With $236.8 billion in assets and a market valuation of $40.9 billion, BB&T was one of the most extensive financial services holding companies in the United States as of September 30, 2019. BB&T offers a comprehensive variety of financial services, including retail and commercial banking, investments, insurance, wealth management, asset management, mortgage, corporate banking, capital markets, and specialty lending, all of which are built on a long legacy of excellence in community banking. BB&T, based in Winston-Salem, N.C., has over 1,700 financial centers in 15 states and Washington, D.C., and is frequently recognized by Greenwich Associates for exceptional customer service in small business and medium market banking.

BBT internet banking, which requires a BB&T login ID and password associated with the individual account, is available for 24 hours of the day, seven days of the week. BB&T (Branch Banking and Trust) is a prominent financial services company in the United States that provides a variety of consumer and business banking, securities trading, asset management, mortgage, and insurance products and services. Offline services are available via BB&T locations in 13 states and complete ATM channels. Online banking is also available 24 hours a day, seven days a week, and is an easy and convenient alternative to traditional banking.

By visiting their website or installing the device-specific application, the Account holder may sign in using their any personal computer, iPad (tablet), or mobile phone. (Apps for BB&T online are supplied in the post for each device)

BB&T Bank Online Banking Login

BBT Bank’s online services are entirely free, and users may conduct practically all banking transactions through the internet from anywhere they have access to a physical branch.

Step1: First, go to the BB&T Bank’s Official Website and look for the “Sign in” button in the upper right corner.

Step2: Next step, click on the “Sign in” button.

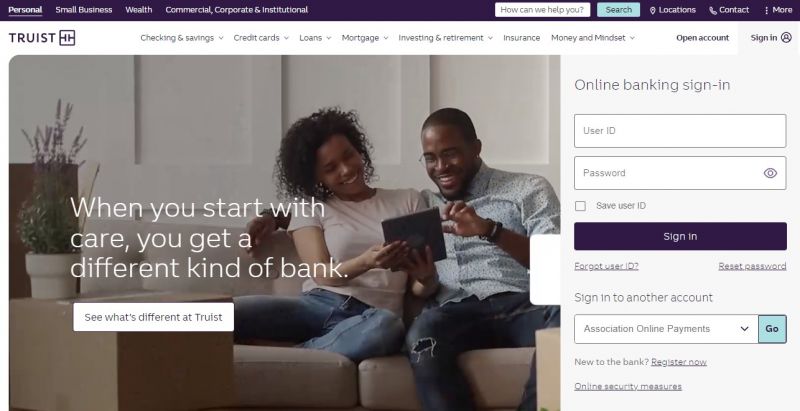

Step3: Now, enter your User Id and Password and then click on the “Sign In” button.

After entering your User ID and password correctly you will be signed in to your account successfully.

How to Enroll into BB&T Bank Online Banking

Step1: First, go to the BB&T Bank’s Official Website and look for the “Sign in” button in the upper right corner.

Step2: In the next step, click on the “Sign in” button.

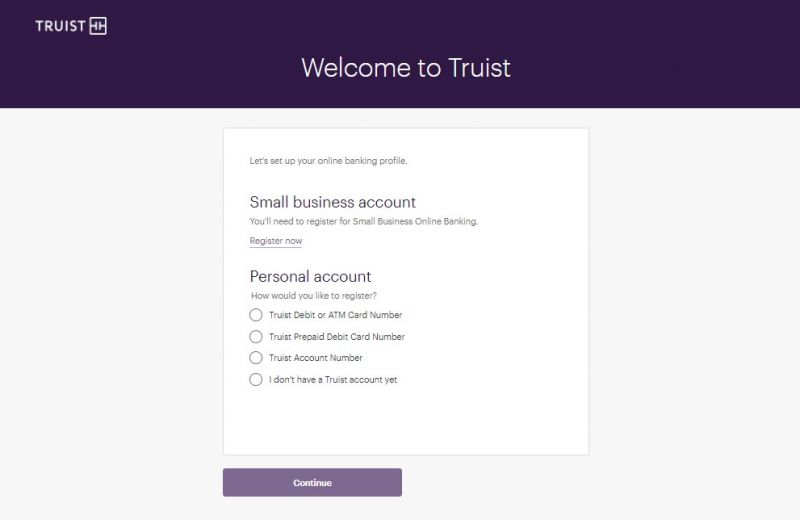

Step3: Now, you have to click on the “Register now” link.

