You shouldn’t pay your excessive hobby payments now when you have a Discover private mortgage invitation to your Mail. They have pre-confident themselves approximately your credit score rating and feature provided you a mortgage with an invite number.

Recently they have come up online, and they have come up online with a lot of preparation and offers that you must know about; that is why we bring you this piece of writing. Please read the entire post given below, and it is also going to work as a guide for you. So without wasting much of your time, let’s dive in.

Discover Personal Loans Credit Card Benefits

- The Discover private loans practice via mail function has made the complete manner very clean and convenient.

- There might be no fluctuations in fees because the rate might be primarily based totally on ongoing costs; this may prevent the cash because the ongoing costs can be decrease than the price you’re paying presently.

- The hobby fee can shop cash for you in line with the distinction between the hobby fee authorized presently and the preceding one.

- There might be no annual fees, no origination fees, no remaining fees, and no pre-price penalty as well.

How to Apply your Credit Card Application

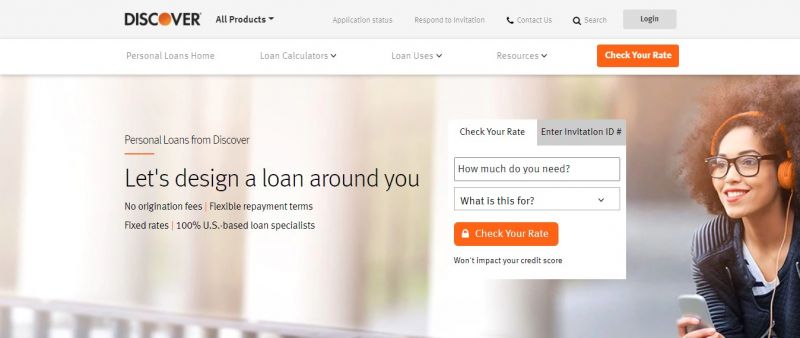

You can apply for the Discover Personal Credit Card by calling at the number (1-800-767-1823) or you can simply mail them. But the most convenient way is that you go online to DiscoverPersonalLoans.com and apply from there. To know the complete process you can go through the below given steps:

Step1: Go to the Official Website of the Discover Personal Loan Credit Card.

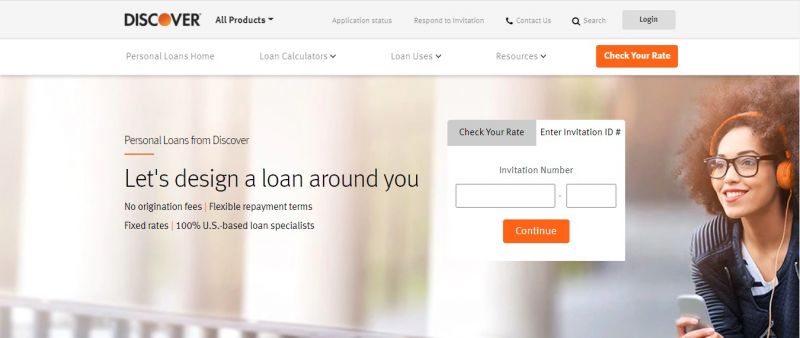

Step2: On the homepage find the “Enter Invitation ID#” button and click on that.

Step3: Now enter your Invitation number that your receive through mail.

Step4: After entering the invitation number click on the “Continue” button.

Step5: Next up, you have to follow some further steps to complete the process and complete the application process.

Discover Personal Loans Credit Card Review

Pros:

- Online tools: Prospective debtors can take gain of Discover’s unfastened training tools, which include a non-public mortgage calculator, a debt consolidation calculator, and an internet library of articles that designate diverse subjects around loans and debt.

- Flexible fee phrases: Many non-public creditors handiest provide three- or five-yr loans; however, Discover gives mortgage compensation phrases of as much as seven years or eighty-four months.

- Few fees: Aside from a past due fee, Discover costs no fees. This way, no origination fee, which a few creditors take out of your mortgage’s total quantity.

Cons:

- Tailored to debtors with appropriate credit scores: Discover calls for a minimum credit score rating of 660, and the standard borrower holds a credit score rating above 700.

- No cosigners: With a few non-public mortgage creditors, you could upload a cosigner on your mortgage in case your credit score rating is too low to get you accredited on your own. Discovery doesn’t permit cosigners, so that you might also pick some other lender if you don’t qualify.

How to Make Discover Personal Loans Credit Card Account Payment

Step1: Open any trusted web browser.

Step2: Open the Official Website of the Discover Personal Loans Credit Card.

Step3: Now, you can make the payment in two ways

Step4: You can make the payment via Mail, and for that, you need to mail in the following address

Discover Personal Loans

P.O Box 6105

Carol Stream, IL 60197-6105

Step5: If you want to make the payment through the phone call on this number:

1-877-256-2632

Discover Personal Loans Credit Card Payment Options

How to Make Discover Personal Loans Credit Card Payment by Mail

Discover Personal Loans Credit Card Payment Mailing Address:

Discover Personal Loans

PO Box 30954

Salt Lake City

UT 84130-0954.

How to Make Discover Personal Loans Credit Card Payment by Phone

Discover Personal Loans Credit Card Payment Phone Number:

1800-672-456

FAQs (Frequently Asked Questions)

Is it difficult to get a Discover pupil mortgage?

With no fees, low hobby rates, and forbearance options, Discover is a marketplace chief in private pupil loans. But those loans are not for clean money. Borrowers want a brilliant credit score rating or a cosigner to get the loans. The superb issue about Discover is that they’re at the Credible platform.

How lengthy does it take for Discover to approve a pupil mortgage?

15 minutes. How lengthy does it take to get a Discover pupil mortgage? The usual time from finished utility to approval for a Discover pupil mortgage is 15 minutes. For a consolidation mortgage, it can take from 30 to forty-five days from acceptance to payoff.

Can you be denied a pupil mortgage?

Can you be denied a federal pupil mortgage? Yes, you can get denied a national pupil mortgage for lots of reasons. It’s a not unusual place false impression that finishing a FAFSA mortgage utility means you’ll robotically get authorized for federal pupil loans.

Can pupil loans be forgiven?

There are no official pupil mortgage forgiveness applications for any private pupil mortgage company. Federal pupil mortgage borrowers can use the Public Service Loan Forgiveness or Teacher Loan Forgiveness applications to wipe away their debt.

Wrapping it up

So this was all we had for this exclusive piece of writing. We have tried to cover the broader aspect of topics associated with this card and this institution. However, if you still feel that we missed out on something, let us know about the same in the comment section.

{{CODEfaq}}