Continental Finance Matrix Credit card is easy and best for the people who need credit to improve their credit score. It is a straightforward technique that helps poor people looking for the steps to achieve a good credit score for applying for further loans.

Using a Matrix Credit card can easily eradicate the confusion and headache of looking for the methods to boost the CIBIL score. So, think that it is a medium to save your time and improve your credit score. However, to get the most of your credit card, one should avoid the unnecessary dues by making the payments on time. Otherwise, it will provide you bad consequences.

So, let us know some of the best ways to make payments and access Matrix Credit Card.

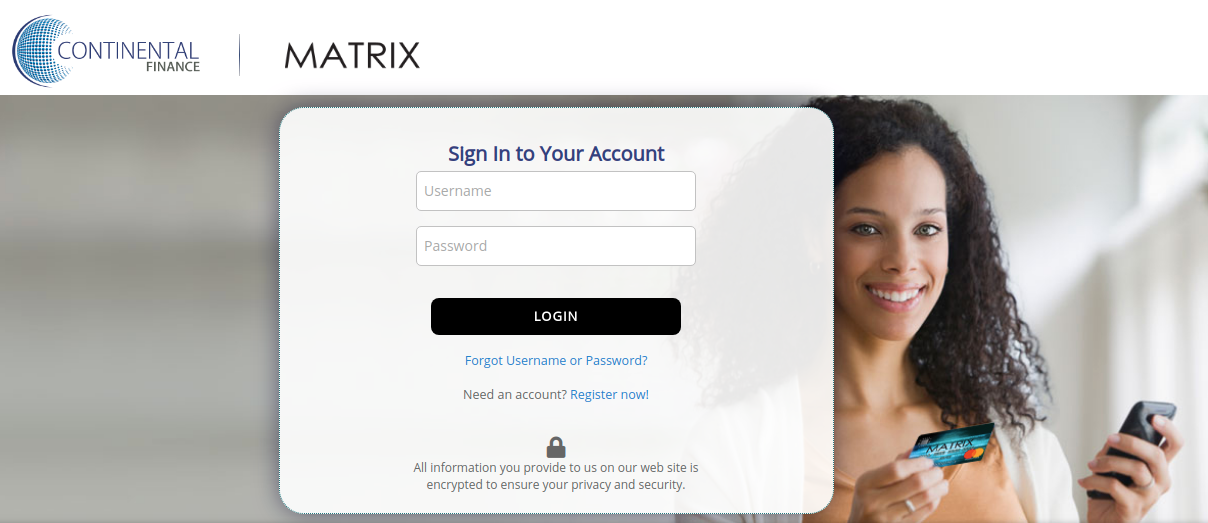

How to login?

Here’s how you can login to Matrix Credit Card.

- Visit the official website of Matrix credit card login page.

- Enter the username and password that you have used while creating the account.

- Tap on the login to my account option.

- In a few seconds, you will be logged in.

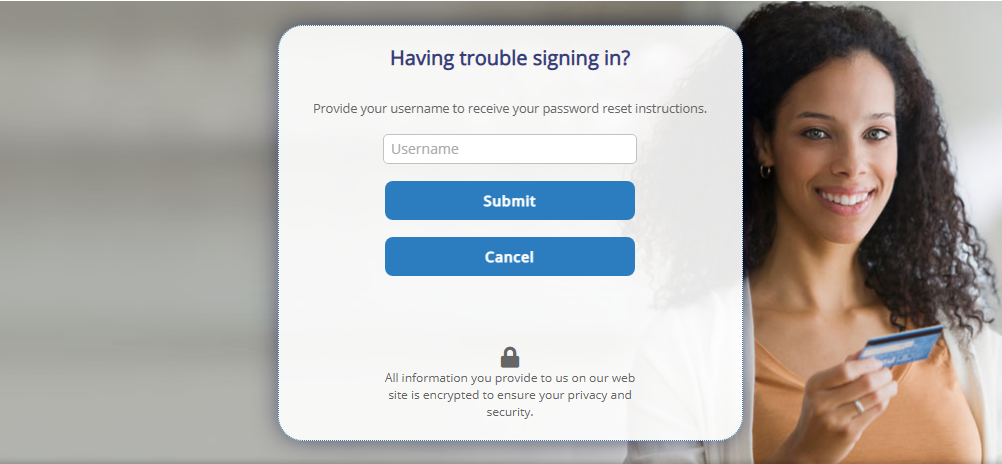

How to reset forgot Password?

In case if you have forgotten your password and want to use your account. Here are the steps that would help you enjoy your account again.

- Open the official website-continental finance matrix credit card, where the important details need to be fulfilled.

- Beneath activate my card option, you will forget my username or password option.

- Tap on forgot my password option, and a new window will appear that will ask to choose an option-: I forgot my username or forgot my password.

- Choose your option, and they will ask you to enter the username you used, then tap on submit button.

- Once they receive your details, you will get a link to reset your password.

- Enter the new password and save the changes.

