The WSFS Bank is based in Philadelphia, Pennsylvania, and operated as a subsidiary of WSFS Bancorp. It provides business and professional banking products and services.

The bank’s online banking service provides customers access to their bank account from anywhere around the world in straightforward steps.

Follow the steps to learn how you can use the service of WSFS banks online banking:

WSFS Bank Online Banking Login

To use the online account, you need to register your bank account with the website.

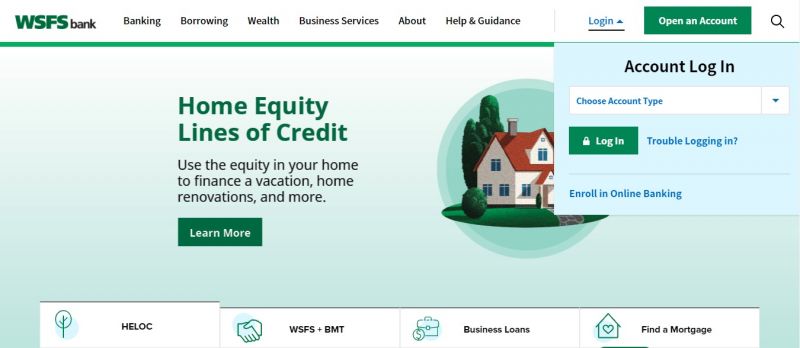

Step1: Visit the Official Website of the WSFS bank.

Step2: Now Click on the “Login” button, at the right-top corner of the homepage.

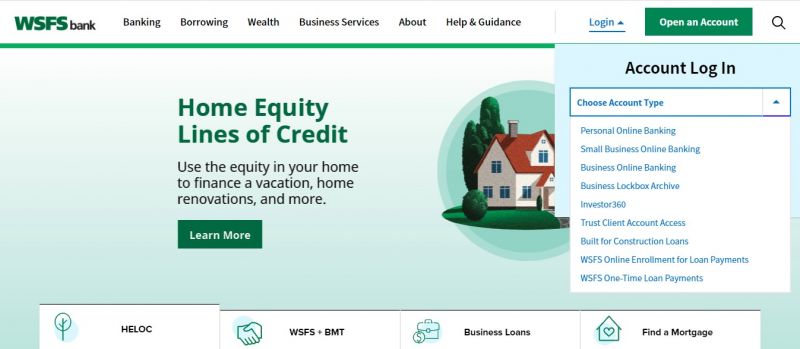

Step3: Here you have to select your account type. To select your account type click arrow, beside the “Choose Account Type” box. As you click on the arrow a drop down list will be displayed with number of option. Click on your appropriate option. For reference here we are clicking on the “Personal Online Banking” link. After this you are taken to the login page.

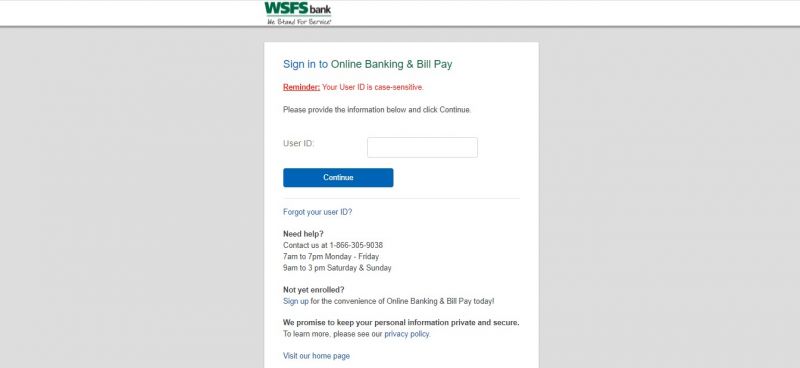

Step4: Enter your User ID and click on the ” Continue” button.

