Metro Bank opened on May 30th, 1989. The late Ray Cox founded it. Metro Bank was built with a solid mission to serve the community. Metro City Bank is a state-chartered bank providing various financial services and support products for small business owners, real estate developers, consumers, and professionals.

The Bank was established in Doraville, Georgia, in 2006, with Georgia, Virginia. Alabama, the Bank started in a temporary modular unit in Pell City with ten employees and has grown to ten branch locations with over 175 employees. Over the years, Metro Bank has been constantly ranked as one of the top-performing banks in the state of Alabama. Metro City Bank gives its customers an easy way of using banking through internet banking.

All customers need to do is visit the Bank’s website and set up a free online account. So, They can use the login details to log in anytime they want and start accessing online services.

This detailed information will help you to manage your bank account at Metro City Bank online.

Metro Bank Online Banking Login

To login into your online account, you only need to provide the correct login details. After entering your right segment, you will navigate to your dashboard.

These are the steps you need to know about login:

Step1: Visit the Official Website of the Metro Bank.

Step2: Now, you have to click on the “Log In” button, at the right-top corner of the website.

Step3: As you click on the “Log In” button, a drop down list with options of type of login. And you have to select one of them, based on type of account you have. For reference here we are selecting “Personal Banking” link.

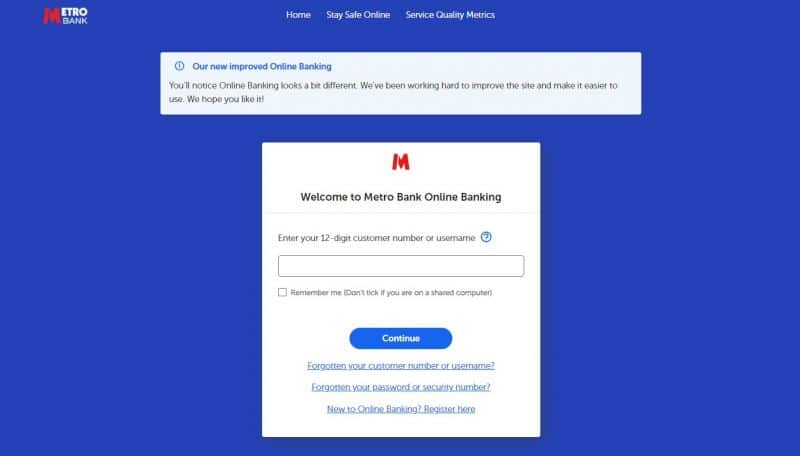

Step3: Here you have to enter your 12-digit customer number or username and then click on the “Continue” button.

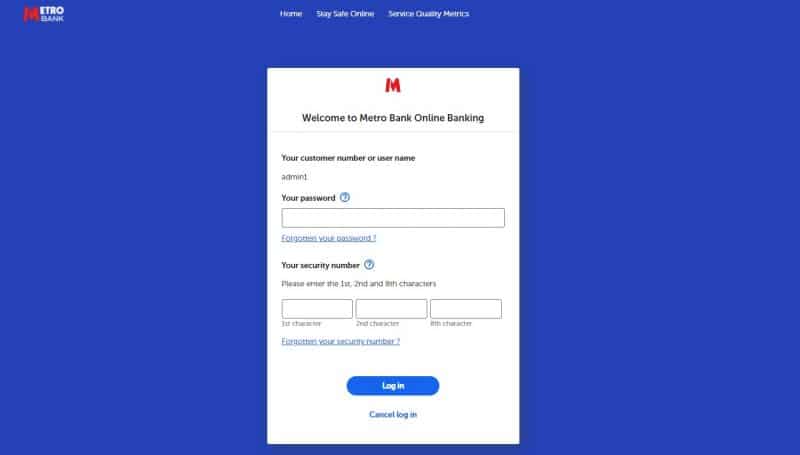

Step4: In this step, you just have to enter your Password, some characters of Security Number and then click on the “Log In” button.

How to Reset Your Password?

If you have lost or forgotten your metro bank account password, you can easily reset it so that you can gain access and conveniently manage your finances online. Once you change your password, make sure you remember it, and you can log in anytime from anywhere.

