in Houston, Texas, that provides personal banking and investing services to consumers and small to medium-sized companies throughout Texas and Oklahoma as of September 30, 2021.

Prosperity Bank, founded in 1983, adheres to a community banking concept, delivering financial solutions to ease everyday financial needs to clients, companies, and communities in the locations it serves. Along with traditional deposit and loan products, Prosperity offers digital banking solutions, retail brokerage services, credit and debit cards, mortgage services, trust and wealth management, and cash management.

Prosperity Bank Online Banking Login

Customers may connect at any time and bank from the comfort of their homes or anywhere in the world, thanks to Prosperity Bank’s user-friendly website. To log in, simply follow these simple steps:

Step1: Go to Prosperity Bank’s Official Website.

Step2: Click on the “SIGN IN TO ONLINE BANKING” button.

Step3: Now, enter your User ID, Password and then click on the “SIGN IN” button.

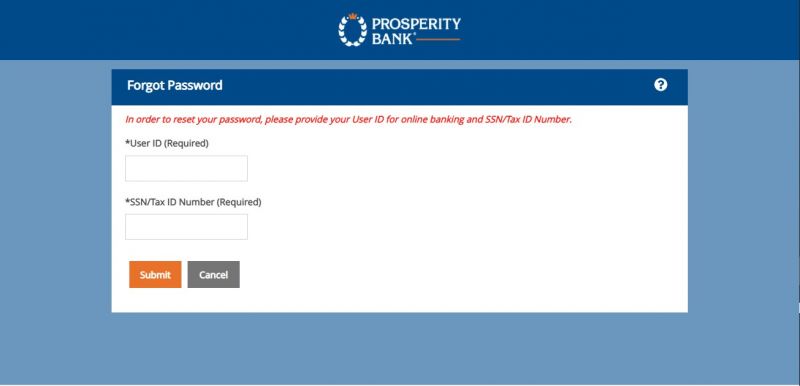

How to Reset Password of Prosperity Bank

In case you forget your password or just wish to reset it for security reasons, you must use a valid user ID. To reset your password, you may follow the steps below:

Step1: Go to Prosperity Bank’s Official Website.

Step2: Click on the “SIGN IN TO ONLINE BANKING” button.

Step3: Now, click on the “Forgot Password” link.

Step4: Click on the “Submit” button, after entering your User ID and social security number.

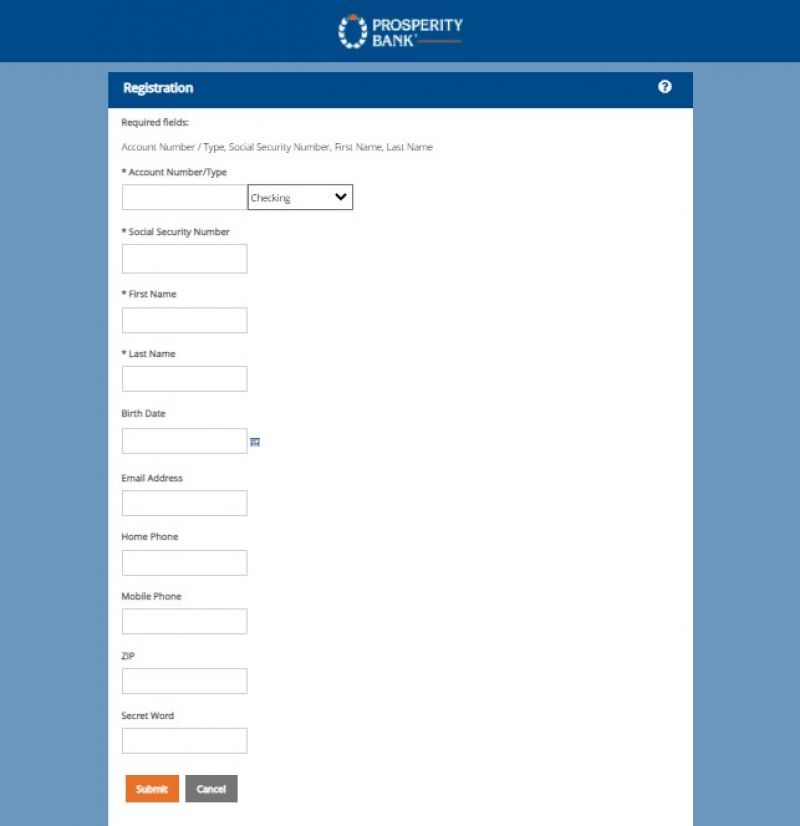

How to Enroll into Prosperity Bank Online Banking

Customers have found it simple to sign up for their internet banking services. Customers who have an account with the bank are eligible for this service, and once enrolled, you may access and manage your account at any time. Follow the steps below to enroll:

Step1: Go to Prosperity Bank’s Official Website.

Step2: Click on the “SIGN IN TO ONLINE BANKING” button.

Step3: Now, click on the “Enroll” link, just above the “SIGN IN” button.

Step4: Here, you have to enter all your required personal details such as your Account Number / Type, Social Security Number, First Name, Last Name etc. and then click on the “Submit” button.