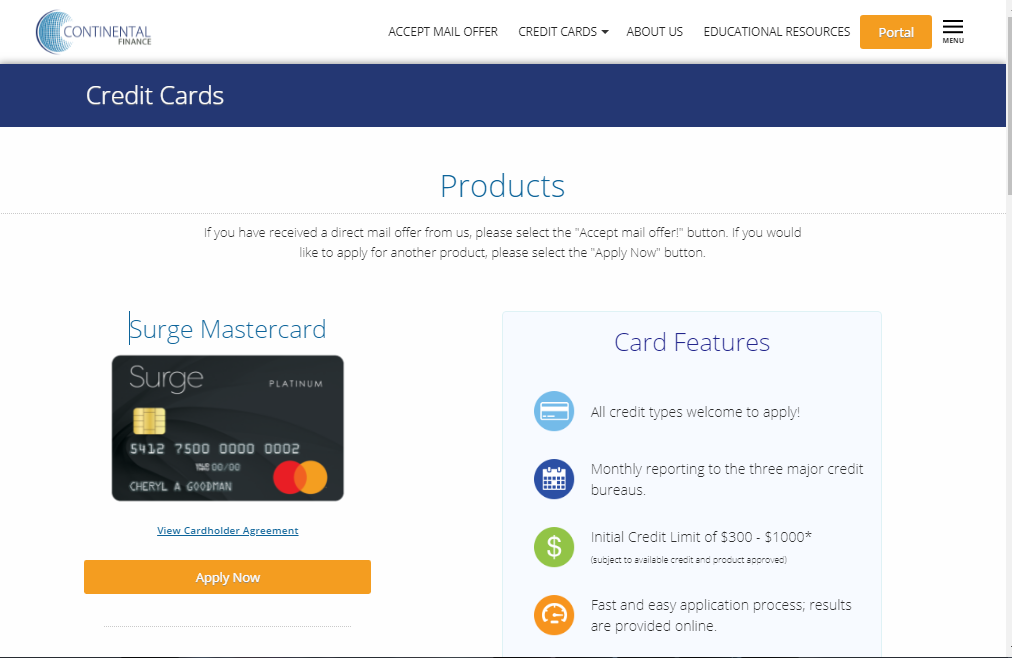

How to Enroll?

The matrix credit card offers poor customers to improve their credit for their better outstanding. If you’re interested in applying for the matrix credit card, the following are the steps you will need to follow.

- First, navigate the official website and tap on apply now link, which would be next to the continental finance matrix credit card.

- In the next step, they will ask you to enter some personal details such as:

- First name and last name

- Home or street address

- City

- State

- Country

- Email address

- Phone number

- Second mobile number

Once the details are entered, your next step is to mark yes or no in the following questions.

- Do you have an active checking account?

- I certify that I am a US resident over the age of 21.

- Accept terms & conditions

- Tap on the continue button.

- Next, they will ask for your date of birth and social security number.

- Enter the details about gross monthly income

- Now designate which card you are applying for, credit or debit card.

- Check the terms & conditions carefully before submitting the request.

- Once all the steps are completed, you will receive a confirmation email and approval email from the Matrix Credit Card.

How to pay with the Matrix Credit Card?

Like using other credit and debit cards of a company, you can take advantage of Matrix credit cards.

- If you have signed up, enter the credentials, such as the credit number you are using.

- Next, enter the credentials of the person/company/institute whom you want to pay.

- Tap on make the payment option, and the amount will be transferred.

Matrix Credit Card Payment Online

Whether for paying rents, regular bills, or clearing your old debt, click on the link, it is the best source to make online payments and secure your funds. The Matrix Credit card facilities are available for United States people only.

Matrix Credit Card Payment via Phone

The matrix credit card users can use their phone to make payments. Here is customer support number to know the process.

1-800-518-6142.

Matrix Credit Card Payment via Mail

If you want to make payment by mail address, so here are the details of customer support who can help you know the details. To know it personally, visit the website.

Matrix Card

P.O. Box 6812

Carol Stream, IL 60197-6812

Matrix Credit Card Benefits

- There are three major credit bureaus.

- Its initial limit is $500.00 only. It can be increased if you make the dues clear on time.

- A matrix credit card can be used anywhere, no matter what location you are in.

- There will be an annual fee, but we recommend you check the terms before applying.

- The credit target is to increase the credit score of poor people who want to clear their debt and improve their CIBIL score.

- There will be no rewards on payment, as it is helping you to overcome debt.

- The application process is very fast and straightforward.

- Users will get free online account access 24/7.

- The cardholders are allowed to make payments via phone, online, and mail.

Similar Credit Card Login

- P.C Richard Credit Card Login

- Pep Boys Credit Card Login

- Raymour & Flanigan Credit Card Login

- Reflex Credit Card Login

- Art Van Credit Card Login

- Victoria’s Secret Credit Card Login

- Wawa Credit Card Login

- Academy Van Credit Card Login

- Yard Credit Card Login

- Blaze Credit Card Login

- Costco Credit Card Login

- Dayton Power & Light DPL Login

- Dillards Credit Card Login

- Kingsize Credit Card Login

- Sheetz Credit Card Login

FAQ’s

- How would Matrix Credit Card improve my credit score?

Today, banks and financial institutions mostly rely on credit scores to analyze whether a person is suitable to get credit or not. If you have a bad credit history, Matrix credit card simply improves your profile by clearing your dues that strengthen your CIBIL score.

- How to increase the limit of credit cards?

Here are some of the best and smart tips that can increase your credit card limit.

- Boost your credit score, which is a CIBIL score, by making timely payments. Always check on dues and clear them on time.

- Keep an eye on the card utilization ratio.

- If your income increases, your credit score limit will increase easily.

- Check on financial obligations if you have to remove them.

- Use a credit card to boost your credit score and limit.

- How fast will my credit card score increase with Matrix Credit card?

The credit card application takes six months to get approved. However, in a matrix credit card, you don’t need to wait so long. The soon you will use the card, the sooner you will increase your credit limit.