ICCU is a credible and trusted financial organization. It has set up its base in various location and always strive for customer satisfaction. The thing here to know is that recently they have come up online and have provided its customers the facility of online banking.

Lately, customers are facing issues with online banking, which needs to get addressed. That is why we bring up this piece of writing for you. Follow this entire piece of writing to get all the insights about the online banking of ICCU banking.

So, let’s get started:

ICCU Bank Online Banking Login

Logging into ICSU online account is relatively easy. You can accomplish that at each time with the use of your PC or cell device. If that is your first time, right here are the stairs to observe to log into your online banking account.

Step1: Open your browser and visit the Official Website of the ICCU bank.

Step2: On the Homepage, at the right-top corner you will find a “eBranch Login” button, click on that.

Step3: Now enter your Username and Password, and then click on the “LOG IN” button.

Once you click on the button, you may get directed to your ICCU online banking account dashboard. It’s a commonplace for clients to overlook their login credentials.

How to Retrieve your Forgotten Password

Often we tend to forget the password of some essential credentials. In such times, it is pretty critical that we be able to retrieve it. Fortunately, ICCU offers its clients the choice to alternate their passwords every time they so wish.

If you would like to reset your password, observe these easy steps:

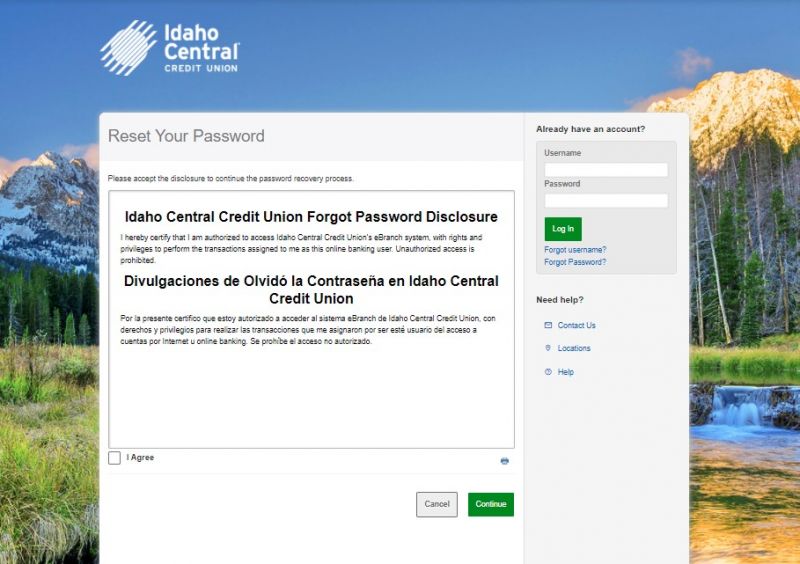

Step1: Go to the Official Website of the ICCU bank.

Step2: On the Homepage, at the right-top corner you will find a “eBranch Login” button, click on that.

Step3: As you click on the button a popup will open, where you have to click on the “Forgot Username or Password?” link.

Step4: Next up, you have to accept the disclosure to continue the password recovery process. And for the same check the “I Agree” checkbox and then click on the “Continue” button.

