Truist Financial Corporation, located in Charlotte, North Carolina, is an American bank holding corporation. The merger of BB&T (Branch Banking and Trust Firm) with SunTrust Banks resulted in the formation of the company in December 2019. Its bank has 2,781 locations in 15 states and the District of Columbia, offering consumer and business banking, securities brokerage, asset management, mortgage, and insurance products and services. It is the tenth-largest bank in the United States by assets, with $509 billion in assets as of June 2021.

Truist Insurance Holdings, with $2.27 billion in yearly sales as of January 2021, is the world’s seventh-largest insurance broker.

Truist Bank Login

Logging into your Truist Bank account from a desktop or laptop computer is a quick and straightforward process.

Step1: Go to the Official Website of the Truist Bank.

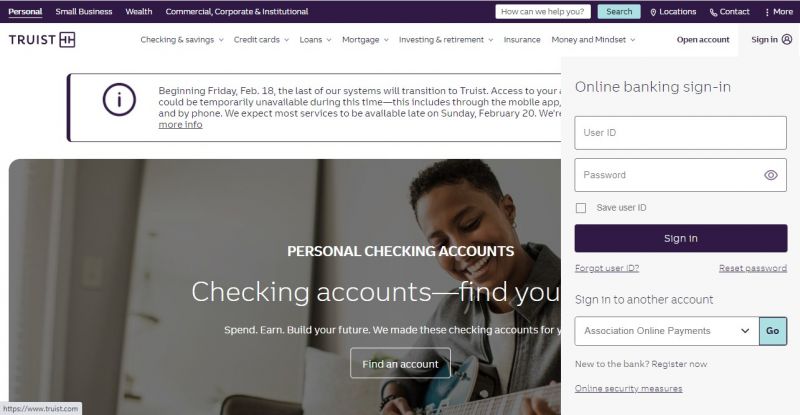

Step2: Click on the “Sign In” button, at the right-top corner of the website.

Step3: As you click on the “Sign In” button, a popup window will open where you have enter your User ID and Password and then click on the “Sign In” button.

How to Recover your Forgotten Password

If you’ve forgotten your password, try the following:

Step1: Go to the Official Website of the Truist Bank.

Step2: Click on the “Sign In” button, at the right-top corner of the website.

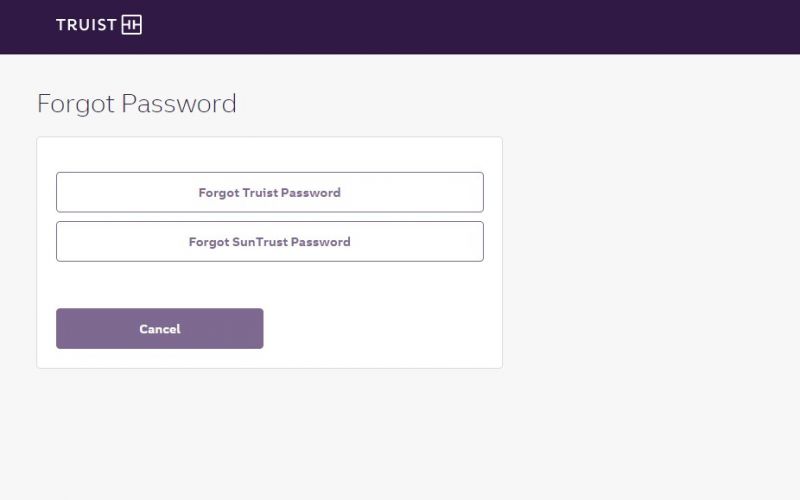

Step3: As you click on the “Sign In” button, a popup window will open where you have to click on the “Reset password” link.

Step4: Here, you have two options, “Forgot Truist Password” and “Forgot SunTrust Password,” you can click according to your need.

