Rochester, New York-based ESL Federal Credit Union provides full-service financial products. There are over 870 people who work for the locally owned banking institution in Rochester, New York, and more than 376,000 members and 11,800 companies. For the past ten years, the bank get recognized as one of Great Place to Work’s Best Small and Medium Workplaces. The credit union has total 22 branch locations and over 40 ATM locations, local telephone and online customer service, and online and mobile banking channels. A broad range of individuals, including Eastman Kodak employees, members of the George Eastman House, and Rochester citizens, are eligible to join ESL.

George Eastman, the founder of Eastman Kodak Company, established ESL Federal Credit Union in 1920 as Eastman Savings and Loan Association. Mr. Eastman’s goal at the time was to develop a financial organization that could help his workers with their financial requirements, particularly mortgages.

Eastman Savings and Loan became ESL Federal Credit Union on February 1, 1996, after converting its charter from a US bank to a Federal Credit Union. It is the largest credit union in New York State and the largest locally held financial institution in the Greater Rochester area. ESL is in the top 1% of national credit unions in terms of assets.

ESL Federal Credit Union Online Banking Login

Customers may easily access financial services using the credit union’s website, which offers an easy-to-navigate layout. The procedure for logging in is pretty straightforward. To log in, follow these steps:

Step1: Go to Official Website of the ESL Federal Credit Union.

Step2: On the left side of the website you will find the login section.

Step3: Click on the “Login” button, after entering your Member number/User ID and Password.

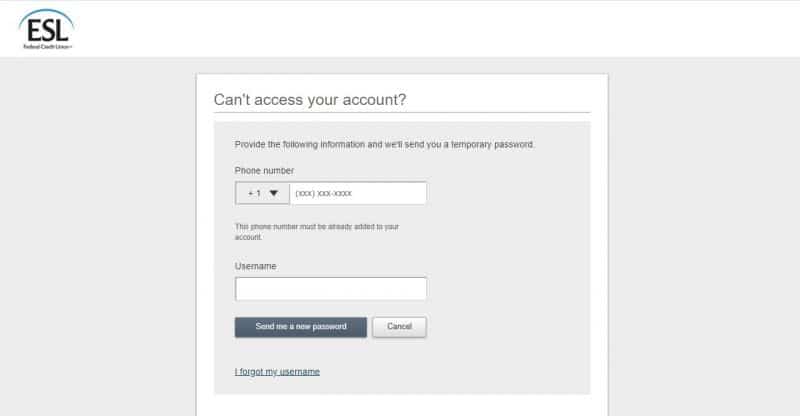

How to Reset Forgotten Password

Step1: Go to Official Website of the ESL Federal Credit Union.

Step2: On the left side of the website you will find the login section.

Step3: In that login section, you will find “Forgotten Password” link, click on that link.

Step4: Now, enter your Phone number(that is added to your account) and Username, and then click on the “Send me a new password” button.

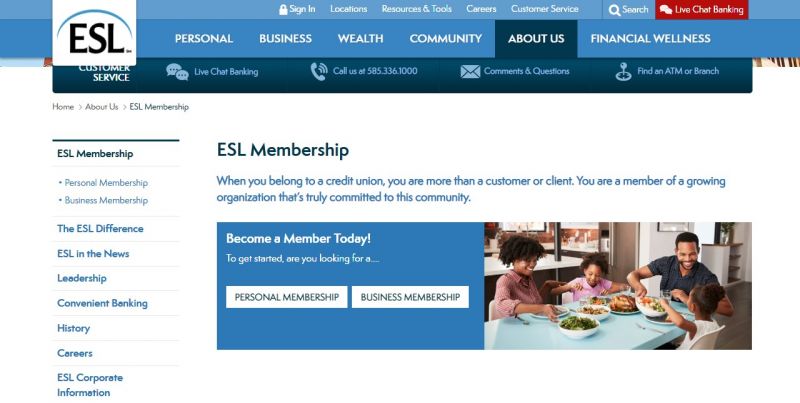

How to Enroll into ESL Federal Credit Union Online

Step1: Go to Official Website of the ESL Federal Credit Union.

Step2: On the left side of the website you will find the login section.

Step3: In that login section, you will find “BECOME AN ESL MEMBER TODAY” button, click on that button.

Step4: Here, you have two options. You can either click on the “PERSONAL MEMBERSHIP” or “BUSINESS MEMBERSHIP” button.

Step5: Again, you have two options, either you can apply online or contact the bank. Here we have to click on the “APPLY ONLINE” button.

