ENT Credit Union is known as an ENT. It is a community credit union serving 14 countries in northern, central, & Southern Colorado, with more than $8 billion in assets and more than 400,000 members.

ENT Credit Union has more than 40 service centers. It is a community credit union that is non-profit and thrives on making credit available and affordable to its members. Members can use the benefit of the online and mobile banking services once they enroll in the service. They can manage their accounts from where they are without having to visit the Bank in person.

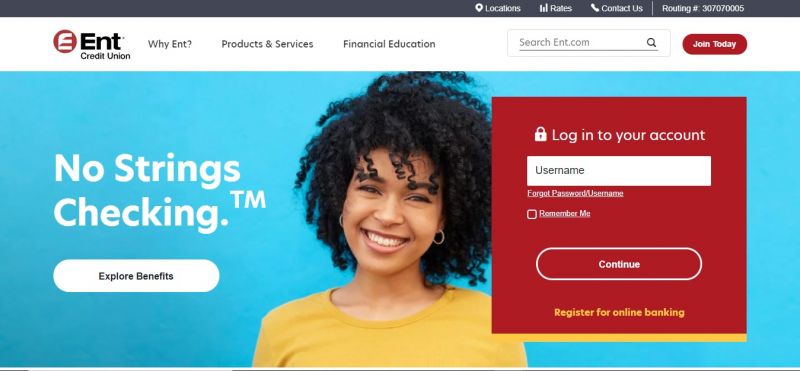

ENT Credit Union Online Banking Login

The login process is straightforward if you remember your login information and have an account with ENT Credit Union.

These are some steps which you need to login into your account:

Step1: Go to Official Website of the ENT Credit Union.

Step2: On the homepage, enter your Username in the login section and click on the “Continue” button.

Step3: Here you have to enter your password and then again click on the “Continue” button.

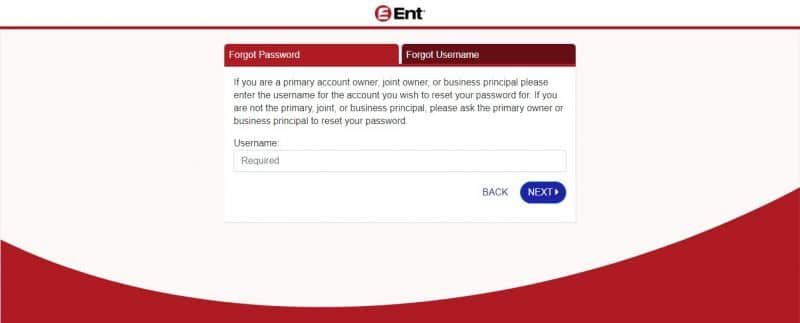

How to Reset your Forgotten Password?

If you have lost your password and don’t know how to recover? Follow these simple steps to get your account back because many new clients may not remember their id passwords, and thus they can not access their accounts. But as we told you, there is a way to reset the password if you have forgotten.

These are the steps to change your account password:

Step1: Go to the Official Website of the ENT Credit Union.

Step2: On the homepage, you have to click on the “Forgot Password/Username” link, below the Username text box.

Step3: Enter your Username and then click on the “NEXT” button.

Step4: In this step bank will ask you to send a verification code. Just click on the “SEND CODE” button.

Step5: Here you have to enter the verification code that bank sent you. After entering the verification code, click on the “NEXT” button.

Step6: After submitting the details, you will land on a page with how you can get back your account.

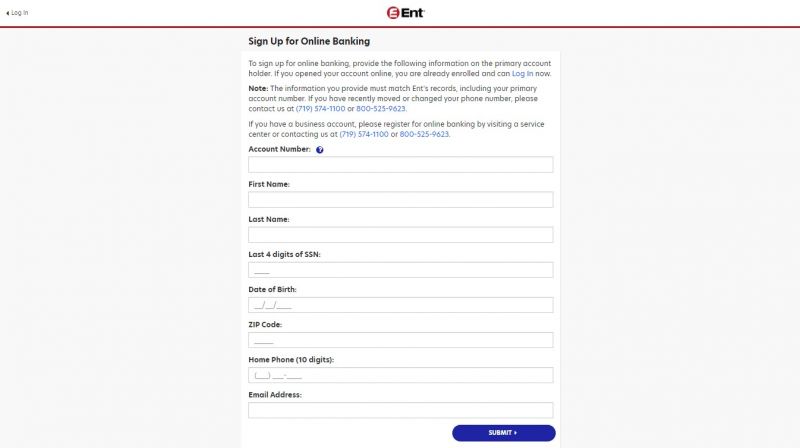

How to Enroll into ENT Credit Union Online Banking?

