The online banking by Civista bank is very beneficial for all its customers. The bank is well known for its services. A lot of people across the nation trust the bank for its credibility. Ranging from personal to business banking, Civista bank offers multiple services to assist all financial needs. The bank also offers loans, credit cards and mortgages to help its users with their dreams.

To get the benefits of online banking features, you need to know some steps.

Here in this post, we shall cover essential steps that are important to continue easy online banking.

Civista Bank Login

Online banking offers a lot of benefits. But to take advantage of such benefits, one must log in to Civista online banking. The login process of online banking with Civista is very straightforward and user friendly.

To login to Civista bank, online banking goes through the following steps:

Step1: Visit the official website of Civista bank.

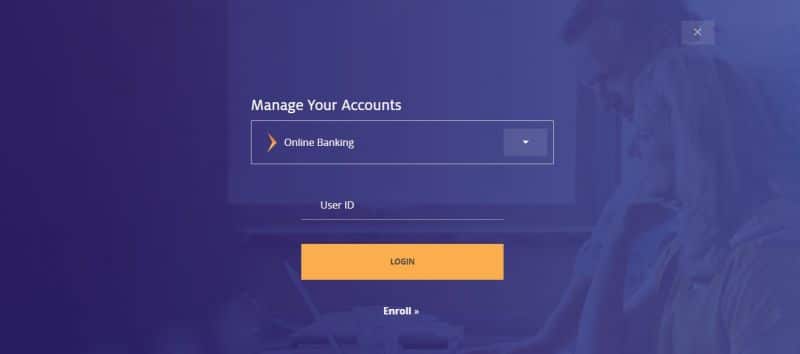

Step2: Now, click on the “Login” button.

Step3: Once you get there, enter your Net Teller ID that is your User ID, and click on the “Login” button.

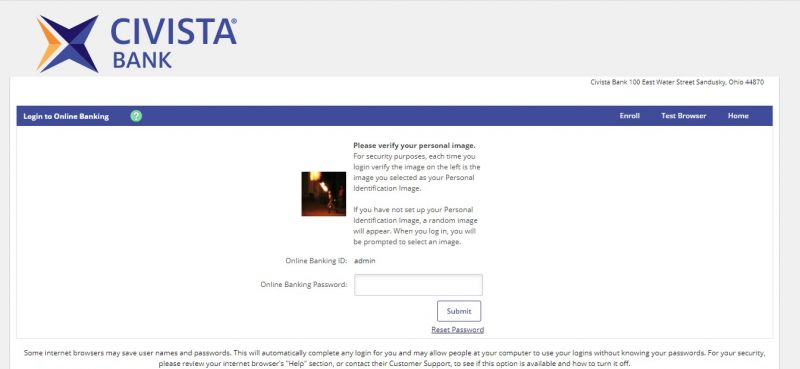

Step4: Enter your “Password”, and click on the “Submit” button.

After verifying your credentials, the bank will authorize your permission to enjoy your online banking. In case of any login error, you can contact the bank helpline number or mail to them.

How to Retrieve Forgottten Password

Over some time, it is recommended to change the password. In case you want to change your password for security reasons or have lost them, the process is very easy. Civista bank allows its users to change their password or login after forgetting the password in a very simple way. All you need to do is follow some easy and simple steps.

Here are the steps you can follow to retrieve your forgotten password.

Step1: Open the official website of Civista bank.

Step2: Now click on the “Login” button.

Step3: Enter your “User ID” and click on the “Login” button.

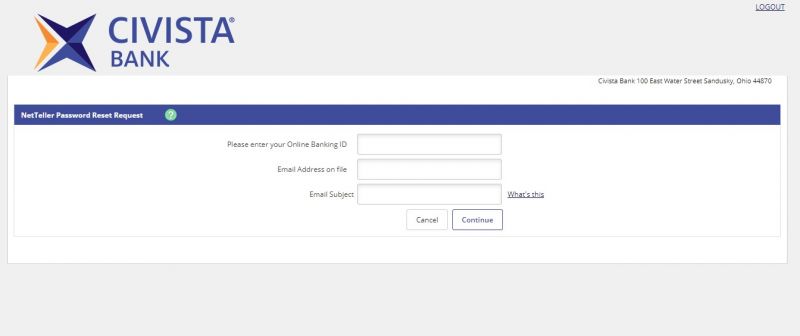

Step4: Now, click on the “Reset Password” link just below the “Submit” button.

