The National Credit Union Administration (NCUA) has established and insured Security Service Federal Credit Union (SSFCU) (NCUA). Security Service Federal Credit Union has 66 sites in Texas, Colorado, and Utah, with over $9.8 billion in assets and over 925,000 members. Security Service is the biggest credit union in San Antonio, Texas, and one of the country’s largest credit unions. With the help CU Service Centers shared branching network, the credit union has access to over 5,000 credit union locations worldwide.

The credit union originally opened its doors at Kelly Air Force Base in San Antonio, Texas, in 1956 as United States Air Force Security Service Federal Credit Union, with just eight members and $25 in deposits. The credit union’s name was changed to Security Service Federal Credit Union by the board of directors in 1968.

Service of Security Federal Credit Union was established as a non-profit, member-owned banking cooperative to meet the financial requirements of members and families of the United States Air Force Security Service Command. Since then, the credit union’s charter has been expanded to accommodate over 2,600 different joining methods. The Security Service Company is a San Antonio, Texas-based provider of traditional financial services.

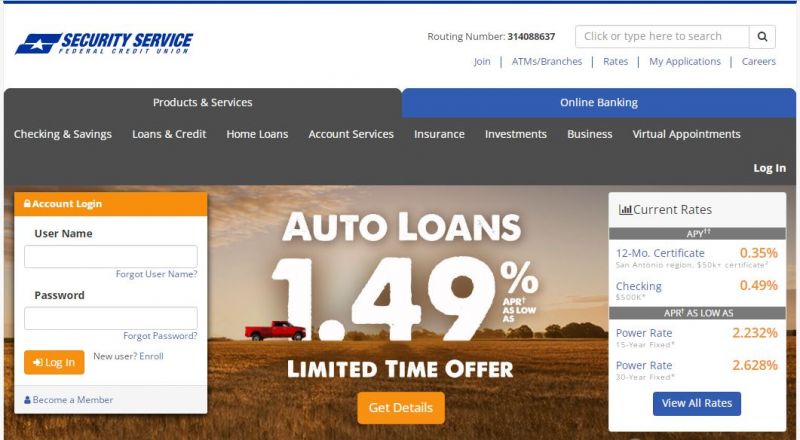

Security Service Federal Credit Union Online Banking Login

If you have a bank account with the bank, you can sign up for internet banking services at any time to access your account online. Only a few bank account data will be required. Here’s how to get started:

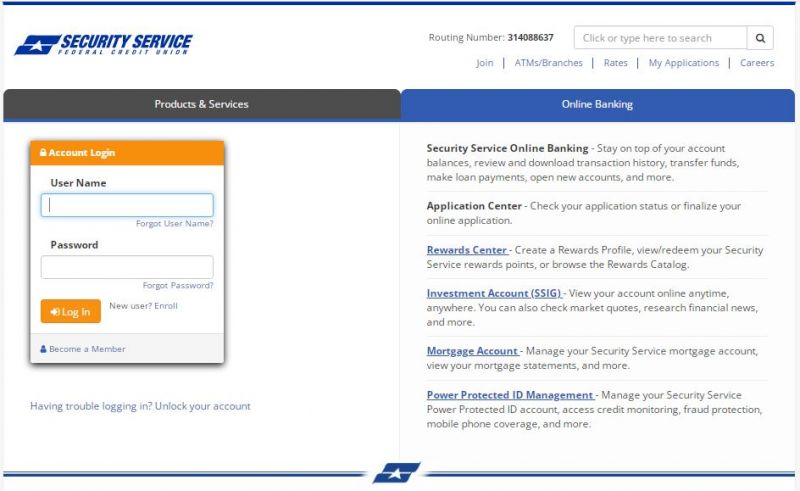

Step1: Go to the Official Website of Security Service Federal Credit Union (SSFCU).

Step2: Click on the “Online Banking” button.

Step3: Then enter your User Name and Password in the Account Login.

Step4: After entering the details click on the “Login” button.