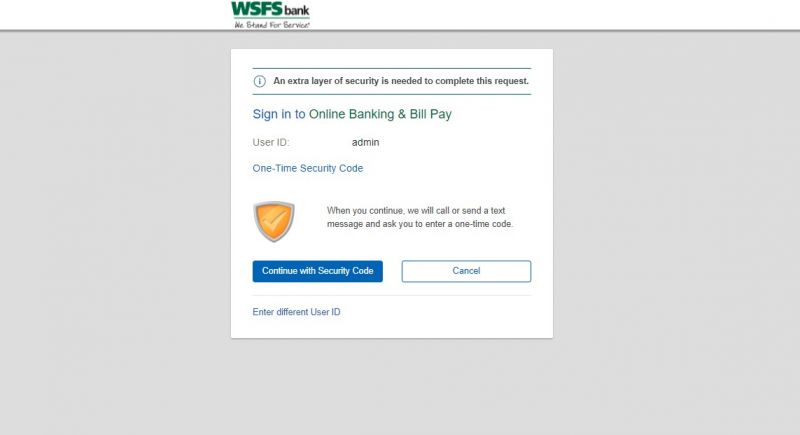

Step5: Here just click on the “Continue with Security Code” button.

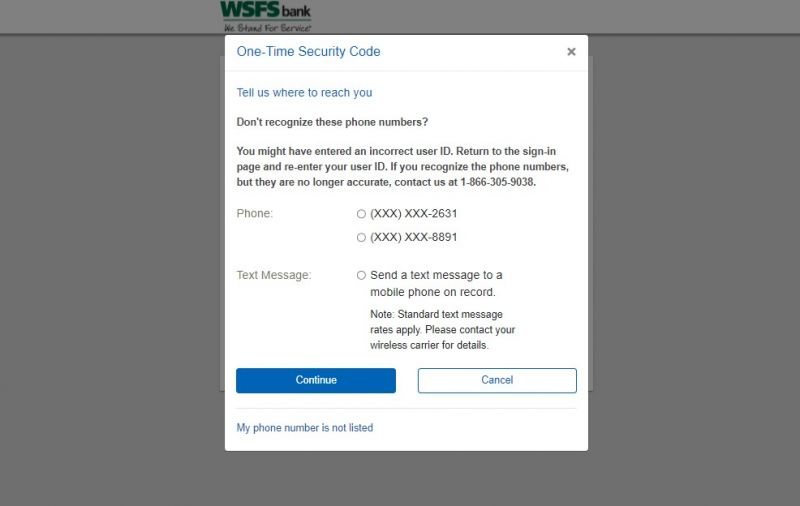

Step6: In this step, you have to choose one option so that bank can contact you and can verify your identity. If you are comfortable with telephonic conversation then select “Phone” option and if you want to receive message then select “Text Message” option. After selecting your option click on the “Continue” button.

