The Call Federal Credit Union was Founded in 1962 by employees of Philip Morris, and Call Federal Credit Union now stands 30,000+ members solid and open to the entire Greater Richmond metro area. Call Federal Credit Union bank provides financial services to its customers and employees. The credit union has made it very easy for their customers to access their financial assistance through internet banking. Once a customer has signed up with the bank, they can access our financial services anytime. All you need is to have is an internet connection if you struggle with managing your account online.

Let us help you through the steps for easy login, resetting the password, and registering.

Call Federal Credit Union Online Banking Login

One of the simplest ways and steps that you will be required to complete anytime you want to access or use the financial services.

Here are simple steps that you will need to take to log in:

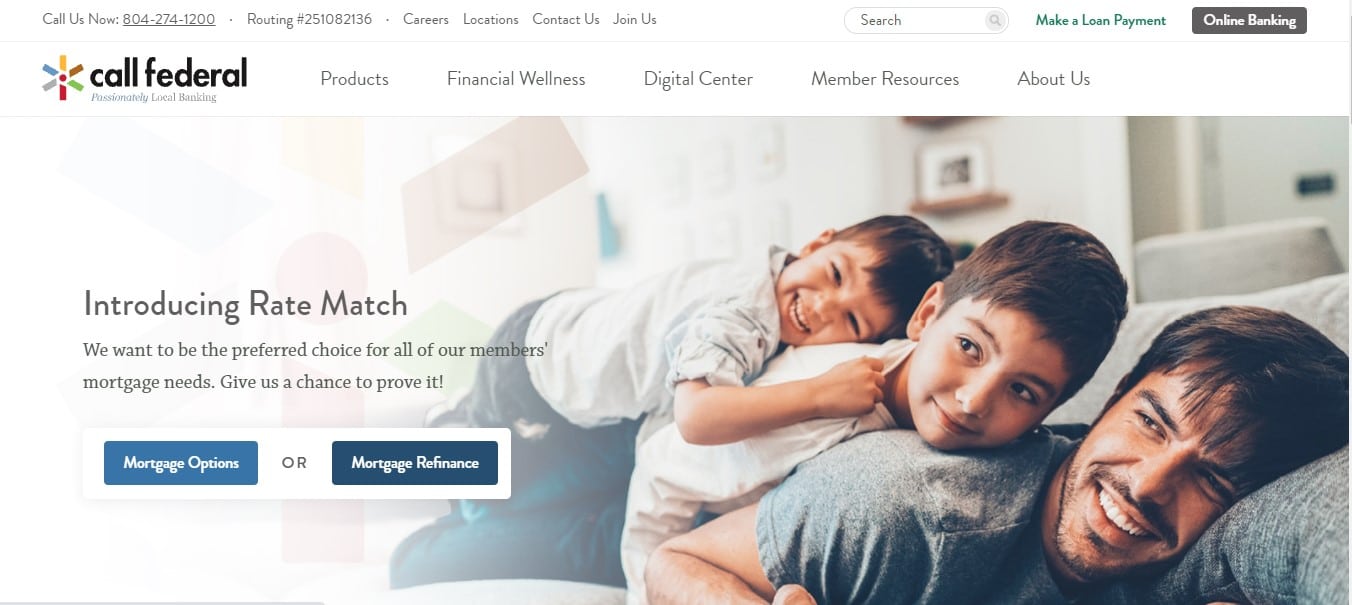

Step1: Visit the Official Website of Call Federal Credit Union.

Step2: On the homepage, at the right-top corner you have to click on the “Online Banking” button.