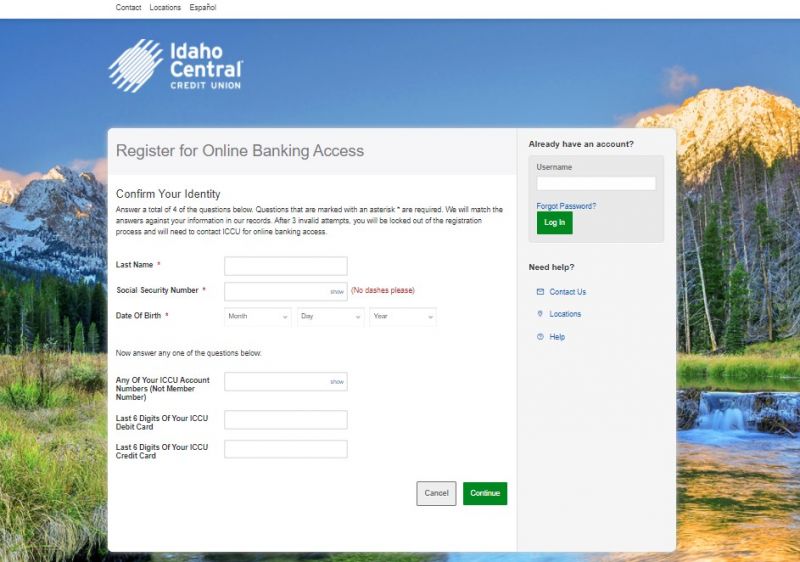

Step5: Now to confirm your identity you have to enter some of your information such as your Username, Social Security Number, and date of birth. And after entering the details click on the “Continue” button.

Once you put up the information, a randomly generated password might get dispatched on your e-mail. You will log in with the temporary password, after which alternate the password to the only one you favor to use. ICCU lets its clients sign up for ICCU online banking.

All you want is both a lively bank account or a financial savings account.

How to Enroll for ICCU Bank Online Banking

To sign up for online banking, continue as follows:

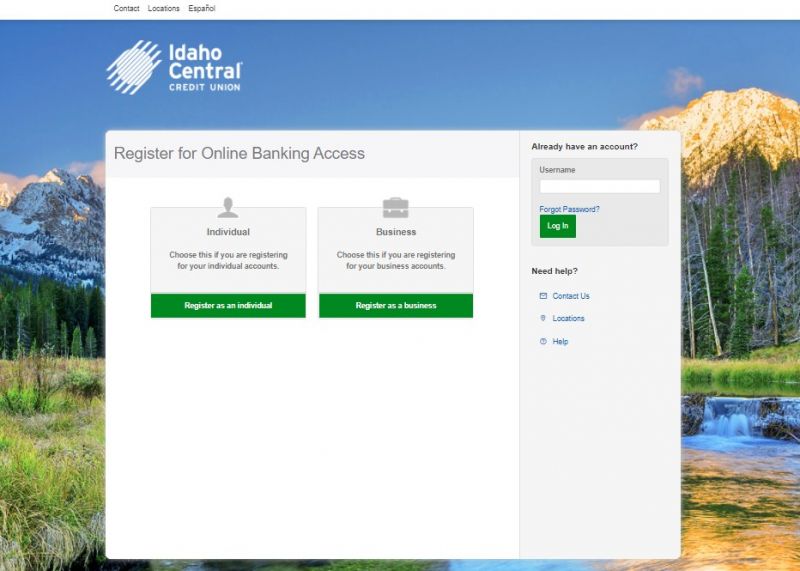

Step1: Go to the Official Website of the ICCU bank.

Step2: On the Homepage, at the right-top corner you will find a “Enroll Today” button below the “eBranch Login” button, click on that.

Step3: Next up, you have to choose that whether your want to enroll as a individual or as business. And according to choice you may click on the “Register as an Individual” button, or “Register as a business” button. For reference, here we are clicking on the “Register as an Individual” button.