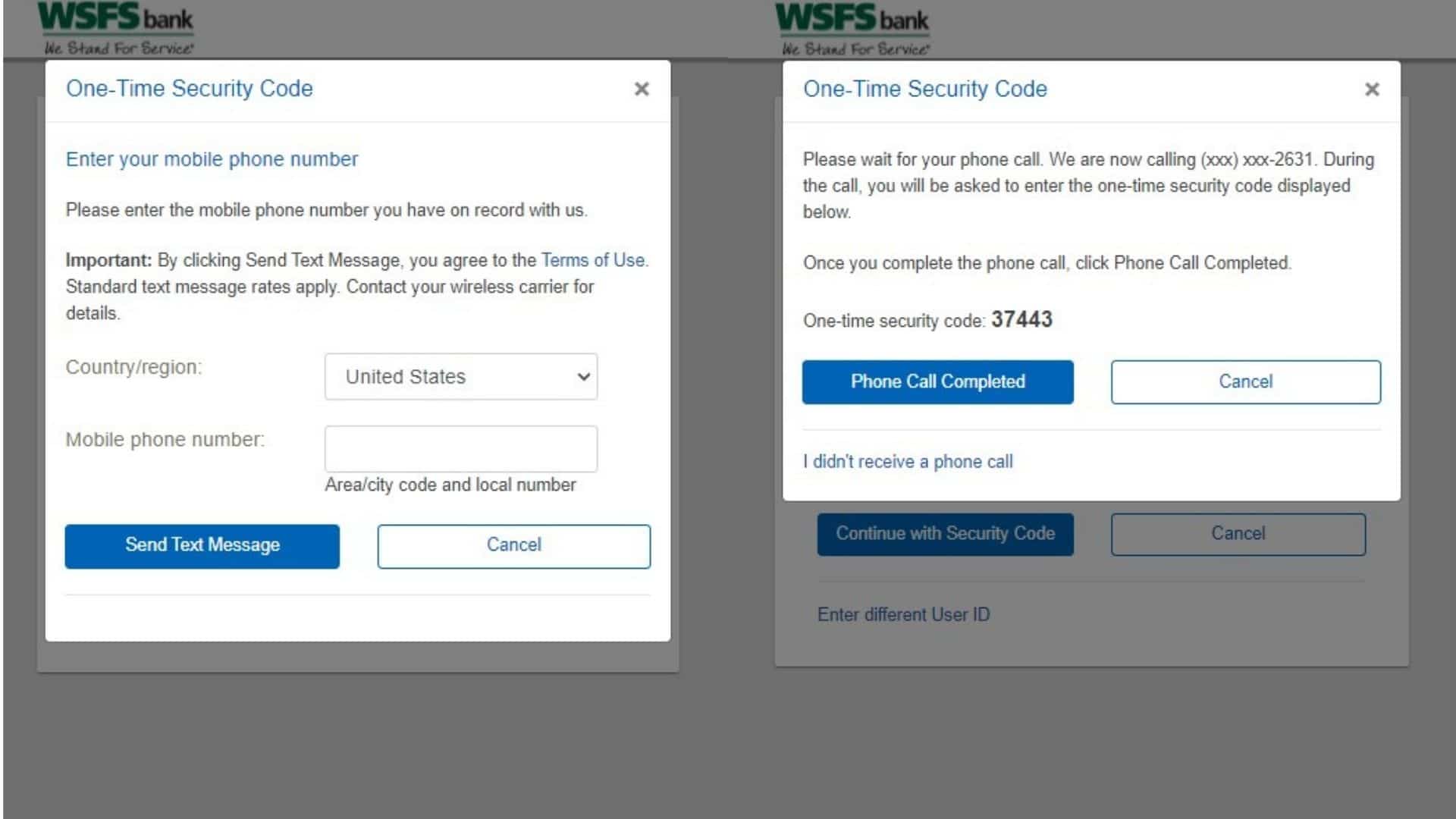

Step7: Now, if you had chosen the “Phone” option a code will displayed on your screen and bank will contact you through a call. And you just have to confirm that code on the call and once you verified that code click on the “Phone Call Completed” button. But if you had opted “Text Message” option, then you have to enter your registered phone number and then click on the “Send Text Message” button. Then you will receive a code which you have to enter in the next step.

If you have entered the correct information, you will land on your online account. You can access your account and check the balance

How to Reset Your Password?

If you are new to the online banking system, you don’t have to worry about your account. You can change or reset your password. But with WSFS Bank you don’t need to change or reset your password because with WSFS Bank Online Banking you have to confirm your identity every time you login to your account. It means that, if you are using WSFS Bank Online banking you do not have to remember any password, and if there is no password to remember, then also there is no process or steps to reset or change it.

In case you face any difficulty in logging into your online account you may contact the customer service or visit to a nearest branch of the bank.

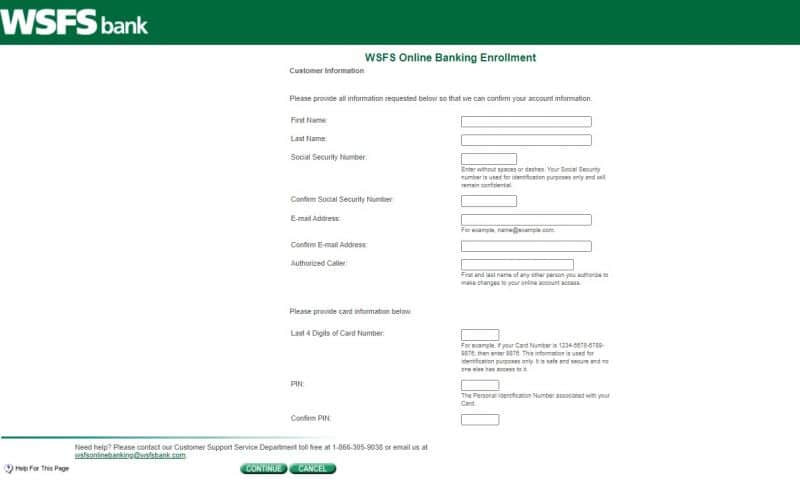

How to Enroll in WSFS Bank Online Banking?

