In today’s world, there is a need for a credit card now more than ever. It is due to the fact that that it is so easy to use also it saves a lot of time. Therefore, today we will let you know about one of such bank’s credit cards.

CIT Bank Online Banking lets you real-time get entry to on your money owed and control your finances every time is handy for you both at domestic or within the office. The best part is recently they have come up online and is providing a lot of services.

If you need to sign up for a web account, understand a way to signal in or reset your password, the tips will cater to you. Let’s get started:

CIT Bank Online Banking Login

Once your online account is activated, having access to your account is easy. You can log in to the cellular browser internet site in the equal manner you’ll from a computer. Or, you may download and exploration the CIT mobile banking app to get entry to your money owed out of your cellular devices. Once the app gets installed, here’s the process:

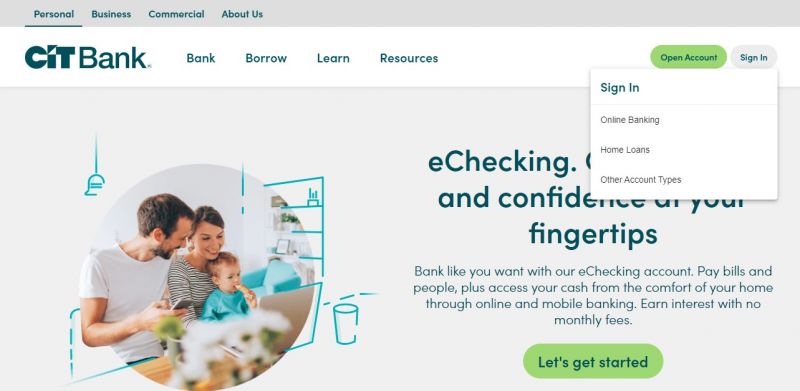

Step1: Open the Official Website of the CIT bank.

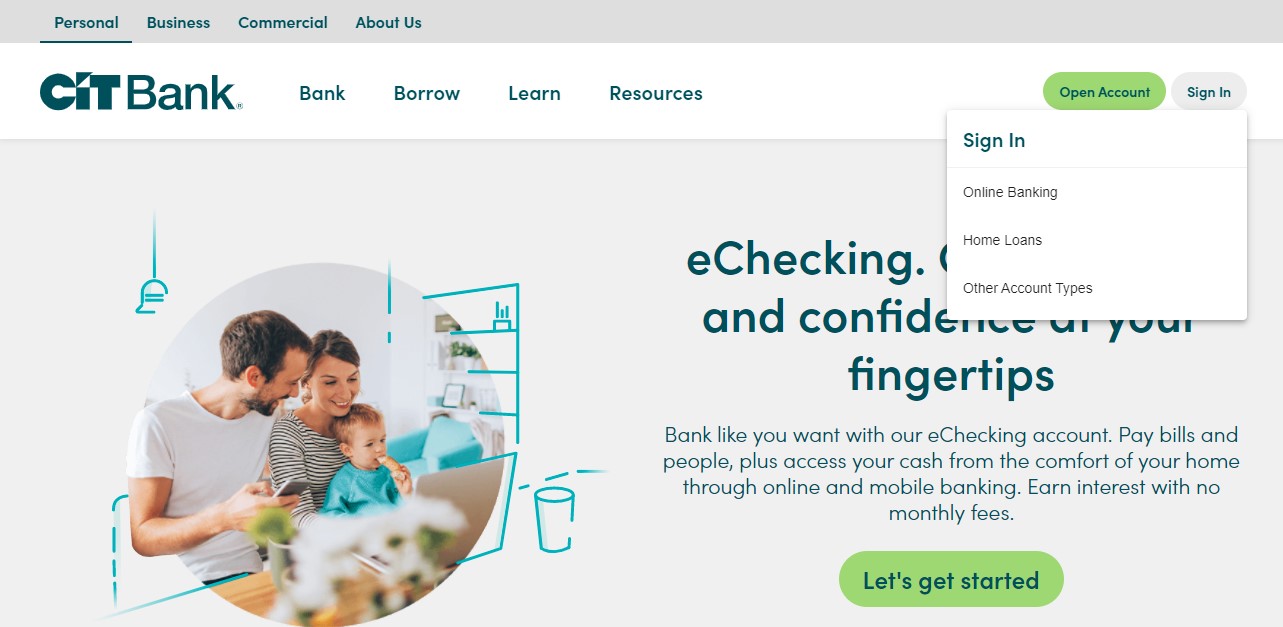

Step2: Click on the “Sign In” button.

Step3: As you click on the Sign In button a popup will open with some options. Click on the “Online Banking” button.