Step5: Further, enter your Netteller ID, email ID, and email Subject and click the “Continue” button.

After this, the bank will send you your new password in your email.

It is for your account’s security purpose and to update you about your password change.

Now, you can successfully log back into your account and continue banking.

To seek extra help in resetting your password, you can contact the bank customer service. Email Bank at [email protected] or call Customer Service at 844-842-0268.

How To Enroll in Online Banking

To enroll for the online banking of Civista bank, it is necessary to have a Civista bank account. To create a Civista bank account, you can directly visit your nearest bank. If you do have an account, it will take a few minutes to complete the enrollment.

The enrollment process is quite easy.

Follow the below steps to enroll yourself in the online banking of Civista.

Step1: Open the official website of Civista bank.

Step2: Now click on the “Login” button.

Step3: Then, click on the “Enroll” link just below the “Login” button.

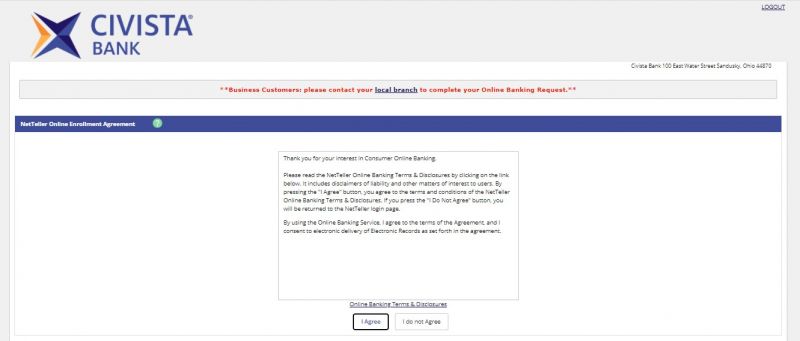

Step4: Go through the Civista online banking terms and conditions. After reading them, click on the “I Agree” button.

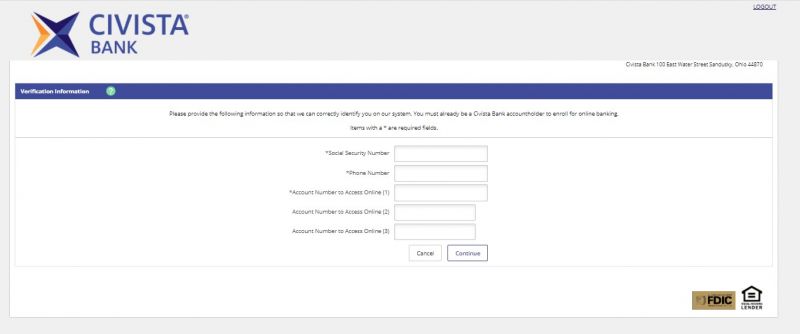

Step5: Enter all the details correctly for your identification. And once you have entered all the details, click on the “Continue” button.

Step6: You have to answer all the following questions on the next page.

After answering all the following questions, you are done with your enrollment.

You will get your login credentials, and you can start your online banking without any hassle.

To seek extra help with enrollment, you can contact the bank customer service. Email Bank at [email protected] or call Customer Service at 844-842-0268.

Manage Your Online Account

After becoming an active member of Civista bank, you are open to many benefits and services. Online banking offers you convenience. You can manage a lot of banking words from your home.

You can check your account balance anytime, anywhere. The bank allows you to monitor your banking activity with your account. You get to transfer funds from one account to another.

If you are in search of any of your transaction history, you can easily access it. The online banking of Civista bank also lets you manage external personal deposit account funds with Bank-to-Bank Transfer. You can pay all your bills from anywhere. The bank offers person to person payment, using which you can transfer money to friends and family members.

Apart from all these services, you can check the status of your loans. The bank allows you to pay your loan from your online bank account without even coming to the bank.

Reviews

Civista Bank is a well-known bank. It is the 14th largest bank in the state of Ohio. With headquarters in Sandusky, the bank has users nationwide. The bank has its branches at 35 locations. It has received an A+ health rating.