Anyone can easily enroll in the online banking of a WSFS bank as long as they have an account with the bank. As a protocol, you need to provide specific details to verify that you have an account with the bank.

You may follow these simple steps to enroll in your online banking account:

Step1: Visit the Official Website of the WSFS bank.

Step2: Now Click on the “Login” button, at the right-top corner of the homepage.

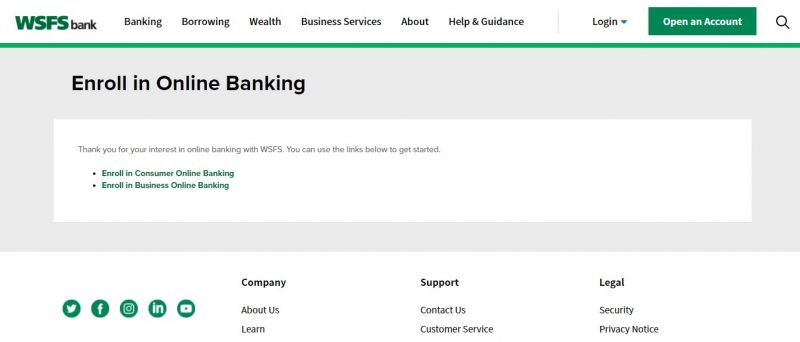

Step3: After this you have to click on the “Enroll in Online Banking” link, below the “Login” button.

Step4: Here you have two options “Enroll in Consumer Online Banking” or “Enroll in Business Online Banking”. You can choose any one of them according to your requirement. For reference here we are choosing “Enroll in Consumer Online Banking” link.

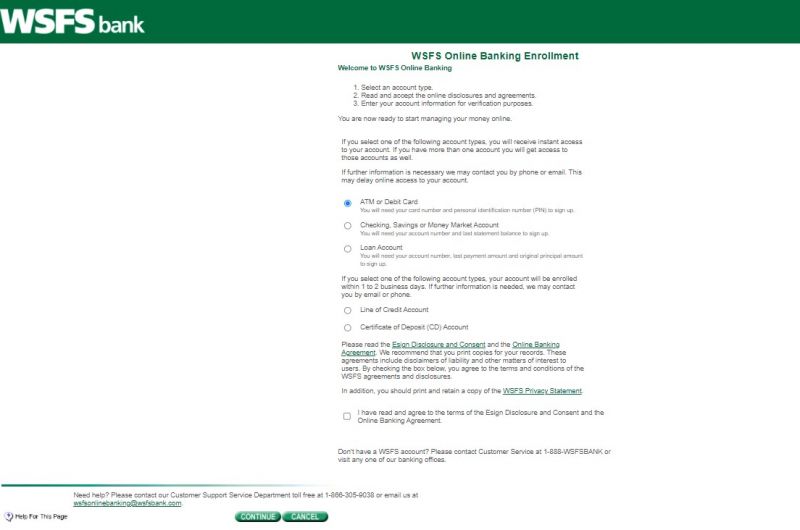

Step5: In this step you have to select an account type, read and accept the online disclosures and agreements. And for that check the checkbox and click on the “Continue” button.

Step6: Fill in all the required details, including your username, password, DOB, mother’s maiden name, SSN, address, email. After filling in all your the details, click on the “Continue” button.

Step3: Now you have enrolled your online banking of WSFS bank, and you can use it anywhere anytime.

Benefits of WSFS Bank

WSFS Bank has many benefits that provide to its customers to take advantages: These benefits include:

- Using your of WSFS Mobile Cash feature at any WSFS ATM you can get the cash efficiently without any card, pin and hassle.

- You can simply manage your accounts, transfer funds, and pay bills without checks, stamps or visiting to the post office.

- You can set up card and bill pay alerts, security notices, and auto-pay to make your life and work easier.

- Receive or send a dollar to friends straight from your phone, and no more check-squabbling or dime-splitting.

- WSFS Bank is regularly helping the communities and educating its clients on the importance of positive financial habits. The bank also allows customers to take control of their savings and checking accounts.The bank doesn’t only provide standard banking services, but the bank also offers wealth management and insurance solutions.