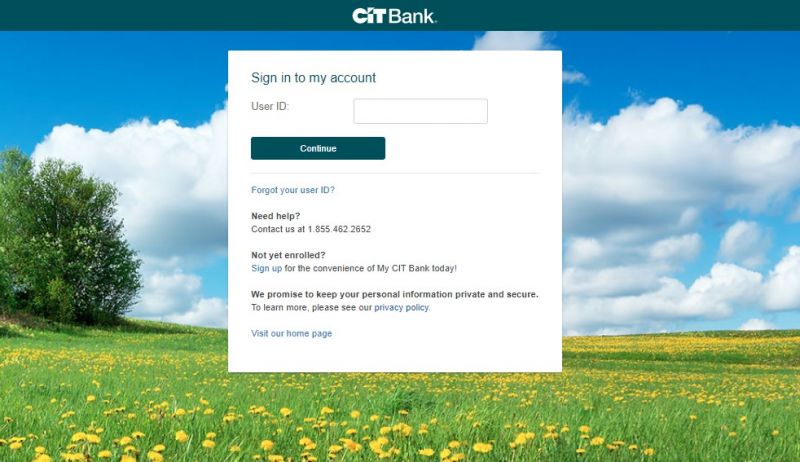

Step4: On the login page you have to enter your User ID and then click on the “Continue” button.

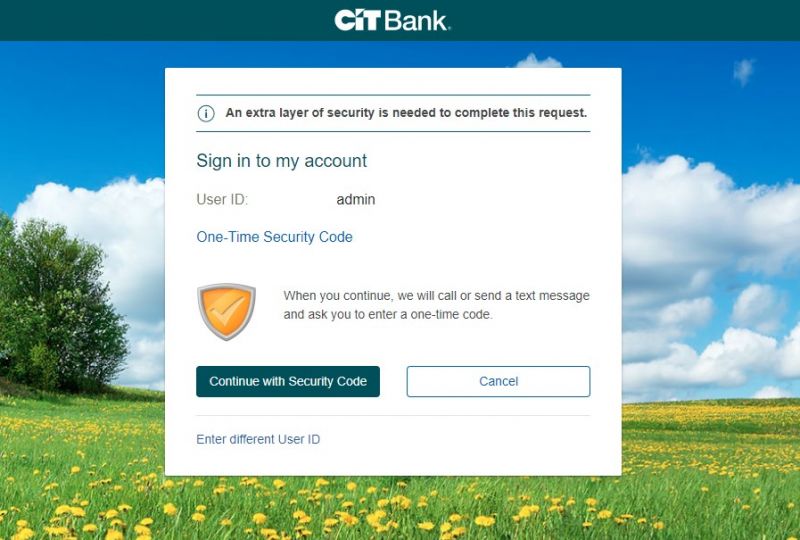

Step5: Click on the “Continue with Security Code” button.

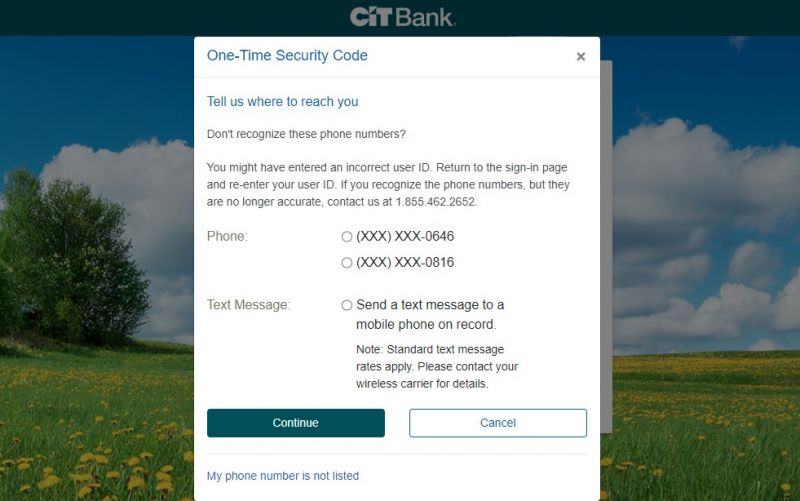

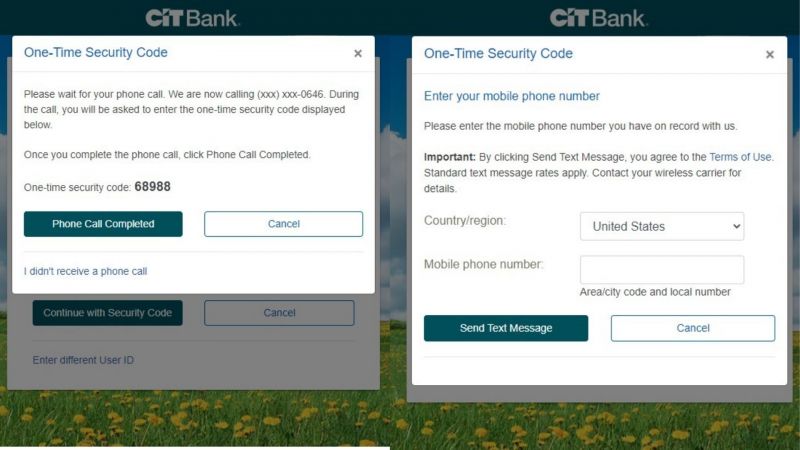

Step6: Here, you have to choose that whether you want to receive a call or a text message. If you want to receive call then select your registered “Phone” number and if want to receive a text message then choose “Text Message” option and after choosing your option click on the “Continue” button.

