Because of prior mistakes, you may be concerned about your credit score. The Milestone Gold Mastercard may be a good option for you. If you’re careful with how much you charge and pay your bills on time and in full, you can use it to help you develop credit. The following are some considerations while submitting your application.

Credit limits on the Milestone Gold Mastercard are set at $300 per card. The yearly fee that you’ll be charged at the time of account opening will deplete the available credit on your credit card.

If your credit limit is set at a low level, it may be difficult to keep your credit utilization (the amount of credit you use about the amount of credit you have) low. One of the most crucial factors to consider while enhancing your credit is your credit utilization percentage.

Take into consideration making payments more frequently than once a month and working toward paying off your obligations in full to make your usage as low as possible.

If you have a less-than-perfect credit history and want to improve your credit profile, you may be eligible for the Milestone Gold Mastercard.

It is possible, though, that if you shop around, you will be able to discover a card with cheaper fees or higher credit limits than the one you presently have.

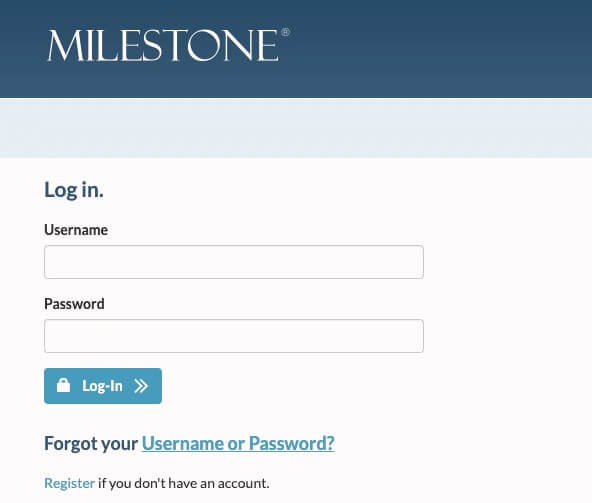

How to Log in to a Milestone Credit Card Account

- Register for online account access using your Milestone Credit Card to get started. Clicking on “Register” and providing your credit card details makes verifying your credit card account a cinch.

- The use of spaces in either the user’s I.D. or the password is strictly prohibited.

- Use your Milestone Credit Card login credentials to access your account. To access your account, navigate to the Genesis Financial Solutions login page and enter your new User ID and Password information there. After that, click “Log-In” to continue.

Once you have registered and logged in, you will be able to manage your Milestone Credit Card account totally online. Your account information, such as passwords and automated payments, as well as the amount owing on your credit card and the frequency of your credit card bills, can all be modified.

How to Reset a Forgotten Password

You may easily recover your Milestone Card Login Password by following these steps.

- Select “Forgot your username or password?” from the drop-down menu.

- Fill in the blanks with the information that has been provided to you, and then click on the submit button.

- Before submitting your request, double-check that you have read and agreed to the terms and conditions of the site.

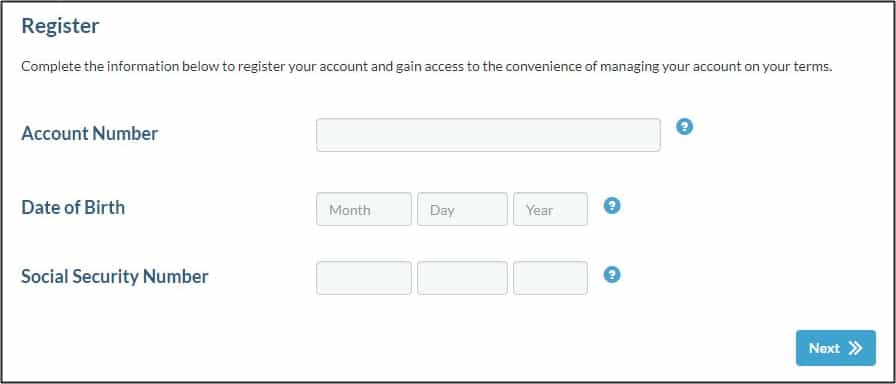

What is the procedure for enrolling?

Please follow the steps outlined below to create a user name and password for your Milestone Credit Card.

- To gain access to your Milestone CC account, go here.

- In the second step, locate and touch on the “Register” link, which can be found on the upper right-hand side of the screen.

