BECU was created to serve Boeing Company. The Boeing workers have established its fellowship credit union.

Boeing Employee’s Credit Union is now the biggest credit union in Washington. It is fourth in the United States. They have 45 branches around the country. BECU bank was only created to serve present and past employees of Boeing Company. But, later in 2002, BECU opened its membership to all Washington state residents. Now the credit union offers membership to all the peoples who work and live in Washington states.

It provides many different financial services to its customers such as saving account, checking account, loans, mortgages, credit card, internet banking, etc.

BECU made it easy by providing internet banking solutions to all its clients. They can easily manage their banking account from anywhere. Online banking made the transaction process easy.

BECU Online Banking Login

If you are new to BECU Online Banking. Then, these steps will help you to log in to the BECU Online Banking account.

BECU members can access to the BECU online banking service. You can manage your BECU Banking account 24 hours a day with secure access. You can follow the simple steps to login to BECU Online Banking.

First, open the banking website through the following link, www.becu.org

Once, you are on the homepage click on “Online Banking” from the main menu.

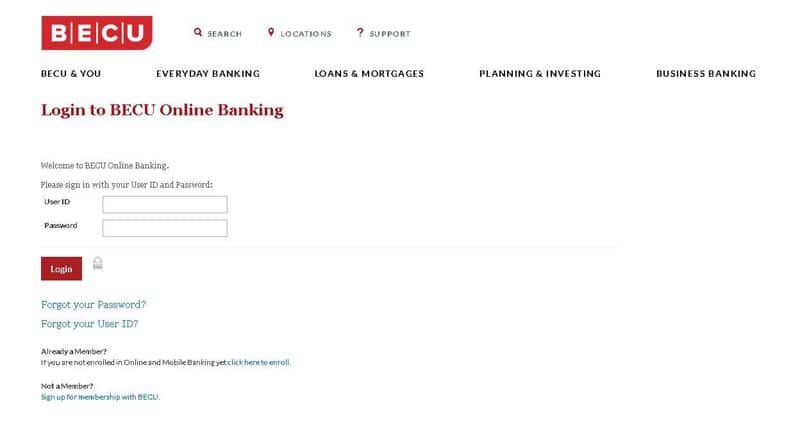

It will take you to the “Login to BECU Online Banking” page.

Here, you need to enter your BECU Online Banking User id and password.

After entering the information correctly, press the “Login” button below.

Now, you are successfully login in to your BECU Banking Account.

With the BECU Online Banking, you can check account balance, apply for loans and credit cards, view statements, make bill payments, money transfer, etc.

How to Retrieve Your BECU Online Banking Password?

If you have forgotten your BECU Online Banking password. Then, you should follow the steps below,

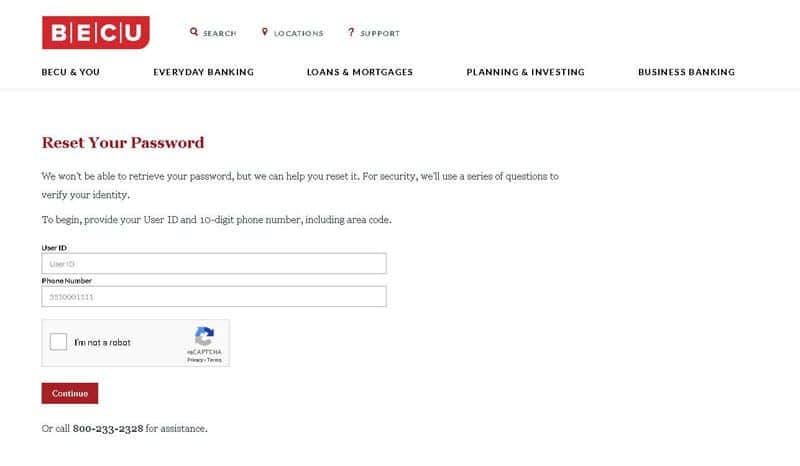

First, go to the Home page of BECU website.

