CitiGroup Inc. has set up a internet site for its customers to control their credit score card account online. It means they have come up online, which is just great, and the customers are quite happy with it.

Consumers who own a Citi Credit card can use its internet site to control their credit score by playing cards without counting on anybody. Before you could do whatever at all, you want to first sign-up for this online service.

Once you sign-up, you’ll get your login credentials, the use of which you could log in for your Citibank credit score card account. From payments to check your current credit score card activities, you could do all of it from this online account. Along with that, it additionally offers you quite a few benefits.

It is important for you that you know how to manage everything online, which is why we have come up with this piece of writing. Read the entire article to get comfortable with its working.

Let’s get started:

Citi Credit Card Login

Step1: Go to the Official Website of the Citi Credit Card.

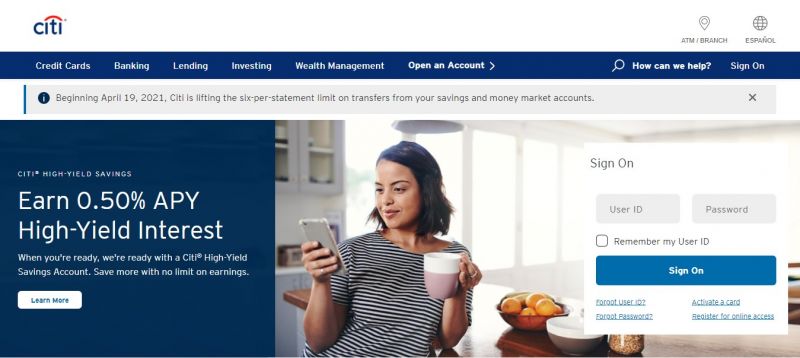

Step2: Now, you need to click on the “Sign On” button.

Step3: Next up, you have to enter your User ID and the Password.

Step4: Make sure you enter all the correct details and after filling in all the details, you have to click on the “Sign On” button, and you will be good to go.

How to Make Citi Credit Card Account Payment

It is effortless to make credit card account Payment. And, the step to do the same is straightforward. Just follow the steps given below:

Step1: Using any trusted web browser open the Official Website of the Citi Credit Card.

Step2: Now, after reaching the official page, you will have two options for making the Payment. You can either make the Payment either through Mail or through the Phone.

Step3: Sign On to your account.

Step4: If you want to make the Payment through Mail, then make the payment at the address given below:

Citibank Government Card Services

P.O. Box 183173, Columbus,

OH, 43218-3173.

Step5: If you want to make the Payment by Phone, then make the Payment through Phone:

1-800-950-5114

How to Reset Forgotten Password

It is not a thing to worry about to forget the password. But, you must know how to retrieve it, And, to recover the same, follow the steps given below:

Step1: Go to the Official Website of the Citi Credit Card.

Step2: After reaching the official page, you need to click on the “Sign On” button, at the right-top corner of the website.

Step3: Click on the “Forgot Password?” link, below the “Sign On” button.

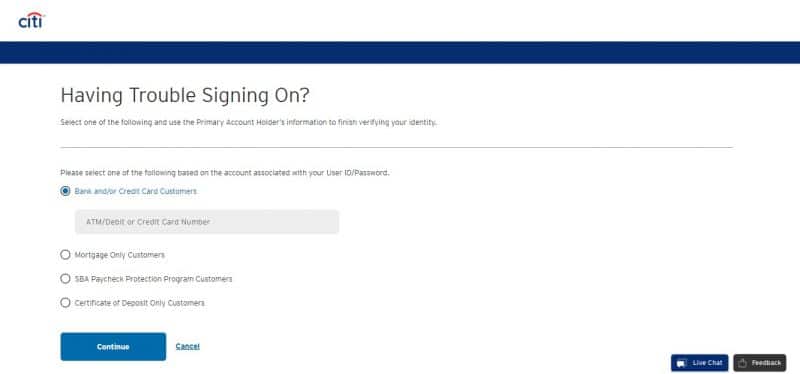

Step4: Enter your Credit Card Number and click on the “Continue” button.

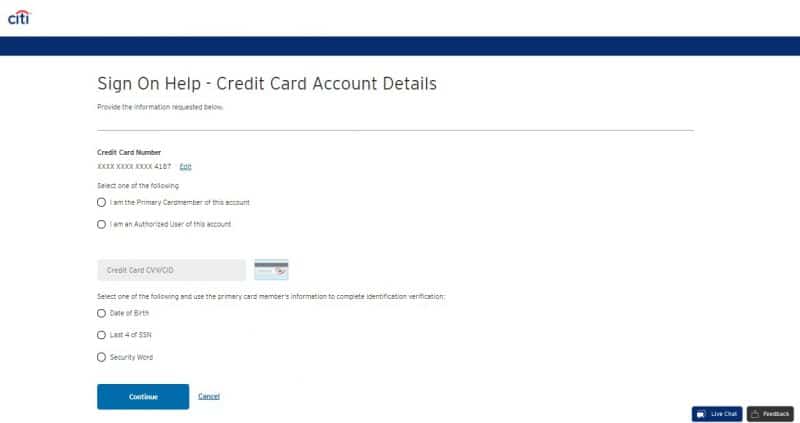

Step5: Now, you need to select whether you are a primary card holder or an authorized card holder, then enter your Credit Card CVV/CID, then you have to select the way and use the primary card member’s information to complete identification verification.

Step6: After doing all this click on the “Continue” button.

Step7: Once done, follow some further steps to reset your password.