Step4: Here, two types of registration are there, one is for business account holders and other one is for Personal account holder. But, for reference we are registering for personal account. And in this step you have to select the way through which you would like to register. After choosing your appropriate option you have to enter the details according to that. And after entering all the required details click on the “Continue” button.

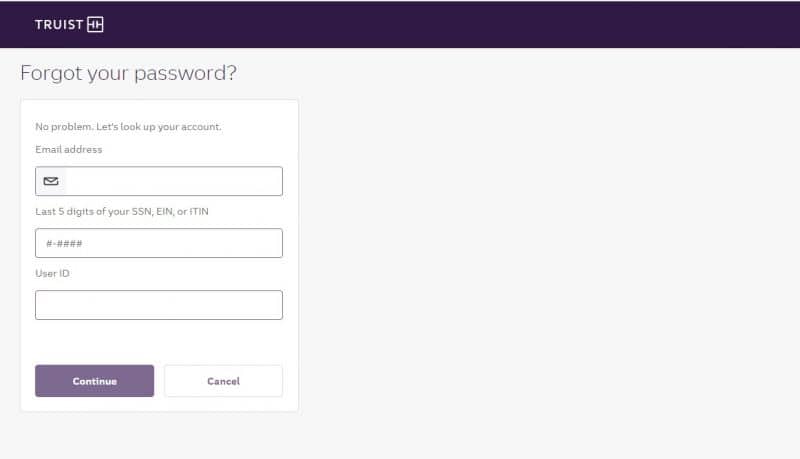

How to Reset Forgotten User ID and Password

BB&T online banking offers an alternative technique to restore a forgotten password. The recovery option is directly in the sign-in box, under the “lost Password?” input form.

Step1: First, go to the BB&T Bank’s Official Website and look for the “Sign in” button in the upper right corner.

Step2: In the next step, click on the “Sign in” button.

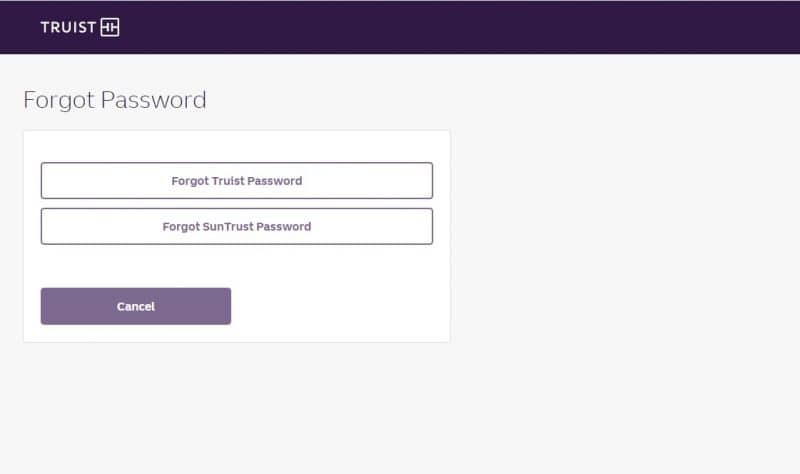

Step3: Now, you have to click on the “Reset Password” link, below the “Sign in” button.

Step4: Again click on the “Forgot Truist Password” button.

Step5: Here you have to enter some of your details/credentials such as your registered email-id, last 5 digits of SSN, user ID and then click on the “Continue” button.

BB&T Bank Online Banking Advantages

- Customers can create a checking or savings account with a minimal minimum deposit easier to switch from their current bank because of the minimal minimum beginning deposit.

- You may have the savings account with no minimum deposit or monthly fees: In today’s low-interest climate, it’s critical to maintain a savings account where monthly costs do not offset the return you receive. There is no minimum balance required for having a online-only eSavings account, and there is no minimum beginning deposit.

- CDs (certificate of deposit) provide various options: When it comes to opening a certificate of deposit, customers have a few alternatives (CD). They can utilize a standard CD, take advantage of promotional pricing, rate fluctuations, or lock-in guaranteed yearly rate rises.

BB&T Bank Offers

- BB&T basics checking account is for customers worried about maintaining a certain balance or satisfying direct-deposit criteria. It has a $50 minimum starting deposit requirement and a $5 monthly charge.