Then, click on “Online Banking” from the main menu.

On this page, you will find the “Forgot Your Password” option right below the login.

Press on the “Forgot Your Password” in order to reset your password.

You need to enter your User ID and Phone Number. Then, Press on “Continue” button.

Soon, you will receive a password in your registered email id.

How to Retrieve Your BECU User ID?

If you can’t remember your BECU User ID, then should read the steps below,

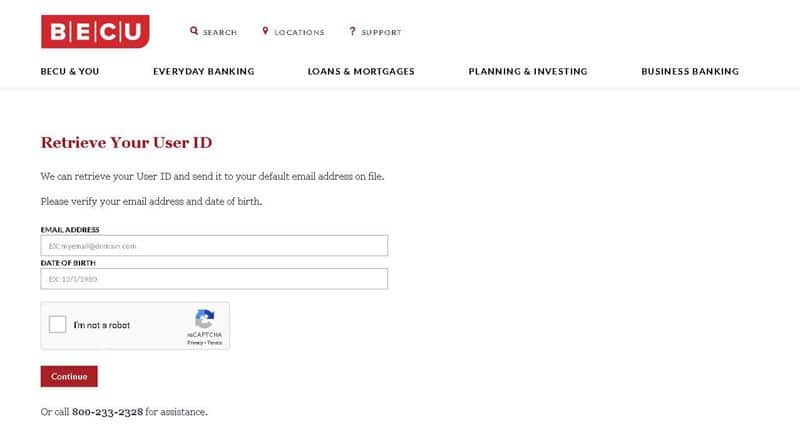

Visit the homepage of BECU website.

Now, you need to go to the online banking page.

Click on the “Online Banking” option on the menu.

On this page, you will find “Forgot Your User ID” right below the “Login” button.

Once you click on “Forgot Your User ID”, it will take you to the “Retrieve Your User ID” page.

You will need to enter the Email Address and Date of Birth.

After entering the information correctly, click on the “Continue” button.

You can also call 800-233-232 to retrieve BECU User ID.

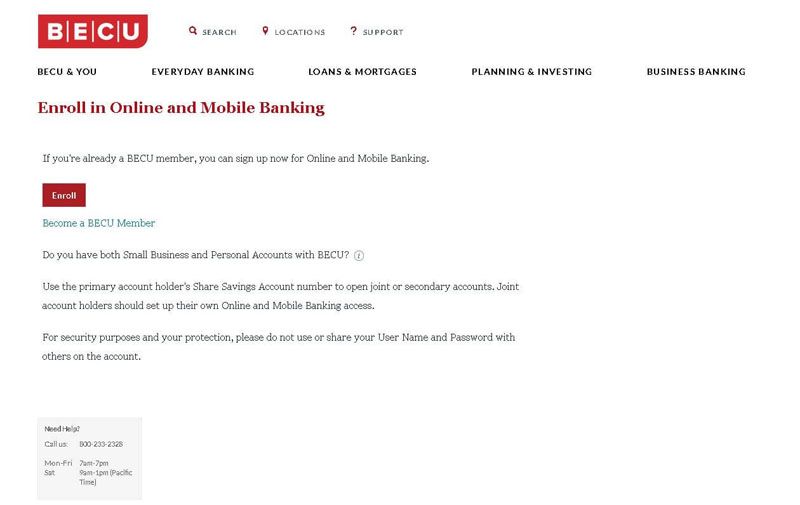

How to Enroll for BECU Online Banking

If you are already a BECU member, you can enroll for Online and Mobile banking.

Visit the BECU home page.

Select the “Online Banking” option from the main menu.

It will take you to the BECU Online Banking Login page.

You will notice the “Already a Member” option right under the Login.

Now, press on click here to enroll.

It will take to the “Enroll in Online Banking” page.