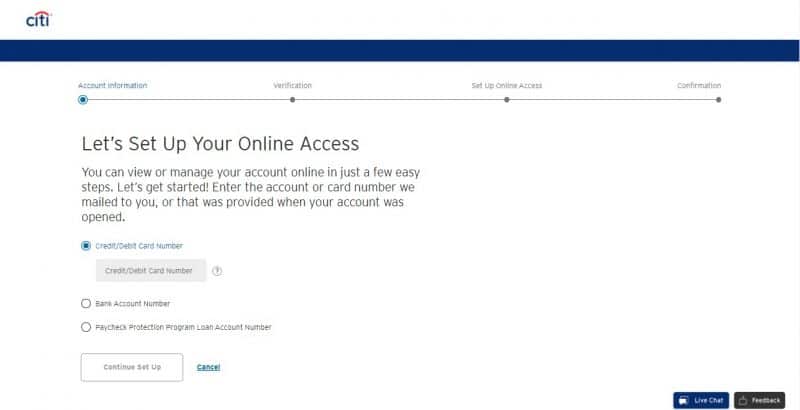

How to Register your Citi Credit Card for Online Access

For the process of registration, all you need to do is follow some steps, which gets mentioned below:

Step1: Go to the Official Website of the Citi Credit Card.

Step2: After reaching the official page, you need to click on the “Sign On” button, at the right-top corner of the website.

Step3: Click on the “Register for online access” link, below the “Sign On” button.

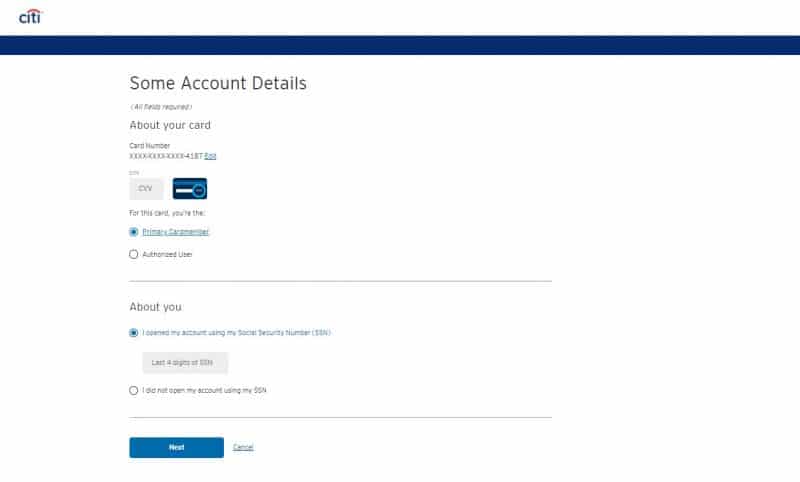

Step4: Next you have to enter your Credit Card Number and click on the “Continue Set Up” button.

Step5: Now, you need to select whether you are a primary card holder or an authorized card holder, then enter your Credit Card CVV/CID, then you have to enter the last four digits of SSN to verify yourself.

Step6: After entering the details click on the “Next” button.

Step7: Once your details are verified, you could get logged into the Citi Credit Card Dashboard. Now you may manage your account online every time you want.

Citi Card Payment Options

How to make Citi Credit Card Payment by Mail

Citi Credit Card Payment Mailing Address:

Citibank Government Card Services

P.O. Box 183173, Columbus,

OH, 43218-3173.

How to make Citi Credit Card payment by Phone

Citi Credit Card Payment Phone Number:

1-800-950-5114

Citi Credit Card Review

If you’re a heavy spender and are severely searching ahead to earn handsome rewards to your card, you’ll be higher off with an excellent credit score card (possibly for a barely better annual rate).

For example, SBI Card PRIME expenses an annual rate of Rs. Three thousand, however, its rewards software might provide you two factors in line with Rs. a hundred and 10X elements on dining, movies, grocery, and departmental keep spending.

Another alternative is HDFC Regalia Credit Card (Annual Fee: Rs 2,500). It no longer provides any expanded rewards; however, the primary charge itself stands excellent at four factors in line with Rs. 150.

Citi Card Benefits

Welcome Benefits – Users arise to 2500 Reward Points on the use of their card within 60 days of card issuance.

Reward Points – Users earn one praise factor for each Rs. a hundred twenty-five spent. 10x characteristics get achieved on garb, and departmental keep spends. Also, three hundred bonus factors get made on spending ₹ 30,000 or greater in a month. Lastly, praise factors earned in no way expire.

Dining Offers – Users arise to 20% cut price on eating invoice at companion restaurants.

Cashback – Users also can use their praise factors to pay their credit score card invoice. 1 Reward Point = Re. 0.35. However, customers have to collect 5,000 factors earlier than they could redeem it.

FAQs (Frequently Asked Questions)

Is Citibank similar to Citi card?

Citibank gives checking and financial savings accounts, small commercial enterprise, and industrial banking, and private wealth control amongst its offerings. Citi Branded Cards is the world’s biggest credit score card issuer.

Is Citi a perfect credit scorecard?

Citi Double Cash is one of the first-class coins returned credit score playing cards at the market. Customers sincerely cannot move incorrectly with born on all purchases. Even though, the human beings with greater specialized spending desires can also additionally choose playing cards that praise unique categories.

How does Citi make money?

Citi Cards gets predicted to develop 8% from $19.7 billion in 2018 to $21.three billion in 2021. In particular, it pushes through internet hobby profits from outstanding card loans. Revenue for patron banking would develop by 6% from $14.1 billion in 2018 to $15 billion in 2021.

What financial institution is Citibank?

Citibank is the patron department of monetary offerings multinational Citigroup. Citibank becomes based in 1812 as the City Bank of New York and later became First National City Bank of New York.

{{CODEfaq}}