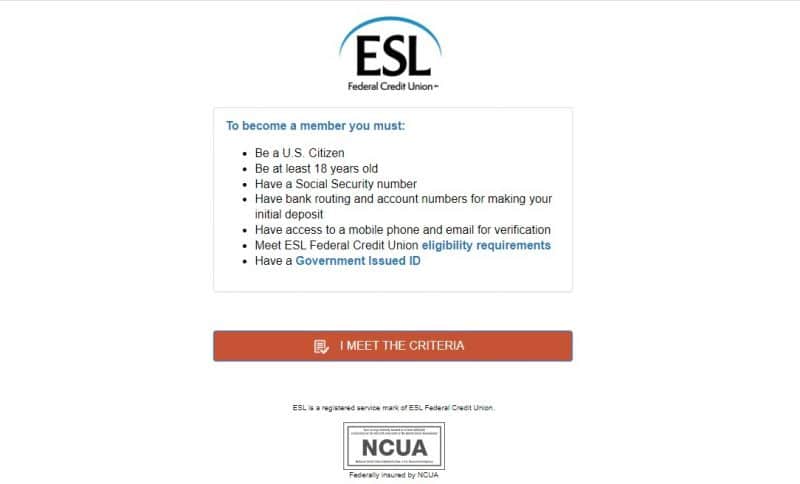

Step6: Now, the bank will show you a list of criteria, if you meet the criteria click on the “I MEET THE CRITERIA” button.

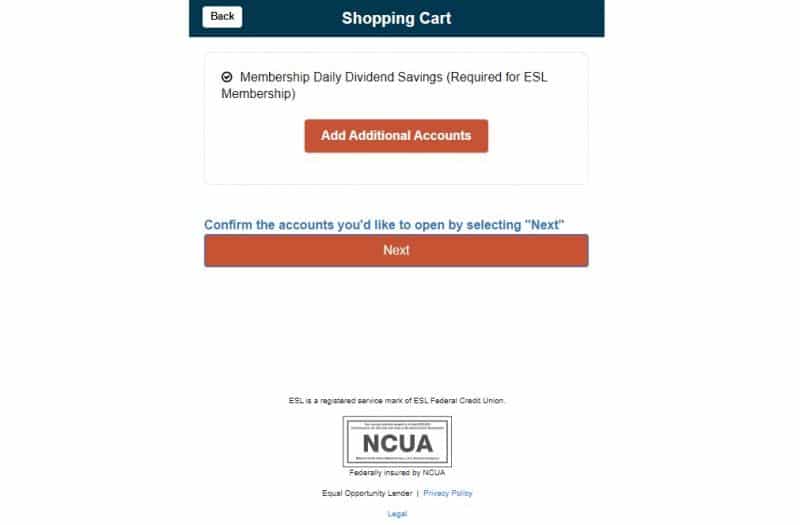

Step7: Click on the “NEXT” button and follow the further steps to complete the process of enrollment successfully.

Here are some ESL Federal Credit Union Extras:

- We have a large branch and ATM network from Rochester to Batavia, Geneseo, Canandaigua, and Newark.

- They’re the area’s largest, locally managed banking institution.

- Since 2002, they’ve earned the Democrat & Chronicle Rochester’s Choice Award in the Bank/Trust category.

- Members come first—unlike most other banks, they don’t have stockholders.

- Their exclusive Owners’ Dividend* might help you save money.

- They put in long hours every day to ensure the success of our members, staff, and community.

- Since 2010, they’ve been named to the Great Place to Work Best Small, and Medium Workplaces list 11 times. One of the reasons we have so many service-oriented all-stars on our squad is this.

How to Manage your ESL Federal Credit Union Accounts

- Check your ESL account’s balances, transactions, monthly statements, and account notices.

- Pay ESL loans and make credit card payments by transferring money from one ESL account to another.

- Pay your ESL Loan using funds from another bank or credit union account.

- Set up Text Banking notifications to get notified when payments are due, checks clear your account, account balances are updated, and more.

- Update your account usernames and nicknames, passwords, and security parameters in a matter of seconds.

- Request an address change, reissue checks, or dispute credit card transactions using easy online forms.

- Stop payment and our collection of simple financial calculators are just a few of the options and resources available to you.

ESL Federal Credit Union Loan

They provide a big selection of loans and credit lines with customizable conditions and a variety of payment choices. So come to ESL anytime you need to borrow.

Benefit and features of a Personal Loan from ESL Federal Credit Union

- Their cheap borrowing costs are due to their competitive rates.

- Their set rates make it easier to budget because you’ll always know how much you’ll have to pay each month.

- You may choose from a selection of adjustable periods ranging from 12 months to 120 months.

- Paying in advance is not subject to any consequences.

- Credit life and disability insurance are provided at a low cost to provide additional financial security.

- The fixed due date for each of our loans, as well as a selection of payment options, simplify budgeting and planning:

- AutoSweep is an automatic transfer from an ESL savings or checking account.

- Any financial institution’s checking or savings account is automatically debited.

- TEL-E$L or ESL internet or mobile banking are both options for transferring cash.

- Please contact an ESL Representative so that they can assist you with this transaction.

Short term loan benefits and features

- Depending on your current credit score, you can borrow anywhere from $250 to $1,000.

- There are no application or hidden costs.

- While you wait, the approval procedure is done quickly and conveniently.

- You can get your amount as soon as you’ve been accepted.