It offers three forms of banking: Personal banking, Business Banking, and Wealth Management. The services of all three banking areas are nice. A lot of people trust the services of Civista bank to keep their money safe. The bank also offers loans, mortgages, and credit cards to its users.

The online banking of CIvista bank offers you a lot of conveniences. You do not need to go anywhere to make your transaction. You can manage your bank account with your mobile phone.

Benefit or Feature of the Bank

The bank offers a good banking service to all its customers. It has some very extensive features which help its customers with their money.

Some of its feature that benefits users are:

- Their banking services of Civista bank are very beneficial to users.

- It offers three forms of banking: Personal banking, Business Banking, and Wealth Management.

- In personal banking, you can open both savings and checking accounts at very low prices.

- In personal banking, you can open savings and checking accounts to monitor your banking.

- It requires no minimum balance and no monthly service charge.

- The bank offers home loans and other home mortgages to help its users.

- If you are a Civista bank customer, it helps you with loans such as Commercial and Agricultural lending.

- It offers convenience in mobile banking, digital banking, and digital wallet to promote online banking.

- The bank customer service is always there to assist you. You can contact them in any problematic situation.

If There are Any Downsides

Often, customers complain about the services of the bank, which needs a bit of improvement.

Civista Bank Contact Details

In case of any complaint or issue with Civista bank you can contact them in the following ways:

Civista Bank Customer Support Number

800.604.9368

Civista Bank Postal Address

Not Available

Civista Bank Information

Bank Website: www.civista.com

Routing Number: 041201635

Swift Code: See Details

Phone Number: 800.604.9368 or 844.842.0268

Similar Bank Login

- Woodforest Login

- Umpqua Bank login

- S&T Bank Login

- Chemical Bank Login

- Morgan Stanley Login

- First Volunteer Bank Login

- BankNewport Login

- First Tennessee Login

- Credit One Bank Login

- Bank Of Hawaii Login

- BECU Login

- Renasant Bank Login

- Andover Bank Login

- First National Bank Texas Login

- Comerica Bank Login

- Camden National Bank

- Androscoggin Bank

- Mountain America Credit Union

- Axiom Bank

- Berkshire Bank

- Capital One 360

- ChartWay Federal Credit Union

FAQs

What are the features of the Civista Money Market Investment Account?

There are various features of money market investment account in Civista bank such as :

- It allows you to write checks.

- It offers the users tiered interest rates so that you can earn more as your balance grows.

- You need not worry about any monthly maintenance fees.

- The bank allows you to make up to six transfers or withdrawals per month.

- It asks for a $2,500 minimum to open a Money Market Investment bank with Civista.

What are the terms loans and credit options of Civista bank?

The bank offers loans and credit options for users wanting to

Invest in real estate or for working capital. You can also apply for loans and credit cards to purchase equipment, inventory, vehicles, and owner-occupied real-estate. The bank offers loans to refinance existing debt as well.

What is the difference between a Free checking account, compass checking, and star checking?

Free checking:

It offers you all the basics of banking. A free checking bank account does not require any minimum balance or monthly service charge. It requires a $50.00 minimum opening deposit to maintain your account.

Compass Checking

It includes all the basics added with extra value-added benefits to make banking much more better. The compass checking account offers you to maintain a free box of selected checks on an annual basis. You also get a free deposit box for one year. With the use of the BaZing mobile app, you get a lot of shopping, dining and travel discounts.

Star Checking

It is a prime membership of Civista bank that offers many features in interest of users. You get to earn interest on your checking balance with tiered rates. It brings to you two free boxes of selected checks on an annual basis. You can use the free coin counter and enjoy shopping, dining all with discounts.

What to do if I seek help from the bank?

There are various ways to contact the bank with different problems.

- You can contact the bank anytime for your query by visiting there.

- You can give them a call on 844.842.0268 for questions related to online banking.

Conclusion

Civista bank is a good choice to make as it offers a variety of services. The bank helps you in your difficult situations as well as with new dreams. You can get easy loans and credit card options for various personal and business needs. The bank customer service is always there to assist you. A lot of people review the bank with an affirmation. The bank would be a great choice for all your financial needs.

For more details, contact the bank at 844.842.0268. Do not forget to share the article with your friends and leave your comments below.