Checking Account Options

WSFS Bank offers six checking account options. WSFS banks have a wide range of services associated to checking account that have been created in such a way that it provides services in almost every financial situation.

Although standard features are provided with all the checking accounts, there are also differences. The different checking account options include:

In addition to the variety of checking accounts, their area unit many savings accounts to settle on from. The accounts associate with standards options also as extra bonuses to suit the monetary scenario. The savings accounts include:

1) Start earning package

2) Start rewarding package

3) Start beneficiating package

4) Interest checking

5) Free checking

Downsides of WSFS Bank

Some of the downsides of banking with WSFS Bank include limited loans and monthly service fees.

LIMITED LOANS

WSFS Bank offers a limited range of loan capabilities.

What is this means is that people who are hoping to finance business or startups, then this bank is not appropriate for you. Because the only loans provided by this bank include personal loans and business lending.

MONTHLY SERVICE FEES

WSFS Bank savings and checking accounts cost a monthly charge. The monthly fee is that the price of account maintenance. The monthly charge may be waived once bound necessities. However, if the standards aren’t met, customers will expect charges to be assessed.

Features of WSFS Bank Online banking

The WSFS bank offers an internet banking service to all the customers who want to handle the bank account online.

The WSFS bank provides a lot of advantages to their customers to enjoy:

1) Pay bills online

2) Transfer money

3) Check account balance and history

4) Find nearest bank / ATM

WSFS Bank Contact Details

WSFS Bank Customer Support Number

302-792-6000

WSFS Bank Postal Address

WSFS Bank

500 Delaware Avenue

Wilmington, DE 19801

WSFS Bank Information

Bank’s Website: www.wsfsbank.com

Routing Number: 031100102

Swift Code: See Details

Phone Number: 302-792-6000

Similar Bank Login

- Deerwood Bank

- Merrick Bank

- DFCU Financial

- Adirondack Bank

- Southland Credit Union

- PNC Bank

- US Bank

- Hudson Valley Credit Union

- Kitsap Bank

- Minnwest Bank

- UMB Bank

- Tinker Federal Credit Union

- Red River Bank

- Lee Bank

- Dollar Bank

Frequently Asked Questions

What is WSFS Mobile Banking? How do I Enroll?

Using WSFS Mobile Banking you can get access to your account data, locate branches and ATMs, deposit checks, send cash to friends and family or anyone, transfer funds, and at the same time pay bills with your mobile device. If you are currently using WSFS on – line Banking, you’ll recruit by reaching to your mobile device’s app store and installing the WSFS Bank app. you will conjointly access your device’s app store from wsfsbank.com. You may use an equivalent user ID and password for WSFS Mobile Banking as you are doing for WSFS on- line Banking.

What if I can not get My Mobile Device to figure out Online Banking?

Verify the following:

1) Your mobile device should be web-enabled.

2) Your mobile network permits secure SSL traffic.

3) you need to have valid WSFS Online Banking details.

How do I Add a New Bill Payment Payee?

Payees can only be added or removed through online banking service. Mobile functionality is available only for sending payments to already registered payees and you can also delete scheduled payments. For deleting a scheduled payment, log in to WSFS Online Banking, select Bill Payment, and delete the payment from your Pending Payments list.

How do I know if My Dealings were Successful?

A confirmation message will be sent by the bank to your registered mobile device. In case if you do not receive a confirmation message, double-check to confirm the transaction and resubmit any transactions that did not process.

What Should I do In the situation where I Lose My Mobile Phone Device?

Account knowledge and login credentials aren’t kept mechanically on your mobile device. Therefore, anyone cannot log in to your accounts simply because they need access to your phone. Don’t add your login credentials to the memorandum pad or voice record them on your mobile device, as this info might then be obtained by others. Watchword defends your mobile device if doable.

Suppose your mobile device is lost or taken. You can Log in to online banking and deactivate your device. In case if you lose your phone, contact your mobile supplier to cancel the service to the device.

Conclusion

WSFS Bank has created ways to service its customers from varying financial circumstances. The beneficial bank provides a lot of advantages to their customers to enjoy like paying bills online, transfer money, check account balance you can even search the nearest banks and ATM’s

Customers who use WSFS Bank can expect business banking solutions, limited lending, savings and checking account options, business banking solutions, but monthly service charges applied.

{{CODEfaq}}