- There are no prepayment penalties or a minimum payback period. The maximum payback duration is six months.

- You now understand why an ESL Short-Term Loan is a terrific option to receive the money you need fast and at a low rate. Because your payment history is submitted to credit agencies, prompt repayment might help you develop or enhance your credit history.

Home Equity Loan benefits and features

You may borrow against the equity in your house with an ESL Home Equity Loan. That is why it is such a cost-effective method of financing.

- For the loan duration, the interest rate will be low and fixed.

- Predictable monthly payments.

- There is no application charge, no points, no closing costs, and no yearly fees.

- Borrow up to 90% of the value of your home.

- A wide range of payment alternatives is available.

- You will not be penalized for paying in advance.

- Their unique Owners’ Dividend is available if you have a debt on your loan.

ESL Federal Credit Union Cash Services

Cash Services overview

Simply visit an ESL branch near you to cash checks, pay bills, and take advantage of our other time-saving Cash Services. Non-members are only required to complete a one-time registration.

- You’ll save both time and money. Using our simple terminology will make things easy for you. Our rates are also quite reasonable. As a result, you won’t need to hire high-priced “check cashers.” You won’t have to be concerned about any hidden costs.

- Keep things as basic as possible. You don’t need an ESL account to utilize our simple Cash Services. After completing the one-time registration procedure, you’ll be able to paychecks and do other things.

- Pay a visit to the branch closest to you. It’s simple to discover an ESL branch near you with 23 inviting locations around the Greater Rochester region.

Check Cashing

You may gain quick access to your money by visiting any ESL location and using our easy Check Cashing Service.

- There are no hidden costs. Once you’ve registered with ESL, all you have to do after you’ve registered* is pay a basic, uncomplicated charge for each check you cash.

- It doesn’t get much easier than this. There is not any requirement for a minimum account balance. You don’t even need an ESL account to participate.

- The service is available in the Rochester metropolitan region. At any of our 23 locations, you may cash checks quickly and simply. They run the gamut from Batavia to Newark, from Rochester to Geneseo.

- Make the most of your time. And you’ll get your money quickly. Cashing your checks is simple after you’ve enrolled.

- ESL checks are cashed. Another method we make money management easier and more comfortable for you is through this service.

Prepaid Card

Money can be obtained quickly. Convenient card-carrying. The Prepaid card has acceptance in the United States and across the world. You now see why the ESL Visa Prepaid Card is an excellent option to carry money without having to carry cash.

- It may be used all around the world. You may use the ESL Visa Prepaid Card to make purchases and withdraw money from ATMs everywhere Visa is accepted.

- Overdraft fees and interest charges are no longer a concern. You won’t be able to make that transaction or withdrawal if there isn’t enough money on your card.

- You can get up to $2,500 every day depending on your balance. Depending on your balance, you can also use your PIN to make ATM withdrawals or purchases up to $600 each day.

- With Visa’s Zero Liability Policy, you can rest comfortably. With Visa’s support, you can protect yourself against fraudulent usage.

- Share your financial situation. Get up to three more customized cards so that others can use the card’s balance. (Keep in mind that the maximum account amount is $10,000.)

- You can quickly manage your money over the phone or online. Call 866.760.3156 to keep track of your transactions and card balance. Access My Account also allows you to manage your money online.

- You can reactive your card at any time. Simply go to any ESL branch, utilize Direct Deposit, go online to Access My Account, or call 8667603156.

ESL Federal Credit Union Contact Details

ESL Federal Credit Union Customer Support Number

585.336.1000 or 800.848.2265

ESL Federal Credit Union Postal Address

ESL Federal Credit Union

P.O. Box 92714

Rochester, NY 14692-8814

ESL Federal Credit Union Information

Bank’s Website: www.esl.org

Routing Number: 222371863

Swift Code: See Details

Phone Number: 800.848.2265

Similar Bank Login

- WSFS Bank

- New York Community Bank

- ENT Credit Union

- South Georgia Banking

- Farmers State Bank

- Alaska USA Federal Credit Union

- Metro Bank

- Call Federal Credit Union

- Union Bank

- M&T Bank

- KeyBank

- Security Service Federal Credit Union

- BB&T Bank

- Randolph Brooks Federal Credit Union

- Regions Bank

- Bank of the West

Frequently Asked Questions (FAQs)

Question1: Who owns ESL federal credit union?

Answer: George Eastman launches Eastman Savings & Loan Association

Question2: What is the total number of ESL banks?

Answer: ESL Federal Credit Union has 22 branch locations in 11 cities around New York that provide financial services to credit union members.

Question3: How much money can you withdraw from an ESL ATM?

Answer: With your ESL ATM or Visa Debit Card, you may withdraw up to $1,000 each calendar day from an ATM.

Question4: Is ESL a federally chartered bank?

Answer: ESL Federal Credit Union, headquartered in Rochester, New York, is a full-service financial organization.

Question5: Who is the leader of ESL?

Answer: Faheem Masood is the leader of ESL.

{{CODEfaq}}