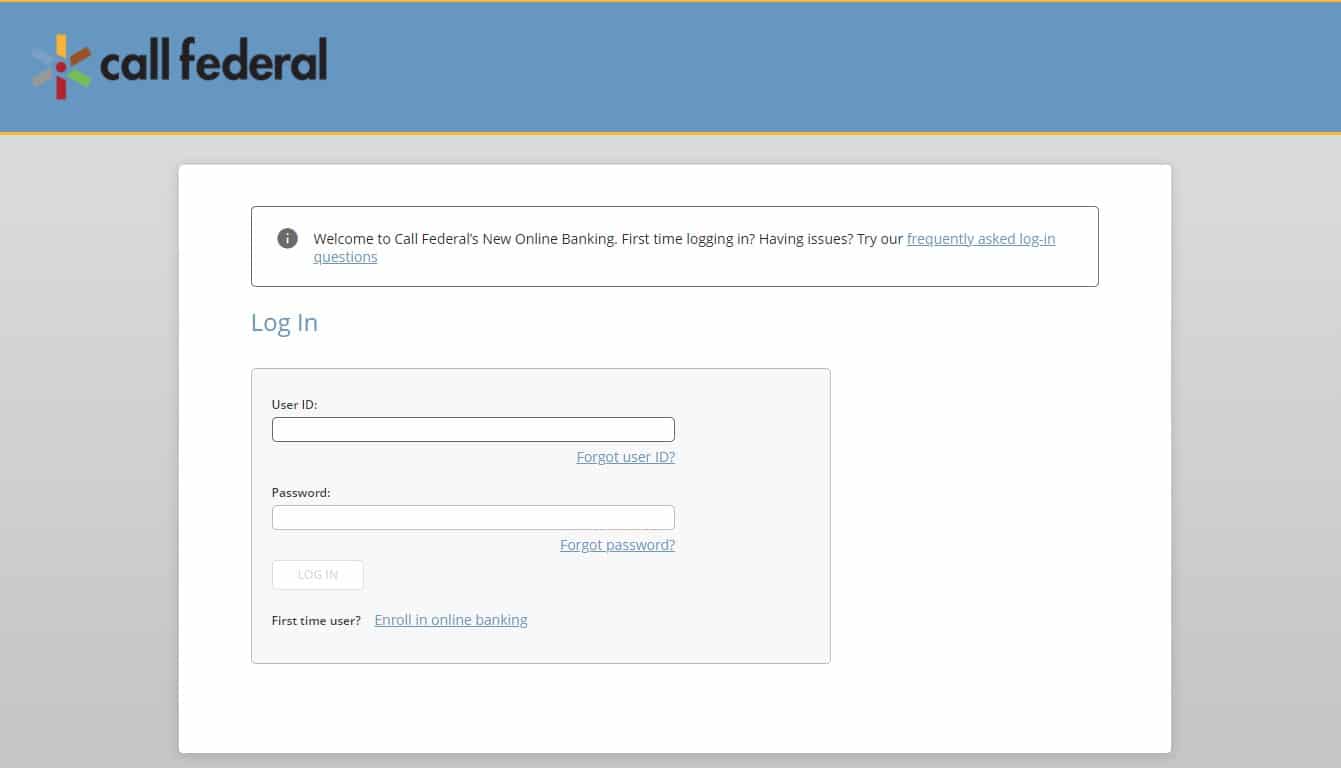

Step3: Enter your User ID and Password and then click on the “LOG IN” button.

But, what if you forgot your password? Don’t worry, and we have got your bank. Let us tell you how you can reset your password:

How to Reset Your Password?

Resetting your password is not an easy task for anyone. Resetting the password for Call Federal Credit Union online account is also not that easy. It requires that you provide a few details and information that will verify you as a customer.

There are 1000 of many people who have forgotten their login details, and you are not the only one that’s why banks want their customers to do the secure password reset.

These are the steps that will help you reset your password:

Step1: Visit the Official Website of Call Federal Credit Union.

Step2: On the homepage, at the right-top corner you have to click on the “Online Banking” button.

Step3: Just below the Password text box, you can see “Forgot password?” link. Click on that link.

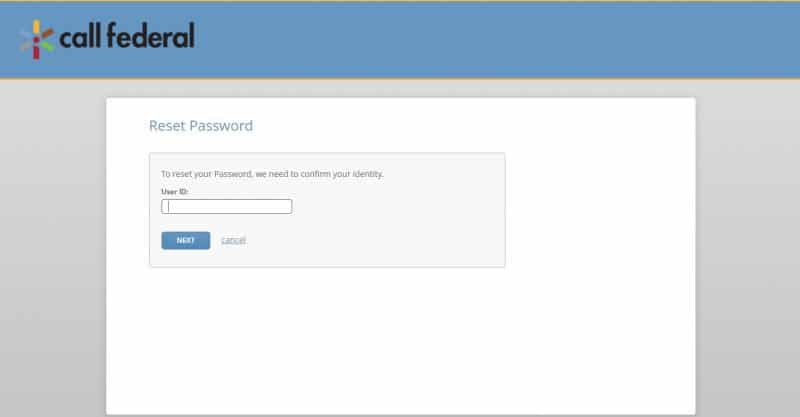

Step4: Provide your User ID and click on the “NEXT” button.