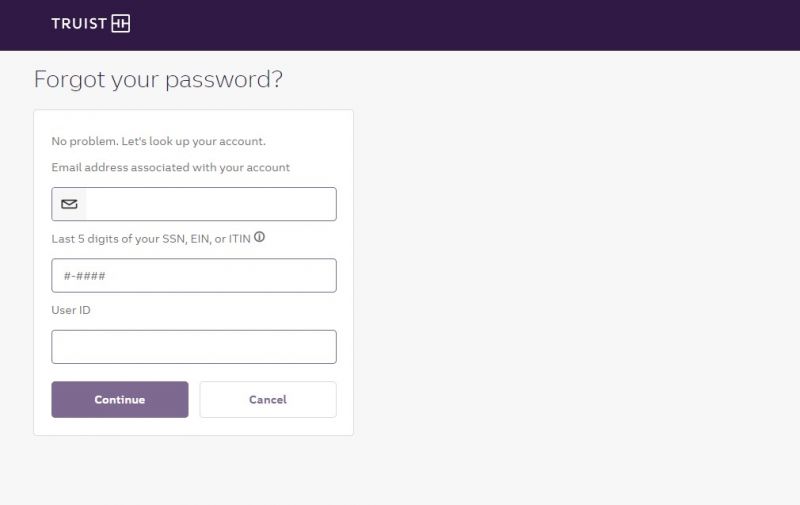

Step5: Now, enter some your personal details, and then click on the “Continue” button.

You should be able to change your password from this location.

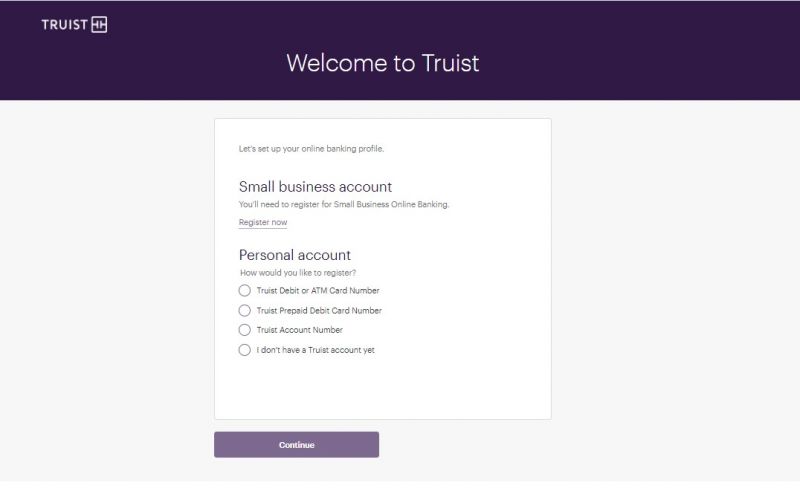

How to Enroll into Truist Bank Online Banking

Step1: Go to the Official Website of the Truist Bank.

Step2: Click on the “Sign In” button, at the right-top corner of the website.

Step3: As you click on the “Sign In” button, a popup window will open where you have to click on the “Register” link.

Step4: Here, you have to choose the way you like to register with the bank, enter your details according to selected options and then click on the “Continue” button.

Advantages of Truist Bank

- Four non-Truist ATM transactions with no cost

- First order of customized checks is free.

- CD and IRA bonus interest rates

- Every statement cycle, two overdraft protection transfer costs are waived.

- Money orders and official checks are available at no cost indefinitely.

Benefit of Truist Dimension Checking Premier

Dimension of the Trueist If you select Premier Tier, you will receive additional benefits.

- Unlimited no-fee ATM transactions, plus surcharge refunds each statement cycle.

- The annual cost of $25 ($70 reduction) for the Delta SkyMiles® Debit Card.

- Incoming local and international wire transfers are free of charge.

- No-fee automatic overdraft protection transfers indefinitely.

- When cashback is redeemed and placed into an appropriate Truist deposit account, you will get a 10%, 25%, or

- 50% Loyalty Cash Bonus or Loyalty Travel Bonus based on your Truist deposit connection.

- Subject to availability, a $25 safe deposit box discount is available.

- With qualifying activities or a connection with Truist, there are simple methods to avoid the monthly maintenance fee.

Key Benefits of Personal Loan in Truist Bank

- Fast decisions are expected, and same-day financing may be available.

- There is no requirement for collateral.

- To save time and money, consolidate high-interest debt.

- Improvements to your house can be financed without the need of any collateral.

- Other major purchases or costs must be paid for.