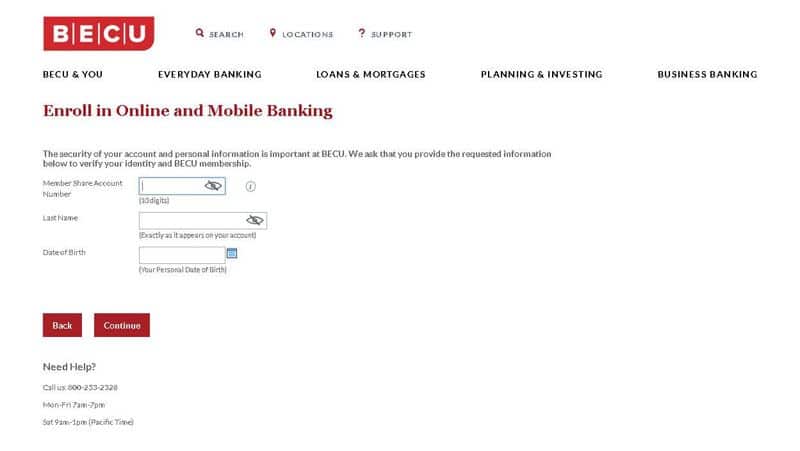

Now, press on the “Enroll” button.

You will need to enter

- Member Share Account Number

- Last Name

- Date Of Birth

After providing the information correctly, press on the “Continue” button and follow the instruction to complete the process.

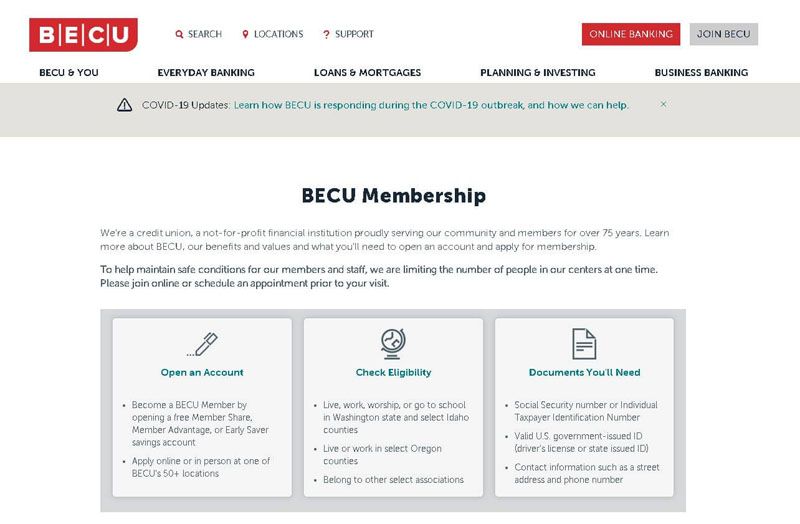

How to Join for BECU Banking

If you want to join BECU banking, you can easily do it from the BECU banking site.

First, visit the BECU website and click on “Join BECU” from the menu.

It will take you to the BECU Membership page.

Select “Open an Account” option

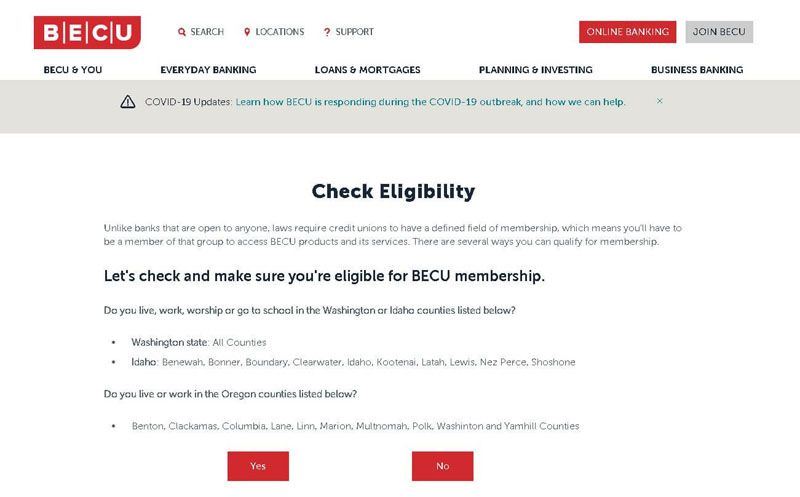

You will be taken to the “Check Eligibility” page. Make sure you read it properly.