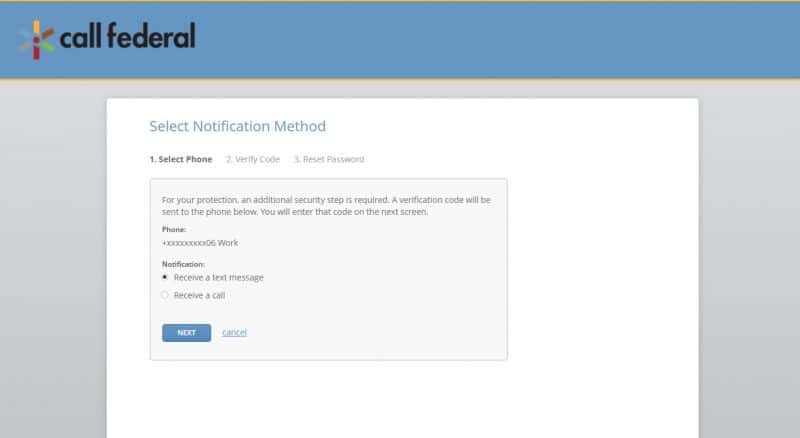

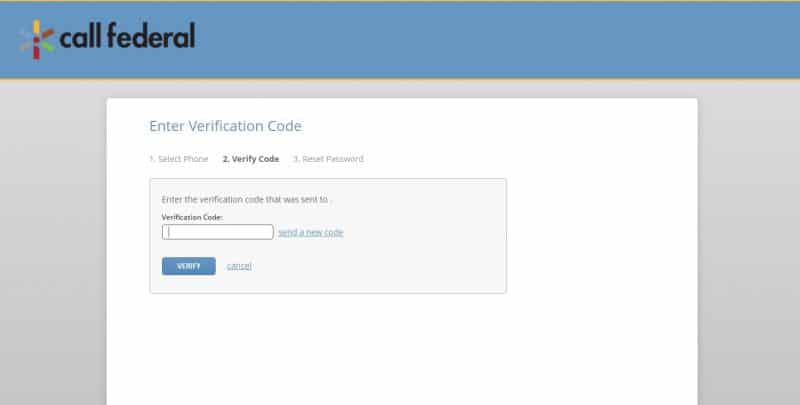

Step5: Now you have to select the notification method through bank can send you the verification code and can verify your identity. You may choose for receiving a text message or call. After selecting click on the “NEXT” button.

Step6: Enter the verification code, and click on the “VERIFY” button.

Step7: Now you can reset your password.

How to Enroll into Call Federal Credit Union Online Banking?

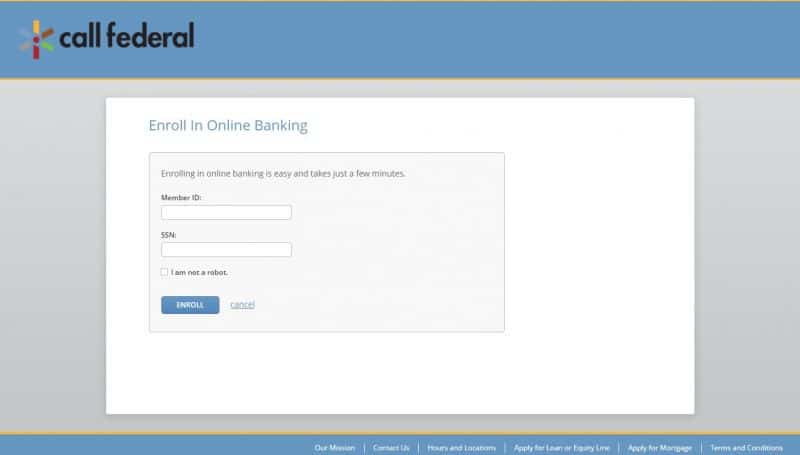

Enrollment is not easy. This is where many people get lost or get confused or find it difficult. But it’s effortless and only requires that you be a customer to start accessing the financial services offered by the bank online.

These are steps you will need to follow to enroll the online banking are :

Step1: Visit the Official Website of Call Federal Credit Union.

Step2: On the homepage, at the right-top corner you have to click on the “Online Banking” button.

Step3: Just below the “LOG IN” button, you can see “Enroll in online banking” link. Click on that link.

Step4: Here you just have to enter your Member ID, SSN, check the checkbox of I am not a robot and then click on the “ENROLL” button.