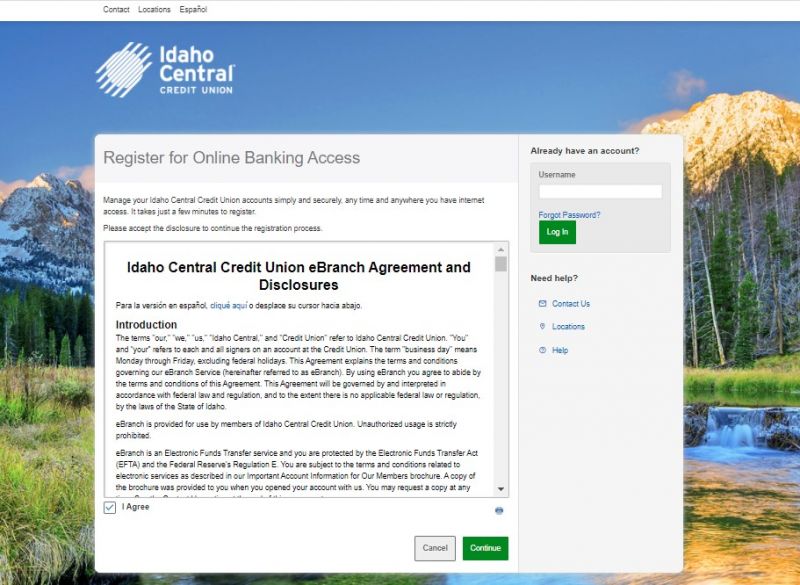

Step4: Now you have to accept the disclosure to continue the registration process. And for the same check the “I Agree” checkbox and then click on the “Continue” button.

Step5: Here you have to enter some of your personal information and then click on the “Continue” button.

Step6: Next up, you have to follow some further steps to complete the enrollment process.

Enrolling in ICCU online banking offers you digitally manipulate your budget and diverse components of your account.

ICCU Bank Online Banking Benefits

- As a customer, you could log in at each time and do the subsequent online banking account.

- View account balances, dividends, and hobby in real-time

- Retrieve month-to-month statements of account

- Setup signals for account activity timetable periodic and automatic finances transfer replace or alternate your password, and personal information evaluation invoice charge is history.

- Download transaction to Quicken, Microsoft Money, or spreadsheet

ICCU Bank Contact Details

ICCU Bank Customer Support Number

1-800-456-5067

ICCU Bank Postal Address

ICCU Bank

P.O. Box 2469

Pocatello, ID 83206-2469

ICCU Bank Information

Bank’s Website: www.iccu.com

Routing Number: 324173626

Swift Code: ICCUUS55

Phone Number: 1-800-456-5067

Similar Bank Login

- Space Coast Credit Union

- Third Federal Savings and Loan

- Sunwest Federal Credit Union

- Wescom Credit Union

- WaterStone Bank

- WestStar Bank

- Spirit of Texas Bank

- Ally Bank

- ING Direct Bank

- First Security Bank

- CIT Bank

- SunTrust Bank

- BMO Harris Bank

- BankVic Bank

- Synchrony Bank

- BBVA Bank

- NBT Bank

Frequently Asked Questions:

What’s the max quantity I can withdraw in a day?

Security functions restrict ATM withdrawals to $500, coin advances to $500, and purchases to $2500 with our Debit Cards. If you’re creating multiple purchases, please name us, and we can briefly increase your restrict.

What’s my routing number?

The routing quantity for ACH transfers to Illinois Community Credit Union is 271989714. Please see our extra commands if you’re seeking to do a cord switch to Illinois Community Credit Union.

How do I upload a person to my account?

Any new member will want to qualify for a membership, offer a current ID, and the primary/new joint member will want to signal a brand new signature card to position on the file.

Can I coin third-celebration checks?

No, we do now no longer permit participants to coins third-celebration checks. How do I follow for a mortgage? You can also follow for a mortgage online, or you could name us at (815) 895-4541 to talk with one of the help representatives.

Or, in case you favor to try this in person, you could prevent via way of means of any of our three branches to talk to a Financial Service Officer to begin the process. In maximum cases, we can have a solution for you earlier than you depart the office. You also can follow for a mortgage via the Ilinois Community CU cellular app.

Do you’ve got cellular deposit?

Yes, we have a cellular deposit via our cellular app to get on Google Play or the App Store.

Wrapping it up

It is all that we have got as far as this piece of writing is concerned. We have tried our prime to present you with all the detailed information of think.

Read the information presented above carefully, and if in the process you counter any problem, do let us know about the same in the comment section given below. We shall try to resolve our queries as quickly as possible. Thank you and Happy Banking ☺

{{CODEfaq}}