- After that, fill out your personal information on the following page, and you’ll be good to go!

- Finally, create a username and password that are secure and easy to remember to complete the procedure.

Milestone’s Customer Service Contact Information

A sympathetic ear to hear your issues and offer guidance is sometimes all that is required. You may want to know more about how to use your MasterCard. They offer a customer service team that can take care of everything for you with a single phone call.

Customer assistance can be reached by calling 866-453-2636 (toll-free).

Phone: 503-268-4711 Fax: 503-268-4711

Milestone’s mailing address can be found here.

Genesis Financial Services Credit Card issuers are listed below.

Postal Code 4477 is an abbreviation for the following:

Beaverton

OR,

97076-4477

How to Pay Milestone Credit Card?

- Online: Paying with your Milestone Credit Card online is simple.

- By Phone: If you want to make a payment by phone, call (866) 453-2636 to speak with a customer service representative from Milestone Credit Card.

- By mail: Alternatively, you can send your check or money order to the address listed below. Genesis Financial Services Card Services Washington, DC 20004 (P.O. Box 84059) In the heart of Columbus, Georgia, you will find the Columbus Inn.

- By MoneyGram: In the case of a MoneyGram transaction, locate a MoneyGram location near you and check that the following information is accurate: Genesis FS Card Services, Inc. is a Florida-based company that provides payment card services. 4911 was the code that was received.

Benefits of Having a Milestone Credit Card

Milestone Gold Mastercard holders are entitled to various perks, including identity theft resolution services, extended warranty coverage, and price protection features, among others. The extended warranty, roadside assistance, and travel assistance are just a few of the benefits that Indigo Platinum Mastercard customers may take advantage of.

The following are some of the advantages of having a Milestone Gold MasterCard:

- A service that assists persons who have been victims of identity theft.

- Warranty extensions are available.

- Stability in the price of goods and services

What is the procedure for applying for a Milestone credit card, and how long does it take?

First, you must be pre-approved for a Milestone Credit Card before you can begin the application process for one. Those who are interested in applying for the Milestone Credit Card will be contacted through email after they have been pre-qualified for the card. There is no way to apply without first completing a pre-qualification process, which can be done over the phone or through the postal service.

It is unnecessary to worry about your credit score being damaged by a “soft” credit inquiry performed for pre-qualification purposes. These applicants will not waste their time or expose themselves to the risk of ruining their credit rating by continuing to apply.

To apply for a Milestone Credit Card, please follow the steps outlined below:

On the Milestone Credit Card website, there is a pre-qualification form that you can fill out to see if you qualify for the credit card. While there is a chance that you will receive a response right away, do not place your hopes on it. If your application has been pre-qualified, a link to an invitation should appear on the page. Please send a message with the following information: your complete name, mailing address; email address; and social security number (SSN). You’ll also need to show confirmation of your annual wage as well as verification of your monthly mortgage payment. Once you have completed your application for the Milestone Credit Card, a hard pull will be performed on your credit record. Only a short length of time can cause a hard draw to harm your credit score.

Like how pre-qualification leads to a swift decision, applying for the Milestone Credit Card should yield a prompt conclusion. Although pre-qualification does not guarantee that you will receive the card, it is a good idea to be aware of this information. If your application for the Milestone Credit Card is denied due to your bad credit history, the Milestone Credit Card may suggest credit cards from partner institutions.

FAQ’s

What should I do if my Milestone credit card isn’t operating properly?

The first step in gaining access to your statements online is to create an online account with the assistance of your card issuer. You’ll need to complete the previously mentioned registration requirements as a first step.

What is the best way to pay my Milestone credit card bill?

Creating an immediate price online is as simple as logging into your account, calling them to make a payment over the phone at their provided telephone number, 866-453-2636, sending them payment by MoneyGram, or mailing your check or money order to the address listed above.

Similar Credit Card Login

- Toys R Us Credit Card

- Credit One

- Mercury Credit Card

- Belk Credit Card

- Cabela’s Credit Card

- Lord and Taylor Credit Card

- JCPenney Kiosk Credit Card

- Lowe’s Credit Card

- Walmart Credit Card

- Ashley Furniture HomeStore Credit Card

- Target Redcard Credit Card

- TJX Rewards® Credit Card

- Zulily Credit Card