To enroll in the online banking service, all you have to do is register yourself with the help of your PC or mobile device and get ready to access your online account. Still, you must be an existing customer of an ent—federal union bank to access online banking.

These are some simple steps to get your account register with ENT:

Step1: Go to Official Website of the ENT Credit Union.

Step2: On the homepage, you have to click on the “Register for online banking” link, below the “Continue” button.

Step3: Here you have to enter your personal details like your account number, first name, last name, Last 4 digits of SSN, Date of Birth, ZIP Code, Phone Number, and Email Address.

Step4: After filling in all the details click on the “SUBMIT” Button.

Benefits of ENT Credit Union to Members Only

1) Better rates on loans.

2) Lower or no fees for services.

3) 40+ local service centers.

4) 55+ local surcharges – free ATMs.

5) An extended hours call center.

6) Comprehensive online and mobile banking.

7 National complete access.

Benefits of ENT Credit Union Online Banking

1) Secure Login

ENT Credit Union online banking has multi-factor security, including facial and recognition login.

2) 24*7 Access

You can access your online account from anywhere, anytime, on your mobile phone or computer.

3) Custom Alerts

You can set the notification for transactions, withdraws, balance, and much more as a unique feature.

4) Banking On the Go

You can quickly transfer funds, check your balance, pay bills, view statements, and more.

5) Live chat with a customer representative.

What ENT Gives you back?

ENT Credit Union support the communities consistent with culture and values while also reflecting membership and strategic plan. The credit union, in general, make contributions to organizations, agencies, and activities that demonstrate state-wide impact in the focus areas of:

- Children’s and family (all members) health, well-being, etc.

- Higher education – primarily via Colorado-based university and community college scholarships.

Conclusion

We have mentioned all the essential steps for logging in, registering, enrolling, or reset your password at Ent credit union bank. Also, the frequently asked questions if you still have any queries, let us know below in the comment section or you may visit the official website of Ent credit union bank. According to us, Ent. credit union is far beneficial for online banking.

ENT Credit Union Contact Details

ENT Credit Union Customer Support Number

800-525-9623

ENT Credit Union Postal Address

ENT Credit Union

P.O. Box 15819

Colorado Springs,

CO 80935-5819

ENT Credit Union Information

Bank’s Website: www.ent.com

Routing Number: 307070005

Swift Code: See Details

Phone Number: 800-525-9623

Similar Bank Login

- Merrick Bank

- DFCU Financial

- Adirondack Bank

- Southland Credit Union

- PNC Bank

- US Bank

- Hudson Valley Credit Union

- Kitsap Bank

- Minnwest Bank

- UMB Bank

- Tinker Federal Credit Union

- Red River Bank

- Lee Bank

- Dollar Bank

- WSFS Bank

- New York Community Bank

Frequently Asked Questions

How much money balance do I need to open a ENT Credit Union account?

If you do, opening an account at a bank or credit union is quite simple. You will usually need between $25 and $100 to open a savings or checking account.

Who can join ENT Credit Union Online?

A)Ent offers credit union membership to all who work or are the school students in Adams, Arapahoe, Boulder, Broomfield, Denver, Douglas, Elbert, Jefferson, Larimer, Pueblo, Weld, and many other countries. Businesses which are located in these counties are also welcome to join the ENT.

Is ENT Bank a good bank?

A)Although the account offerings aren’t extensive, Ent Credit Union provides all of the primary account types customers typically choose, from checking and savings accounts to a money market and certificates of deposit.

What are the disadvantages of ENT Credit Union bank?

- Must be a member: To use the benefit, you need to be a community member. You can’t just step into any credit union and take out a loan from them or open an account without joining their financial institution first. Since most federal credit unions are made up of members who share something in common, you’ll have eligible for specific eligibility requirements to become a member of the Bank. Sometimes it’s as simple as depositing $5 into a savings account, and sometimes terms and conditions can be different from becoming a credit union member.

- Limited accessibility: Union credit doesn’t have branches in every area. If you travel a lot and prefer online banking, this may be an issue for you and your work. Sometimes a credit union may not be near you or where you live and work either. They did not even offer a full menu of financial products everywhere.

How do I open an ENT account?

If you fit within Ent Credit Union’s field of membership, you can easily open an account online or visit a local branch. You’ll need to provide the details like (your name, email, Social Security number, contact information, etc.). Ent Credit Union can check your credit as a part of the account opening process.

{{CODEfaq}}