Prosperity Bank Card

- There is just one card. There are several advantages.

- There is No Liability Defend yourself from unauthorized charges

- 24X7 fraud detection

- Notification of Travel

- The card is accepted at all ATMs.

- Assistance with Lost or Stolen Cards is also available 24X7.

Features for Prosperity Bank Online Banking

The new and upgraded Online Banking and Mobile Application include a more user-friendly design, increased security choices, and additional features and capabilities, such as:

- The user experience has been improved.

- Views of the home page that may be customized.

- Log in/out timings are tracked, as well as notifications when your security questions are modified.

- The upgraded identity verification procedure provides increased security and

- Customize the appearance and feel of your Mobile Banking features to match your Online Banking profile.

- With the new spending module, you can keep track of your savings objectives and costs.

- Quicken and QuickBooks may be accessed directly with this URL.

- Additional alert alerts for changes to your account’s profile or security, as well as loan payment reminders.

- Accounts that you’ve recently opened are automatically shown, as well as other information.

- Debit card security and notification have been improved.

External Transfers

External Transfers allow you to transfer funds from one of these Prosperity accounts to and from another financial institution quickly and easily using Online Banking, including Checking, Savings, Money Market Checking, Money Market Savings, and Brokerage.

PROSPERITY BANK REVIEW

Prosperity Bank is a subsidiary of Prosperity Bancshares, Inc., a Texas, and Oklahoma-based holding company. Prosperity is headquartered in Houston, Texas.

Prosperity Bank is one of Texas’ most dependable and trustworthy financial institutions. Banks are often judged on their goods, services, and customer service, as well as their efficiency.

The multibillion-dollar corporation has excelled in all three areas. As mentioned in this essay, customer reviews may witness this.

Prosperity Bank Services

Prosperity Bank provides a variety of personal and business banking services. Small to medium-sized consumers and enterprises are among the clients they serve.

Personal and commercial banking services and products, internet banking, debit and credit cards, mortgage service, mobile banking, 24-hour voice response banking, trust and wealth management for customers, and commercial and retail brokerage services are among the bank’s offerings.

IRA accounts at the bank provide clients with tax advantages on their retirement savings.

Personal Banking Products and Services

Customers of Prosperity Bank can choose from various banking products and services. They are as follows:

- Personal checking accounts, personal savings accounts, money market accounts, and other deposit products

- Car loans, home equity loans, home renovation loans, and house loans are among the bank’s loan options.

- Customers of Prosperity Bank have access to online banking services such as internet banking enrollment, transaction notifications, statements, and account transfers, among other things.

- Trust services, client debit, credit cards, and investment services are among the other banking services available to Individual customers.

Benefits of Prosperity Bank

Prosperity Bank is one of America’s most significant banks, offering dependable banking services and products. The following are some common benefits of banking with the bank:

- Customer service is outstanding.

- According to client reports, many consumers are delighted with the bank’s customer assistance services. They describe the bank’s employees as helpful and pleasant.

- Loan approval—The importance of loans in today’s world cannot be overstated, and if you’re in business, you’ll need a steady supply of cash to keep your operation running. The bank will get a lot of credit if it can get into the bank quickly. A large percentage of consumers stated that the bank rapidly examines and authorizes loans and mortgages, particularly for individuals and businesses. Loan offices are also beneficial, and they generally answer consumers swiftly.

Prosperity Bank Contact Details

Prosperity Bank Customer Support Number

1-800-531-1401

Prosperity Bank Postal Address

Prosperity Bank

1301 North Mechanic

El Campo, Texas 77437

Prosperity Bank Information

Bank’s Website: www.prosperitybankusa.com

Routing Number: 092901683

Swift Code: See Details

Phone Number:1-800-531-1401

Similar Bank Login

- South Georgia Banking

- Farmers State Bank

- Alaska USA Federal Credit Union

- Metro Bank

- Call Federal Credit Union

- Union Bank

- M&T Bank

- KeyBank

- Security Service Federal Credit Union

- BB&T Bank

- Randolph Brooks Federal Credit Union

- Regions Bank

- Bank of the West

- ESL Federal Credit Union

- First Interstate Bank

Frequently Asked Questions (FAQs)

Question: Is Prosperity Bank a legitimate financial institution?

Answer: Prosperity Bank is a wholly-owned subsidiary of Prosperity Bancshares, a multibillion-dollar financial holding firm headquartered in Texas. Personal and commercial banking, investment and trust services, are all available through the bank.

Question: How much a customer have to pay to open a Prosperity Bank account?

Answer: You may open one for as little as $200. In addition, the bank will eliminate the $3 minimum balance fee if you maintain that level in your account.

Question: Is Prosperity Bank a state-owned institution?

Answer: As of July 1, Prosperity Bancshares Inc. (NYSE: PB), American State Financial Corp, and its subsidiary American State Bank have finalized their merger.

Question: Is there overdraft protection at Prosperity Bank?

Answer: Prosperity Bank offers overdraft protection programs that will help you prevent becoming overdrawn on your account. These options, which include automated transfers from another account or an overdraft line of credit, are available in place of Advantage Overdraft.

{{CODEfaq}}