- Customers who maintain a $1,500 average balance or have direct deposits of $500 or more can avoid the $12 monthly charge with Bright Banking. The minimal first investment is $50.

- A checking account for students can be opened with no minimum initial deposit and no monthly fees. This account also covers up to two non-BB&T ATM fees every statement cycle. Students can also waive the monthly maintenance cost by opening an eSavings account.

- This account is accessible to everyone above the age of 55. It offers free checks and the opportunity to withdraw funds from a CD early without incurring a penalty charge in the event of a medical emergency. It costs $100 to open, and if you have a $1,000 balance or have $500 in combined direct deposits, you can avoid the $10 monthly charge.

- Premium checking account comes with no-cost money orders, bonus CD rates, two monthly overdraft charge waivers, and maximum four non-BB&T ATM waivers.

- BB&T charges a $30 monthly fee unless you hold $25,000 in deposits and investments or have a $150,000 or more mortgage with BB&T.

Credit Card of BB&T Bank

Customers can choose from four credit cards offered by BB&T Bank. Each was created with a particular customer and features perks tailored to that demographic. A balance transfer card, a cashback card, and a travel rewards card are all available.

Customers may search for prequalified deals without having their credit score affected. Such deals may be accessible in as little as 60 seconds. The following are the available credit cards:

1. Bright BB&T

2. BB&T Spectrum Cash Rewards

3. BB&T Spectrum Travel Rewards

4. BB&T Vantage Visa Signature Credit Card

Bank Customer service

- Customer support is available by phone at 1-800-226-5228 from 8 a.m. to 8 p.m. EST Monday through Friday and from 8 a.m. to noon EST on Saturday. On Sundays, it is closed.

- You may chat with a banker in person at any of the more than 2,900 locations located throughout 17 states. There are branches all over the East Coast and far west as Texas.

- Your account is accessible online and via BB&T’s mobile app, available for both Apple (4.8 stars, 346,400 ratings) and Android mobile devices 24 hours a day.

- 12 View transaction history, customize your accounts, pay bills, deposit checks, and more using this app. It even offers a budgeting component that keeps track of your expenditure on your objectives.

- The BB&T Bank’s Twitter account may address general queries. 3 However, do not provide your account number, Social Security number, or any other personally-identifying information for security reasons.

BB&T Bank Contact Details

BB&T Bank Customer Support Number

844-487-8478

BB&T Bank Postal Address

BB&T Bank

200 S College ST Fl 1

Charlotte, NC 28202-2077

BB&T Bank Information

Bank’s Website: www.truist.com

Routing Number: 053101121

Swift Code: See Details

Phone Number: 844-487-8478

Similar Bank Login

- Lee Bank

- Dollar Bank

- WSFS Bank

- New York Community Bank

- ENT Credit Union

- South Georgia Banking

- Farmers State Bank

- Alaska USA Federal Credit Union

- Metro Bank

- Call Federal Credit Union

- Union Bank

- M&T Bank

- KeyBank

- Security Service Federal Credit Union

Frequently Asked Questions (FAQs)

Question: Who owns BB&T bank?

Answer: Truist Financial Corporation, located in Charlotte, North Carolina, is an American bank holding corporation. The merger of BB&T (Branch Banking and Trust Firm) with SunTrust Banks resulted in the company’s formation in December 2019.

Question: Who bought out BB&T Bank?

Answer: BB&T, based in Winston-Salem, North Carolina, amalgamated with SunTrust in late 2019 to establish Truist, whose logo now adorns the 300 Summers St. tower. The announcement of the merger, which was announced at the end of 2019, went unnoticed amid the COVID-19 epidemic.

Question: When will bb&t bank deposit stimulus checks?

Answer: Economic Stimulus Payment (EIP) direct payments will be posted to accounts on January 4,” BB&T wrote in an email to clients.

Question: Can SunTrust customers use BBB&T bank?

Answer: SunTrust branches are not available to BB&T clients for other transactions. Customers may continue to use their BB&T credit and debit cards the same way they always have.

Conclusion

I hope you find this helpful material helpful and get all the information related to BB&T Bank. Please let us know/inform if you have any questions in the comments section, and we will gladly answer them.

{{CODEfaq}}