Now, select “Yes” or “No” based on your living location.

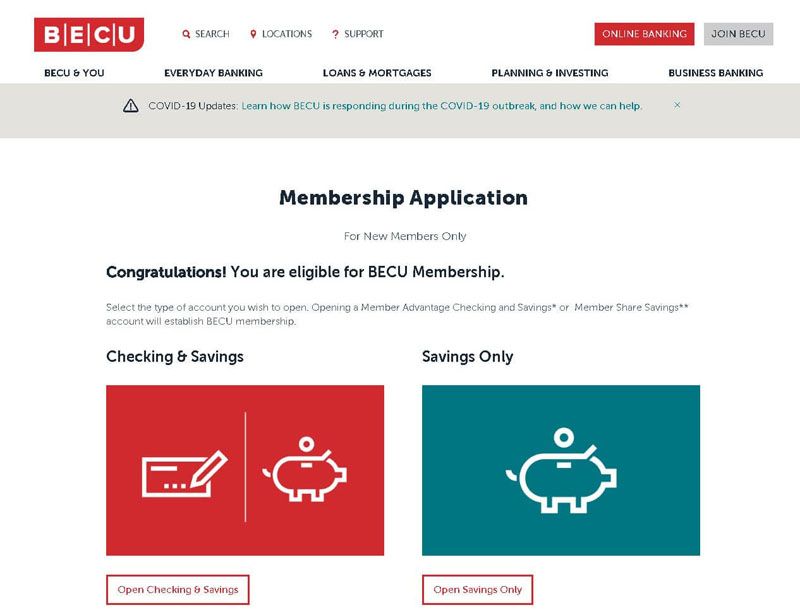

If you are eligible for BECU membership. Then, you will be taken to the “Congratulation” page.

There are two option you can choose from,

- Checking & Saving

- Saving Only

After selecting an option, you will be taken to the next step.

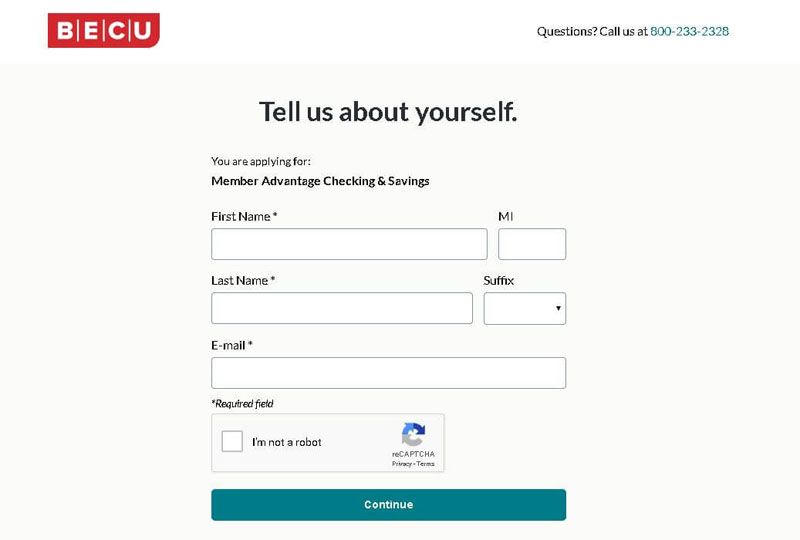

Here, it will ask you to enter your first name, middle name, last name, and email address. After entering them, press the “continue” button below.