- Monthly payments that are predictable and fit into your budget

History of Truist Bank

In their hometown of Wilson, North Carolina, Alpheus Branch, and Thomas Jefferson Hadley started the Branch and Hadley commercial bank in 1872. Branch bought out Hadley’s interests in 1887 and renamed the firm Branch and Company, Bankers, after several transactions, largely with local farmers. In 1887, the bank relocated to a new location on Nash Street in Wilson, North Carolina. Branch, his father-in-law Gen. Joshua Barnes, Hadley, and three other men were granted a charter to manage the Wilson Banking and Trust Company by the North Carolina General Assembly two years later.

The corporation ultimately landed on the name Branch Banking and Trust Company after many additional name changes. Until his death in 1893, Branch was an active member of the corporation. In 1978, the Wilson Branch Banking and Trust Company Building was added to the National Register of Historic Places.

BB&T began selling Liberty Bonds during World War I and by 1923 had amassed over $4 million in assets. In 1922, BB&T Insurance Services was established, followed by a mortgage section in 1923. Despite the fact that banks around the country failed as a result of the 1929 stock market crash, BB&T was the only one to survive in Wilson.

Merger with Southern National Bank

The bank amalgamated with Southern National Bank, a bank having origins in the state’s eastern region, in 1995. BB&T now has 437 locations in 220 communities in the Carolinas and Virginia. Southern National Corp. was formed from the merger, but all of its banking companies were renamed BB&T. BB&T had the highest deposits and branches in North Carolina of any bank, with $19 billion in assets. According to Southern National CEO Glenn Orr and incoming BB&T Chairman John Allison, the combination established a bank that would be too profitable for an out-of-state bank to take over.

Orr left the company when the transaction was completed. In Winston-Salem, North Carolina, the headquarters became known as the BB&T Financial Center.

In a $985 million agreement announced in November 1996, Southern National Corp. acquired United Carolina Bank, a bank situated in eastern North Carolina. The assets of UCB totaled $4.5 billion. Whiteville had 400 employees, but despite the loss of the headquarters, the community would soon have 500 BB&T employees operating in a 250-employee contact center and other enterprises. 91 UCB branches began the process of converting to BB&T on September 22, 1997, while 67 additional BB&T branches closed in October because they were too near to other BB&T locations. Southern National Corp. became BB&T Corp. on May 19, 1997, and its ticker symbol SN became BBT.

Truist Bank Contact Details

Truist Bank Customer Support Number

844-487-8478

Truist Bank Mailing Address

Truist Bank

200 S College ST Fl 1

Charlotte, NC 28202-2077

Truist Bank Information

Bank’s Website: www.truist.com

Routing Number: 042000314

Swift Code: See Details

Phone Number:844-487-8478

Similar Bank Login

- Armstrong Bank

- First Commonwealth Bank

- VyStar Credit Union

- Union Savings Bank

- Old National Bank

- New Peoples Bank

- Bremer Bank

- America First Credit Union

- Center State Bank

- Fulton Savings Bank

- First Republic Bank

- Wells Fargo Bank

- Huntington Bank

- Citizens Bank

- Fifth Third Bank

Frequently Asked Questions (FAQs)

Question: Is Truist Bank a reputable institution?

Answer: One of the bank’s most powerful offerings is the Truist Bank Online Savings Account. It features a $0 minimum initial deposit and no monthly maintenance costs if you choose to get your bank statements online. You could prefer high-yield savings account with an online institution if you want to earn a greater rate.

Question: Are SunTrust and Truist the same financial institution?

Answer: According to FDIC statistics, BB&T (Branch Banking and Trust Company) and SunTrust, both located in Winston-Salem, North Carolina, concluded a merger of equals on Dec. 9, 2019, to form Truist Bank, the sixth biggest bank in the United States by assets.

Question: Is Truist Bank a global institution?

Answer: Consumers with limited English proficiency can use the following Truist resources: At our Multicultural Banking Centers, we have multilingual associates on hand. Some products and services have materials available in Spanish, Korean, Vietnamese, Mandarin, and other languages spoken in the areas.

Question: How do I transfer funds from Truist?

Answer: Follow the instruction below to transfer funds from Truist.

Question: What is the mission of the Truists?

Answer: Their mission at Truist is to encourage people to live better lives and communities. That occurs as a result of genuine concern for making things better. To address the requirements of clients, empower coworkers, and improve communities.

{{CODEfaq}}