In contrast to other credit cards you may have used in the past, CareCredit is a medical credit card. It provides financing for procedures that are not covered by your insurance. Even though CareCredit’s financing programs with 0 percent interest periods can be appealing if you have these expenses, reading the fine print and paying in full by the end of the promotional term can help you avoid getting hit with exorbitant interest rates later on.

After more than three decades, CareCredit finally made its debut on the consumer lending market. When DenCharge was launched, it was marketed as a credit card exclusively for dental professionals. With the addition of a more complete financing solution that incorporates a wide range of health and wellness services, Synchrony Bank has expanded its reach. More than 11 million people use a credit or debit card, and the number continues to climb.

Other family members can also use a CareCredit card to pay for their medical bills, even if they are not designated as principal account holders. It’s as simple as adding them to the account as a legitimate user who has access to the account.

The CareCredit Credit Card’s fundamentals are as follows:

The CareCredit card, in contrast to a normal bank or credit card, is not intended for routine expenditures such as grocery shopping or booking an airline ticket.

What is the reason for this? The primary aim of this card is to reimburse you for medical expenses. You can put it to use for the following activities:

- Dermatologic procedures for cosmetic reasons include hair removal, rhinoplasty, Botox injections, and other dermatologic procedures.

- Preventive dental treatment, teeth whitening, porcelain veneers, and dental implants are some available services.

- In addition to Lasik and vision care services such as cataract surgery, eye exams, eyeglasses, and contact lenses

- The vast majority of the services and materials purchased at a veterinarian’s office fall under the area of veterinary care, which includes:

- Services such as Lap-Band surgery, chiropractic care, and sleep testing for sleep apnea are all possible candidates for inclusion in this group.

The CareCredit card can be used by anyone in your family, including your immediate family members.

Rite-Aid and other large drugstore chains are excellent places to go if you need to pick up a prescription or stock up on supplies such as diabetes testing strips or insulin.

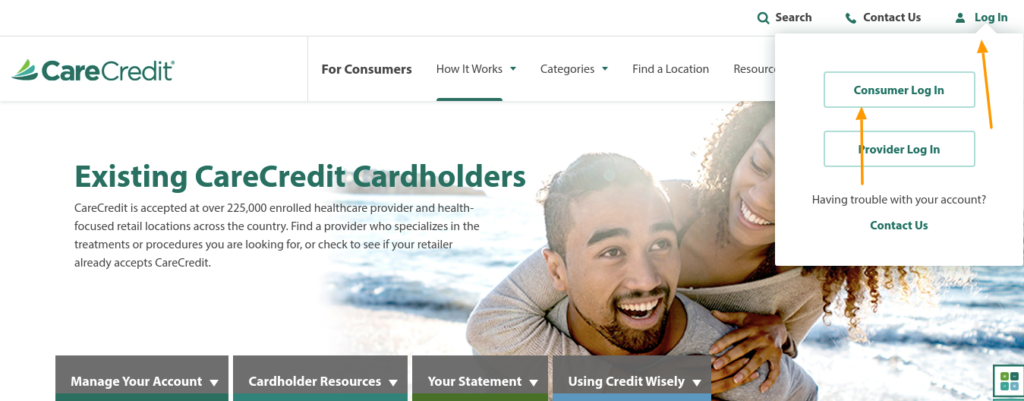

How to login?

- To log in as a care credit customer, all you have to do is go to the website.

- A login box can be found in the upper right corner of the screen. Simply click on it to complete the process.

- To proceed, you must enter your Username and Password.

How to Reset Forgotten Password

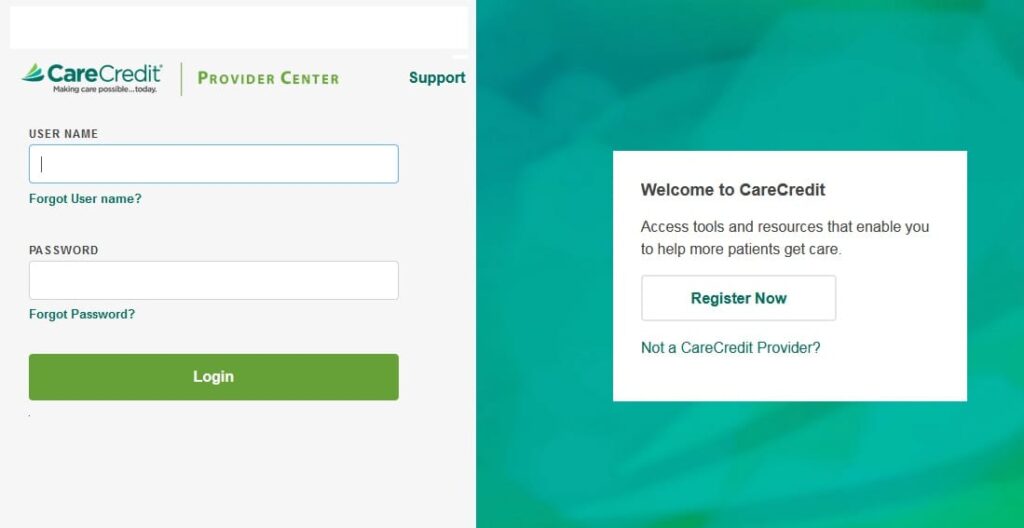

The following are the procedures to take to recover access to your Care Credit account:

- The Care Credit webpage can be accessed by clicking here. It’s as simple as clicking the “Login” button once you’ve arrived.