Step7: Now, if you had chosen the “Phone” option then a code will be displayed on your screen and you will get a call. And you have to verify that code on call. Once the phone call is completed click on the “Phone Call Completed” button. And if you had selected “Text Message” option then you have to enter your phone number and then click on the “Sent Text Message” button. After this you will receive a code. You have to enter that code to verify your self.

How To Retrieve a Forgotten User ID

If you overlook your consumer facts or password, there are numerous methods to enter your CIT Bank login facts. Here’s what you want to do:

Step1: Open the Official Website of the CIT bank.

Step2: Click on the “Sign In” button.

Step3: As you click on the Sign In button a popup will open with some options. Click on the “Online Banking” button.

Step4: On the login page you to click on the “Forgot your user ID?” link, below the “Continue” button.

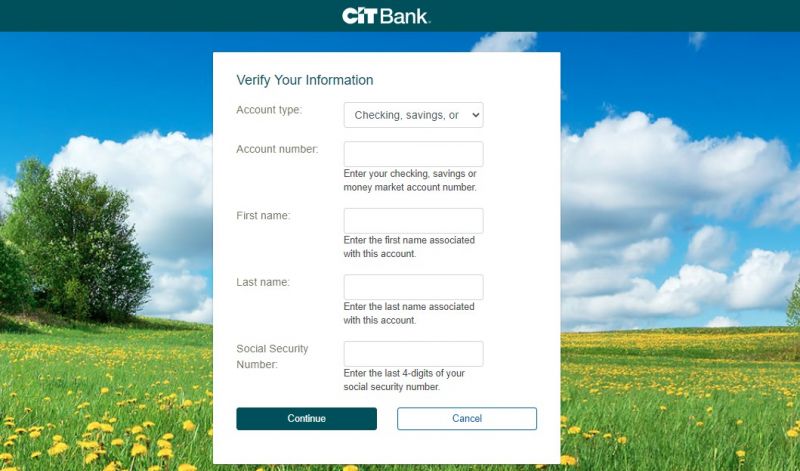

Step5: Here you have to enter some of your details. After entering all required details click on the “Continue” button.

If none of those alternatives works, you may constantly touch CIT for assist (888) 501-6847.

How to View Your CIT Bank Statement Information

Check your financial institution statements frequently to make sure your account transactions are correct. You can view, download or print your financial institution statements at once from the financial institution’s internet site. You also can view your comments via the Mobile app.

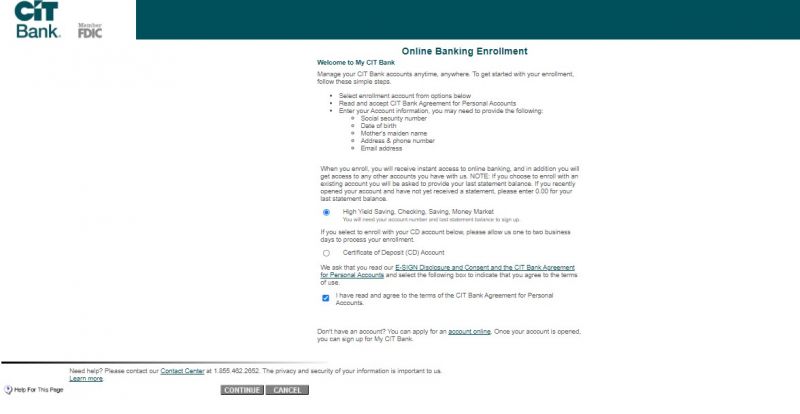

How to Enroll in Citi Bank Online Banking

Step1: Open the Official Website of the CIT bank.

Step2: Click on the “Sign In” button.

Step3: As you click on the Sign In button a popup will open with some options. Click on the “Online Banking” button.

Step4: On the login page you to click on the “Sign up” link, below the “Continue” button.

Step5: Here you have to select enrollment account from options given below, read and accept CIT Bank Agreement for Personal Accounts and then click on the “Continue” button.