Here are steps to reset your password:

Step1: Visit the Official Website of the Metro Bank.

Step2: Now, you have to click on the “Log In” button, at the right-top corner of the website.

Step3: As you click on the “Log In” button, a drop down list with options of type of login. And you have to select one of them, based on type of account you have. For reference here we are selecting “Personal Banking” link.

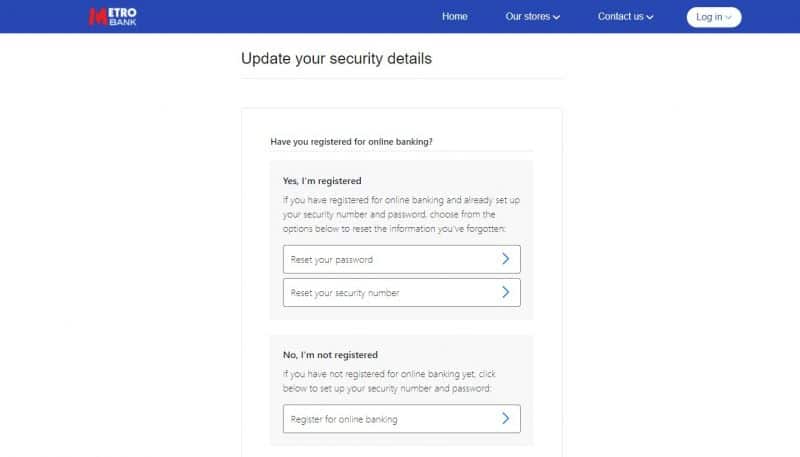

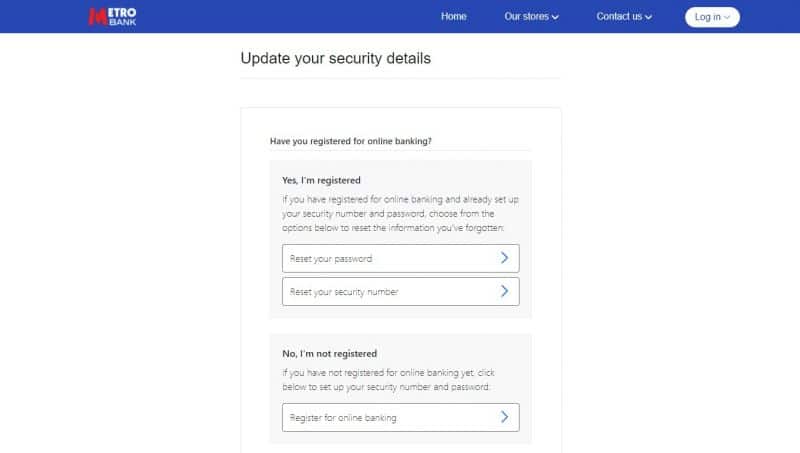

Step4: Below the “Continue” button, you have to click on the “Forgotten your password or security number?” link.

Step5: Click on the “Reset your password” button.

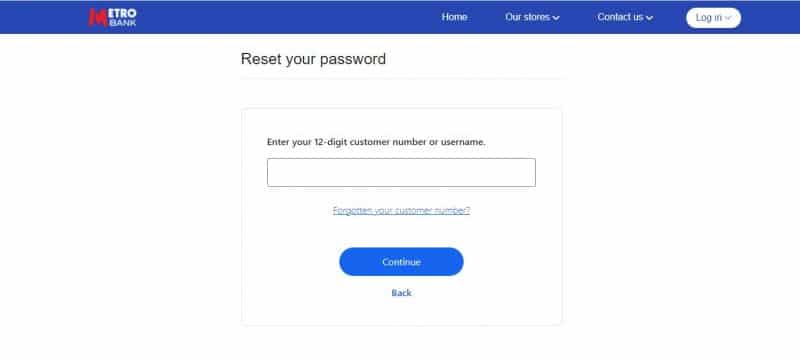

Step6: Now, enter your 12-digit customer number or username and then click on the “Continue” button.

Step7: After this you have to enter some digits of your Security number and again click on the “Continue” button.