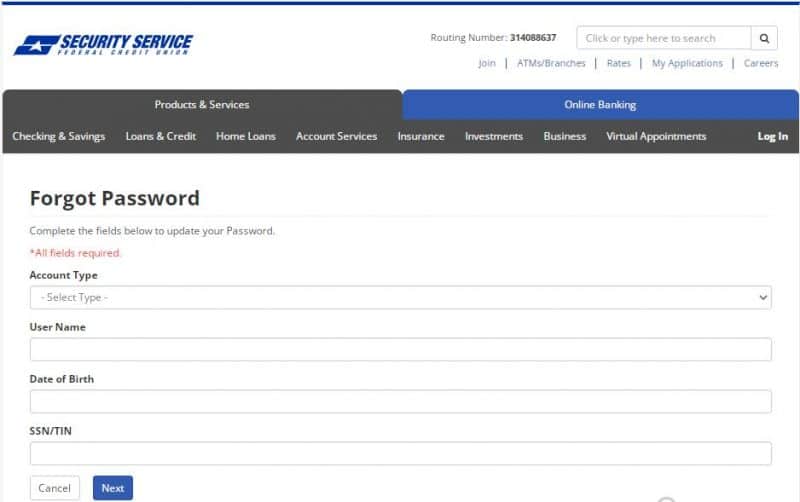

How to Reset Security Service Federal Credit Union Online Banking Password

To restore access to your online account, you may reset your password at any time. You’ll get a new password to access your online account in just a few steps. To recover access to your online account, follow these steps:

Step1: Go to the Official Website of Security Service Federal Credit Union (SSFCU).

Step2: Click on the “Online Banking” button.

Step3: Now, click on the “Forgot Password?” link.

Step4: Here you have to select your account type, and enter some of your details such as Username, Date of Birth, and SSN and then click on the “Next” button.

To reset your password, you’ll have to go through these stages.

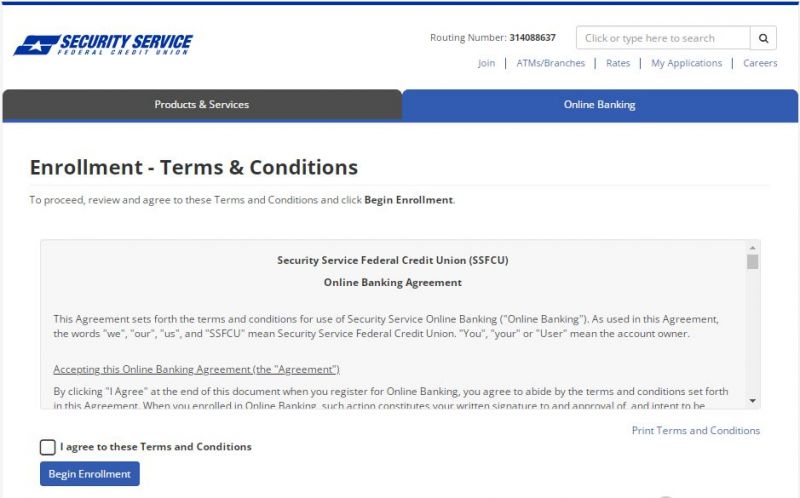

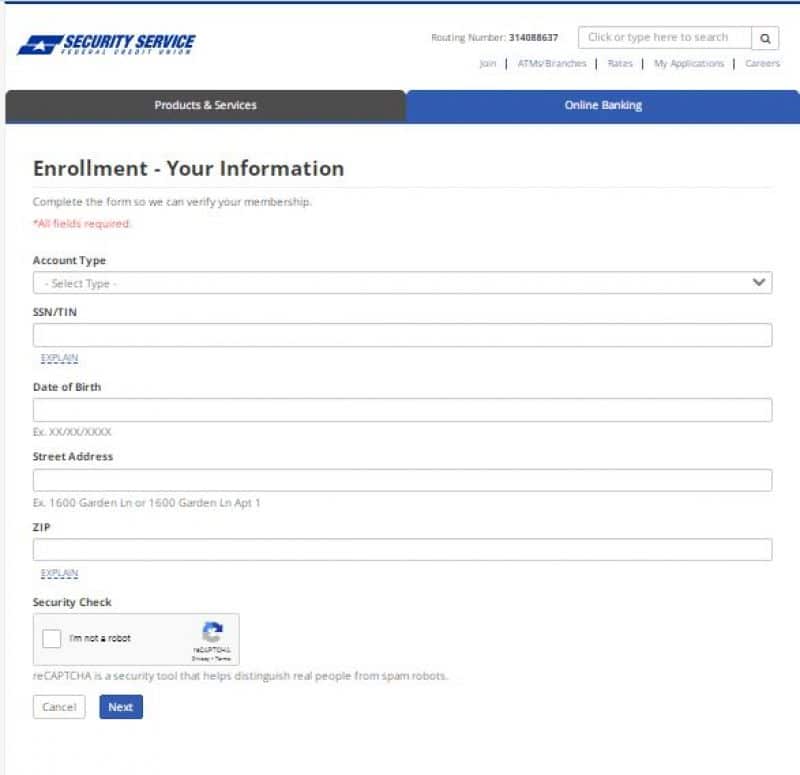

How to Enroll into Security Service Federal Credit Union Online Banking

Step1: Go to the Official Website of Security Service Federal Credit Union (SSFCU).