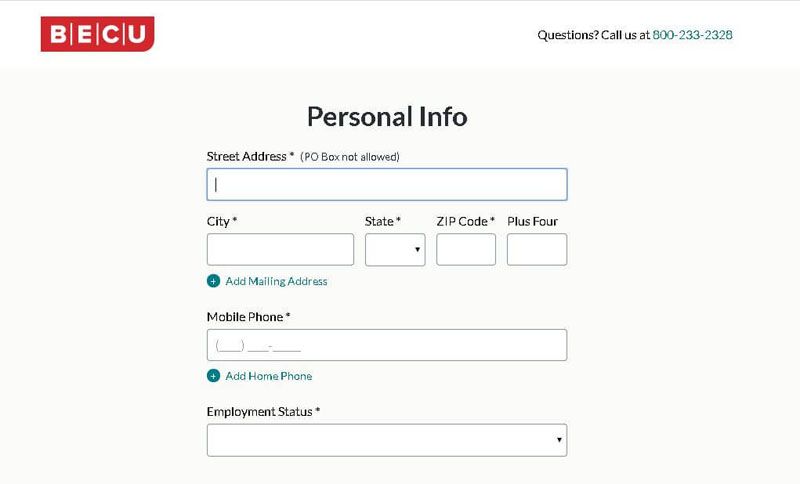

You will be taken to the next page, here, you will need to enter your personal information and validate your identity.

In the Personal Info section, you will need to enter

- Street Address

- City

- State

- Zip Code

- Mobile Phone

- Employment Status

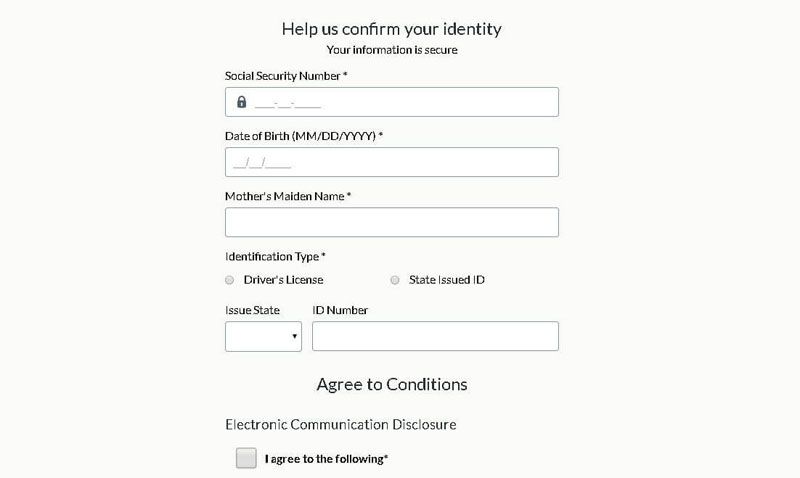

In the next part, you will need to verify your identity, it will ask you to enter

- Social Security Number

- Date of Birthday

- Mother’s Maiden Name

- And, Identification proof (Driver’s License or State issued ID)

After proving all the information, you will need to read and agree to conditions.

Now press on the “Continue” button below to proceed.

You will follow the instruction to complete the process.

Benefit and Features of BECU Online Banking

BECU online banking prove many important features,

- You could manage your account online and check account balance.

- BECU online banking helps you to view statement.

- You will receive e-Statements with online banking.

- It allows you to apply for credit cards and loans.

- You could pay your bills and transfer money to other accounts.

- View previous transactions.

- Find bank and ATM locations

- BECU members get paid parental leave benefits up covering 12 weeks.

- Members are qualified gets degree sponsored.

- Boeing employees credit union provides full medical, dental and vision insurance.

- BECU offers many more benefits like disability insurance, paid holidays, Employee assistance programs, etc.

BECU Mobile and Online Banking System Requirements

To keep everything smooth, you should check the system requirements for BECU Online banking.

BECU Online Banking Requirements

You should have the recent version of Chrome, Edge, and Firefox installed on your computer.

If you use Internet Explorer, 10 and 11 version is recommended

Safari version 9 and higher

For, best online banking experience use the updated version of Chrome, Safari, Edge, Firefox and Internet Explorer.