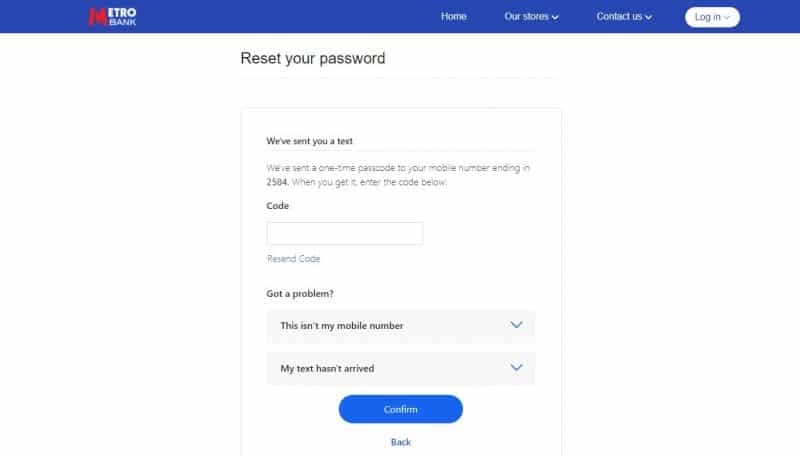

Step8: In the next step bank will send a one-time passcode to your registered mobile number. Enter that code and click on the “Confirm” button.

After following these steps you could reset your password successfully.

How to Enroll into Metro Bank Online Banking?

Step1: Visit the Official Website of the Metro Bank.

Step2: Now, you have to click on the “Log In” button, at the right-top corner of the website.

Step3: As you click on the “Log In” button, a drop down list with options of type of login. And you have to select one of them, based on type of account you have. For reference here we are selecting “Personal Banking” link.

Step4: Below the “Continue” button, you have to click on the “New to Online Banking? Register here” link.

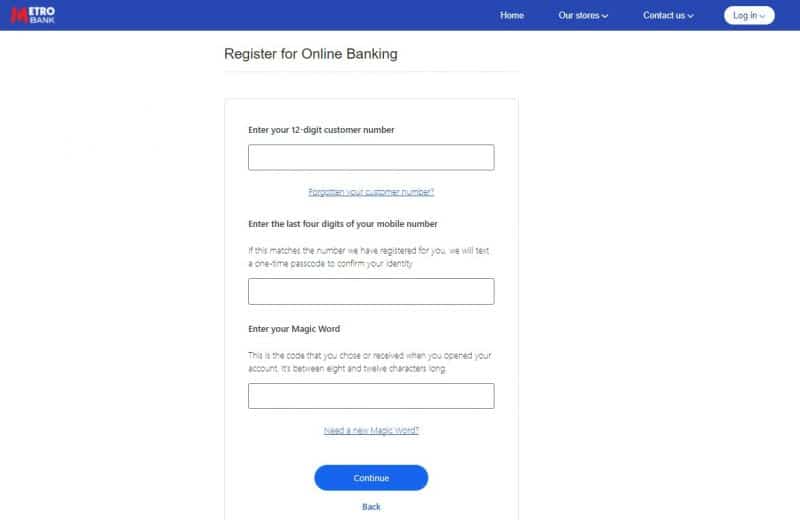

Step5: Now, enter your 12-digit customer number, last four digits of your mobile number, Magic Word(8-10 digit, Security Number) and then click on the “Continue” button.

Make sure that you have entered the correct details or provided accurate information.

Additional Services of Metro Bank

1) Telephone banking

2) Remote deposit capture

3) ATM Banking

4) International services

5) Mobile banking

Benefits of Metro Bank Online Banking

1) Pay bills online

2) Transfer money to other bank accounts

3) Find the nearest branch or ATM

4) Check the balance

Careers at Metro Bank

Metro City Bank’s team believes that each staff member is significantly contributing to the ongoing success of the Metro Bank. The Bank selects individuals who appreciate diversity, welcome new ideas, excel in customer service and have a solid commitment to teamwork to ensure this success. In return, The Metro City Bank offers a competitive salary and a comprehensive benefits package.