Step2: Click on the “Online Banking” button.

Step3: Now, click on the “Enroll” link.

Step4: In this step you have to agree to the terms and conditions and for that you have to check the checkbox and then click on the “Begin Enrollment” button.

Step5: Here you have to select your account type, and enter some of your details, fill the captcha and then click on the “Next” button.

Manage your Security Service Federal Credit Union Online

Here are some of the benefits of having a Security Service Federal Credit Union online account:

- Check the balance of your account.

- Make sure you pay your bills.

- A transfer from one bank account to another is possible.

- Apply for a home loan

- Locate the nearest ATM machine.

- Sign up for email alerts and updates.

Security Service Federal Credit Union Debit Card

With the help of a debit card you have access to the funds in your checking account in a secure and easy manner. In Security Service Online Banking, you may even customize your card with your own photo. Open a checking account in person and receive a new debit card in one of 11 vibrant colors.

Purpose of Service Federal Credit Union (SSFCU)

Security Service’s mission is to improve our members’ lives by providing practical financial solutions and a lifetime of service excellence guided by our fundamental principles.

Member service is at the heart of the Security Service’s daily choices and activities from the front lines to the boardroom.

Our mission is to assist members in securing a secure financial future by listening to their financial requirements and devising creative solutions to help them better their financial conditions.

Facts About Security Service Federal Credit Union

- Security Service Credit Union is one of the best credit unions in the country.

- Security Service Credit Union is Texas’ biggest credit union, with 70 sites in Texas, Colorado, and Utah.

- More than 100 Security Service ATMs are part of the network.

- More than 500 Stripes ATMs provide free transactions.

- Shared Branching offers access to 5,000 credit union sites across the country.

- 30,000 CO-OP Network ATMs provide free transactions.

Loans of Service Federal Credit Union (SSFCU)

- Home Loans: When you purchase, develop, or refinance a home, Security Service offers two strong choices to help you save money. With their Power Mortgage, you may save up to $5,000 on closing expenses and avoid paying an origination charge, lowering your upfront expenditures. With their lowest, reduced rate, choose their Power Rate to save on monthly payments.

- Personal Loans: They provide a wide range of personal loan programs, from signature to debt consolidation, to meet your specific requirements. They can help you locate the proper personal loan for your situation with low rates and flexible terms.

- Home Equity Loan: Home equity loans and lines of credit are available via Security Service to help you fund what you need, when you need it. Rates are lower than most personal loans since you utilize the equity in your house as security.

- Auto Loans & Other Vehicle Loans: Low interest rates make buying a new or used car simple and inexpensive. Boats, RVs, and motorbikes are also eligible for financing. Loan payments are simple and convenient, and they may be made online, over the phone, at your local branch, or at a Security Service ATM.

Premium Business Checking

Premium Business Checking gives you access to major corporate rewards, whether your firm is big or small. With 24/7 customer services, data breach protection, mobile phone coverage, and legal services, you can save time and money while safeguarding your business.

Security Service Federal Credit Union (SSFCU) Membership Eligibility

NCUA provides federal insurance. Eligibility for membership is necessary.

1) You may be charged standard data and text messaging charges.

2) Eligibility and qualification criteria apply to mobile check deposit.

3) Alerts are depending on the preferences you select. The majority of warnings are delivered in real time; however, some may not be. The Security Service is not liable if an alert is not issued or received.

4) Before using the app, set up Bill Pay and payees in Online Banking.

Power Protected Checking

Power Protected Checking comes with up to $1,000 in mobile phone coverage, 24/7 identity theft protection and monitoring, high interest, and easy access to your funds.

Security Service Federal Credit Union Contact Details

Security Service Federal Credit Union Customer Support Number

1.888.415.7878

Security Service Federal Credit Union Postal Address

Not Available

Security Service Federal Credit Union Information

Bank’s Website: www.ssfcu.org

Routing Number: 314088637

Swift Code: See Details

Phone Number: 1.888.415.7878

Similar Bank Login

- Red River Bank

- Lee Bank

- Dollar Bank

- WSFS Bank

- New York Community Bank

- ENT Credit Union

- South Georgia Banking

- Farmers State Bank

- Alaska USA Federal Credit Union

- Metro Bank

- Call Federal Credit Union

- Union Bank

- M&T Bank

- KeyBank

Conclusion

I hope you find this helpful material helpful and get all the information related to Service Federal Credit Union (SSFCU). Please let us know/inform if you have any questions in the comments section, and we will gladly answer them.