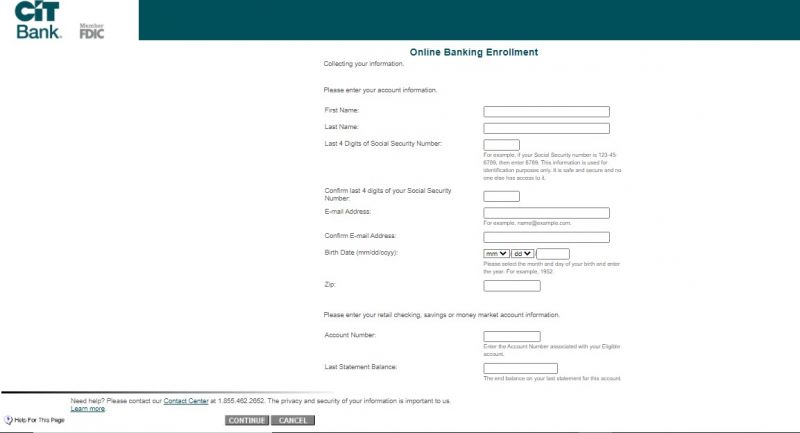

Step6: Now you have to enter your and yours’s Account information. After entering all the details correctly click on the “Continue” button.

If you’ve got any trouble finishing the one’s steps, touch Customer Service at 1(855) 462-2652

Manage CIT Bank Online Banking Account

Having CIT Bank’s online banking account, you may:

- Access and control account alerts

- Schedule and switch finances among CIT Bank money owed

- Schedule and switch finances to and from different banks

- See statements and account activity

- Manage money owed and account facts

- How do I log in to my Citibank credit scorecard?

CIT Bank Online Banking Benefits

- No financial institution branches or ATMs – CIT Bank is virtual and does the whole thing online. If you need to go to a department, that isn’t always an option. Although CIT Bank refunds up to $15 according to the month in financial institution ATM costs, clients who get entry to ATMs greater often might also exceed that amount.

- Limited account alternatives – Customers get presented most detailed bank account, financial savings money owed, and one cash marketplace account. Three If the one’s money owed do now no longer meet your needs, CIT Bank does now no longer offer every other alternative. Additionally, it no longer provides investments, non-public loans, or domestic fairness loans, or strains of credit score.

- Does now no longer provide 24/7 consumer help – As a virtual financial institution, complete inquiries are treated online, via its app, or through automatic phone banking. Customer help hours get restrained at CIT Bank. Live phone help is to be had from nine a.m. to nine p.m. Monday via Friday and 10 a.m. to six p.m. on Saturday. Customer carrier isn’t always to get had on Sundays.

CIT Bank Contact Details

CIT Bank Customer Support Number

8554622652

CIT Bank Postal Address

CIT Bank N.A.

P.O. Box 7056 Pasadena,

CA 91109-9699

CIT Bank Information

Bank’s Website: www.cit.com

Routing Number: 124084834

Swift Code: Not Available

Phone Number:8554622652

Similar Bank Login

- Delta Community Credit Union

- Johnson Bank

- Savings Bank of Mendocino County

- Maries County Bank

- Flushing Bank

- Evans Bank

- Space Coast Credit Union

- Third Federal Savings and Loan

- Sunwest Federal Credit Union

- Wescom Credit Union

- WaterStone Bank

- WestStar Bank

- Spirit of Texas Bank

- Ally Bank

- ING Direct Bank

- First Security Bank

Frequently Asked Questions

Is CIT Bank legit?

Yes, CIT Bank is FDIC insured (FDIC# 58978). The federal authorities protect your cash up to $250,000 according to the depositor, for every account possession category, withinside the occasion of a financial institution failure

Is CIT FDIC insured?

CIT Bank and OneWest Bank are a part of the equal FDIC-insured institution. According to the depositor, for every account possession, deposits held beneath every call aren’t separately insured; however, they get mixed with deciding whether or not a depositor has passed the $250,000 federal deposit insurance limit.

How do I set off my Citibank Mobile Banking?

Step1: SMS MBANK to 52484.

Step2: You will acquire an SMS from the financial institution with the download URL for Citi Mobile.

Step3: Click at the hyperlink withinside the message.

Step4: A WAP web page will set off you to go into your cellular variety.

How do I set off my Citibank Mobile Banking?

Step1: SMS MBANK to 52484.

Step2: You will acquire an SMS from the financial institution with the download URL for Citi Mobile.

Step3: Click at the hyperlink withinside the message.

Step4: A WAP web page will set off you to rereview your cellular variety category.

Who Is CIT Bank Best For?

CIT Bank is an excellent shape for clients who pick a virtual financial institution, checking and financial savings money owed that may get opened online without costs or minimal stability requirements. It lets in digitally savvy clients to:

- Earn an aggressive fee on checking and financial savings money owed

- Open a bank account that rebates financial institution ATM costs

- Open financial savings account without a minimal stability requirement

- Have to get entry to a no-penalty certificate of deposit (CD)