- As soon as you log into your Care Credit account, you’ll be presented with two alternatives.

- It is possible to retrieve your user name and password by going to the Care Credit website by clicking on the link in the previous sentence.

- Please keep in mind that the page you will be forwarded to will have the word “Synchrony” written across the top of it.

- Although it may seem strange at first, Synchrony now owns Care Credit, which is why this development.

- You must fill out the following information before proceeding: Your account number, the last four digits of your Social Security number, and your birth date are the three pieces of information you must provide.

- Now, we’ll aid you in regaining access to your Care Credit password if you’ve forgotten it.

- If you want to get started, you’ll need to go back to the Care Credit home page on the internet.

- This time, you’ll select “I’ve forgotten my password.”

- The screen that appears after you click “I’ve forgotten my password” is quite similar to the one that I’ve just described.

Congratulations! Your assignment has been completed. Because of this, you now know your Care Credit user name as well as your password.

CareCredit Credit Card Application and Acceptance Procedure

You can apply for a CareCredit card in one of three ways: online, by phone, or in person. Depending on your option, you can submit your application online, over the phone, or in-person at your doctor’s office.

It is stated on the CareCredit website that approval is instantaneous, so you can begin making purchases immediately after applying.

In most circumstances, if you apply for the card in the doctor’s office and are approved, you will be able to use it the same day.

If your credit is less than fantastic owing to missed payments or collection accounts, this is something to keep in mind.

Making a payment with the Care Credit Card is simple:

- Care Credit Pay by Phone

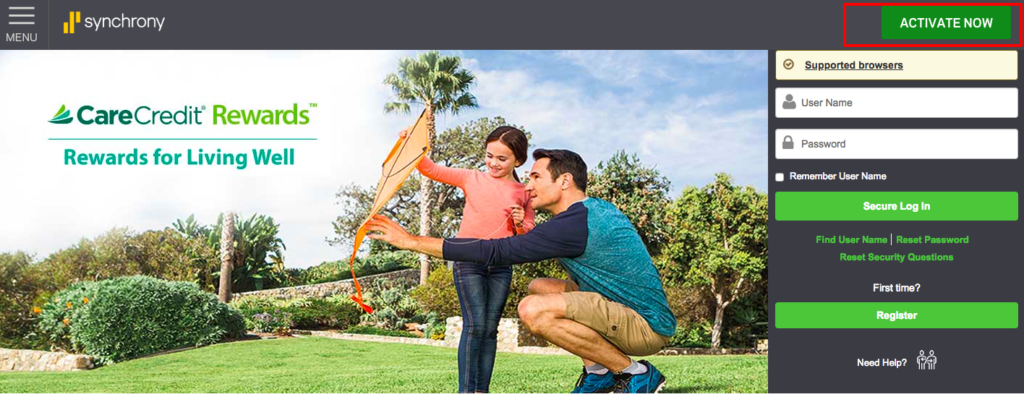

Those who do not have access to a computer system and instead rely on their smartphone or tablet should consider implementing this method. There is no difference in the login process for Firefox OS regardless of the operating system (Android, ios, or Windows phone).

To begin using your mobile phone’s internet web browser after finishing the online setup process, you must first launch the browser on your phone. Afterward, either search for CareCredit Login or go directly to CareCredit’s website. The linked page for MySyncrony may be found on this page. To see all of your login options, you must first select Your Account from the drop-down menu.

You will currently be required to submit information regarding your CareCredit online account to complete in those three blanks. You must mention the CareCredit online account Username if you choose the first alternative. Finally, you’ll be prompted to enter the secret password associated with your CareCredit account. After you’ve completed this step, choose the Secure Login option.

- Make a payment using the internet.

Following that, you’ll need to log into your online account using your Care Credit login credentials. If you wish, you will make a purchase with your credit card at that location.

- Payment option.

Please see the following link for the address and contact information: care credit payment address. You can get in touch with them by any methods indicated above, including email.

Benefits of Carecredit Card

Carecredit cardholders can pay their medical bills at any time, regardless of whether or not they are insured.

In some cases, Carecredit cards allow you to save time by eliminating the need to compute your medical expenditures manually.

With the assistance of their guide and phone support, you’ll have no trouble determining how to spend your money most effectively.

As soon as your application is approved, you will have unrestricted access to the money and will be able to use it to pay for all of your expenses.

All citizens should use Carecredit cards to keep up with the latest technological advancements.

FAQs

If a Carecredit card is rejected, what are the chances of it happening?

Filling out incorrect information on your Carecredit card application can result in your card being rejected for various reasons, including the card’s expiration date. If you are experiencing any of these issues, please get in touch with your manager or the toll-free number mentioned on the official website.

Is it possible to use my Carecredit card to pay for groceries?

Using your care credit card to pay for food is a viable option.

What is the maximum amount you may spend on a CareCredit card?

The Carecredit card has a credit limit of $25,000 established. You are not permitted to exceed the credit card limit.