It considers employment to qualified applicants are without regard to race, the color of the person, religion of a person, sex of a person, national origin of the person, age of a person, disability, genetic information, sexual orientation, gender identity, veteran status, or any other protected characteristic. Select the link below if you want more information about our EEO policy or your rights as an applicant under the law.

Metro City Bank provides reasonable accommodation to qualified individuals, and people with disabilities and disabled veterans can also get equal opportunity in the job application process. If you have any difficulty using our online system and need accommodation due to a disability, you may contact vpendergast@metrocitybank.com. The option is reserved for individuals who cannot use or require assistance because a disability is not intended for other purposes.

Customers Review About Bank Services

Customer1

Metro bank provides a savings rate of 0.10%, making the Bank rank poorly compared to the average U.S. bank. Its one-year and five-year term lengths CDs earn at a rate of 2.55% and 1.24%, respectively, while its highest-yielding money market account makes at an APY of 1.00%. Given Metro City Bank provides a poor savings rate, you should consider choosing another bank to earn more on your deposits.

Customer2

Metro City Bank has 15 total bank locations in Alabama, Georgia, New Jersey, New York, Texas, Virginia, and many more. It also offers mobile and web apps for an online banking experience. Metro City Bank has got high marks from customers for its mobile banking services. The Bank mobile app has an overall rating of 4.5 out of 5 (out of 15 customer reviews on Apple and Android) compared to the national average of 3.8. You can use Metro City Bank’s app to control your funds by monitoring current statements, sending and money as well as accessing customer service. Metro City Bank gets a superb consumer satisfaction score due to relatively few complaints reported to the Consumer Financial Protection Bureau (CFPB).

Customer3

Metro City Bank offers several deposit products, like savings accounts, money market accounts, CDs, etc., to give the many options to manage your money. Metro City Bank does not have the best savings rate, which means you should think about other possibilities of other banks about banks that deliver more return on your money. Metro City Bank’s CD rates are fair in comparison to other U.S. banks.

Customer4

Metro City Bank ranks as a medium-sized bank with assets totaling $1 billion and $1 billion in deposits. Metro City Bank has an excellent Texas Ratio of 3.60%, signifying that Metro City Bank has a terrific financial shape and is unlikely to fail. Additionally, Metro City Bank is FDIC-insured, meaning that your money is insured up to $250,000, even in the event of bank failure.

Customer5

This is probably the worst and most non- likable Bank I have to deal with. I needed information on a business account (I was told to stop by at any time, no problem). So I came down told them what I needed, and they refused to help me ( this is the third time this has happened).

I told them to let me speak to the manager, but I guess they were at lunch. The assistant manager told the ladies at the customer service desk that she would help me. I was standing there looking at her, and she was, and three other people were too busy putting their makeup on. I told the customer service desk lady to stop fixing her face that I wasn’t leaving till she helped me. Right, when I sat down, she released the information to me right away. I ended up closing both accounts with them, and now I am in the process of completing my business account because they lack customer service, are rude, and they do not care about their customers.

Metro Bank Contact Details

Metro Bank Customer Support Number

907-563-4567 or 800-525-9094

Metro Bank Postal Address

Metro Bank

P.O. Box 196613

Anchorage, AK 99519-6613

Metro Bank Information

Bank’s Website: www.alaskausa.org

Routing Number: 325272021

Swift Code: See Details

Phone Number: 907-563-4567

Similar Bank Login

- US Bank

- Hudson Valley Credit Union

- Kitsap Bank

- Minnwest Bank

- UMB Bank

- Tinker Federal Credit Union

- Red River Bank

- Lee Bank

- Dollar Bank

- WSFS Bank

- New York Community Bank

- ENT Credit Union

- South Georgia Banking

- Farmers State Bank

- Alaska USA Federal Credit Union

Frequently Asked Questions

Conclusion

We have mentioned all the information you can use while logging in, resetting your password, and enrolling in online banking. According to us, Bank is quite good, and we are giving it a rating of 4.2 after reading all the reviews of customers and bank details. We hope that the information is helpful for our customers.

{{CODEfaq}}