After that, you will be directed to the page, and all you have to do is some small verifications. And after all the verifications are done, you can access your account.

Benefits of Call Federal Credit Union Online Banking

Once you are done with the enrollment, you will get unlimited access to your account. Other advantages include:

1) You can make a loan payment

2) Find a location near you

3) Apply for loan and mortgage rates

Customer Reviews on Call Federal Credit Union Online Banking

While working there, it was clear that my manager only cared about the sales. He was constantly judging, pushing, and reviewing us only based on sales. A credit union is not supposed to be like that with anyone that way. They have the same sales goals for every location so, if you are at a dead branch and only get like six members a day, you will have the same purpose as a branch that sees 100+ members per day.

Call Federal Credit Union is a very wonderful place to work for. It’s only been two months that I have been working with them. I am so much happier. I also like the work/life balance. They Have set hours and also allow time to see family and friends whenever you want. The bank is passionate about its employees and members and treats everyone who walks through those doors like family.

Call Federal Credit Union Contact Details

Call Federal Credit Union Customer Support Number

804-274-1200

Call Federal Credit Union Address

Call Federal Credit Union

4605 Commerce Rd.

Richmond, VA 23234

Call Federal Credit Union Information

Bank’s Website: www.callfederal.org

Routing Number: 251082136

Swift Code: See Details

Phone Number: 804-274-1200

Similar Bank Login

- Hudson Valley Credit Union

- Kitsap Bank

- Minnwest Bank

- UMB Bank

- Tinker Federal Credit Union

- Red River Bank

- Lee Bank

- Dollar Bank

- WSFS Bank

- New York Community Bank

- ENT Credit Union

- South Georgia Banking

- Farmers State Bank

- Alaska USA Federal Credit Union

- Metro Bank

Frequently Asked Questions

How can I use a Mobile Deposit?

First, you must endorse the back of the check and print “For Mobile Deposit at Call Federal” or also “For MDC at CFCU.”

While logged into your mobile banking account, locate and click on the “Deposit” button; after that, click New Deposit. Select the “price” or “amount” space and fill in the amount of your check. Make sure you Double-check that you have entered your check amount correctly and adequately, and then click Continue.

Now prepare your deposit by ensuring that your check lays flat and isn’t folded or mutilated. Take a picture of the bill. Ensure that the image you click is clear and that all four corners are visible according to the guidelines. Submit, the front then takes a picture of the back of the cheque. repeat the same process to deposit multiple checks

Once it is completed, you will receive a notification as soon as possible if it has been approved or rejected.

What checks are not suitable or acceptable via mobile deposit?

The following items will not be accepted when sent through mobile deposit:

- Checks over $5,000

- Third-party checks

- Items issued or drawn off a financial institution located outside of the United States

- Items not in U.S. currency

- Bills are drawn off of your Call Federal account

- Altered or incomplete checks

- Checks requiring an authorization

- Stale or post-dated checks

- Starter or counter checks

- No traveler’s checks, AMEX Gift Cheques, money orders, or savings bonds

- Previously negotiated checks

- Bills once converted to substitute checks

How do I set up automatic Bill Pay?

In the online banking app, select or click on “Pay a Bill” and choose whether to pay the U.S. or International Bill from your account. Choose from where the payment is coming, and after that, select the payee from your checking account, and select the amount.

Select payee, date, and schedule as a one-time or repeat transfer.

If I lose my debit card or credit card, can I turn off my card to prevent fraud from occurring?

Yes, you can control the card functionality through the mobile app or online banking web page. In your account, Tap on “More” then “Card Control” in the Service section, then C.U. mobile app or “Financial Tools” after that “Control Control” in online banking to view the details or your debit and credit cards in and turn your cards on or off as per your need, set up the alerts and spending limits by vendor types, spend amount, and by location. You can even set the boundaries for dependents’ credit cards or anyone else on a joint account.

When Filling a dispute, will I have to block my cards?

For this, you may be required to block your card for security reasons and get a new card and card number from the bank. If there is any fraudulent activity on your credit or debit card, you need to secure the card as per VISA rules. If you are filing the dispute for something other (e.g., non-receipt of merchandise or services, credit not processed, or incorrect amount processed), in that case, you will not be required to block the card.

Conclusion

We have written down all the essential details about the bank, from enrolling to log in or reset your password. We have also mentioned some important frequently asked questions and reviews of the employee, and we hope that the information is helpful for you all. Tell us in the comment section about your review of the bank.

{{CODEfaq}}