BECU Mobile Banking App Requirements

You should have iOS 8 and latest version for Apple Smartphone

And, Android 4.4 and latest version for Android Smart device.

You can download them from the respective app stores.

Important Security Tips for Secure Banking

It is important to check the https button of the website. You can click on the address bar to verify the identity of BECU bank. It will show as identity verified. To keep your online banking information safe, you should check the address bar. It will have a secured green lock and identity verified with the bank name.

BECU Online Banking Review

BECU members get advantages of checking accounts. Members have to pay no monthly fee and minimum balance requirements. The checking account members also earns interest.

Checking Account:

Nobody likes fees.

- You don’t have to worry about the standard monthly fee with BECU savings account. There is no minimum balance requirement.

- They don’t have any monthly maintenance fees.

- BECU has no foreign transaction fees for international transactions.

- There is no ATM surcharge fees in BECU.

High interest rate in Checking & Savings

You can earn little more with your checking and saving accounts.

- BECU’s Members advantage saving accounts get 6.17% APY for up to $500.

- Members get 4.07% annual percentage yield for up to $500. But, you will be qualified for the BECU membership advanced program.

- BECU members get interest above $500. It means the rate for above $500 is much lower.

- BECU members get free FICO score.

- You can track your spending and expense with the Money manager tool.

Credit Cards

BECU offers lowest rate credit cards. There some good features of the BECU credit card.

- There are no annual fees.

- BECU credit card has no foreign transaction fees.

- There is 0% APR on purchases and balance transfer for the first 12 months time.

BECU (Boeing Employees Credit Union) Hours of Operations

Monday – 7:00 AM to 7:00 PM

Tuesday – 7:00 AM to 7:00 PM

Wednesday – 7:00 AM to 7:00 PM

Thursday – 7:00 AM to 7:00 PM

Friday – 7:00 AM to 7:00 PM

Saturday – 7:00 AM to 7:00 PM

Sunday – Closed

BECU (Boeing Employees’ Credit Union) Customer Support Number

BECU (Boeing Employees’ Credit Union) Routing Number:

325 081 403

BECU Receiving Bank ABA Number

325 081 403

BECU (Boeing Employees’ Credit Union) Support Number:

Online Banking related Toll-Free phone number in US and Canada – 800-233-2328

Account Related Number – 800-369-3567

Business hours,

Money to Friday – 7:00 am to 7:00 pm

Saturday – 9:00 am to 1:00pm

BECU 24-hour Telephone Banking Number:

206-439-5700

BECU (Boeing Employees’ Credit Union) Credit Card Support Number:

800-233-2328

Business Hours,

Money to Friday – 7:00 am to 7:00 PM

Saturday – 9:00 am to 1:00pm

BECU (Boeing Employees’ Credit Union) Debit Card Support Number:

888-241-2510

Business Hours,

Money to Friday – 7:00 am to 7:00 PM

Saturday – 9:00 am to 1:00pm

BECU (Boeing Employees’ Credit Union) Support Email

mediacontact@becu.org

BECU (Boeing Employees’ Credit Union) Mailing Address

If you need to send payment, you can use this address

VISA Payments

BECU

P.O Box 84707

Seattle, WA 98124

Mortgage Payments

Attn: Central Loan Administration

BECU P.O. Box 986

Newark, NJ 07184-0986

Other Loan Payments and Correspondence

BECU

P.O. Box 97050

Seattle, WA 98124-9750

BECU Bank Information

BECU Headquarter Address: Tukwila, Washington, United States

Official Website: www.becu.org

ATM Locations: visit the BECU banking site to find ATM locations

Android App: BECU Android App

Apple App: BECU Apple App

Similar Bank Login

FAQs

What does BECU stand for?

Becu stands for Boeing Employees Credit Union.

Is BECU a Boeing company?

BECU was founded by a group of Boeing employees.

Can anyone open an account at BECU?

If you are affiliated with Boeing or live, work, or school in Washington state. Then, you’re eligible for BECU membership.